The corner office.

What ambitious newly-minted college graduate wouldn’t want to aim for the corner office?

I didn’t.

That was far from my goal when I graduated from college over 20 years ago.

All I wanted to do was work my tail off in my 20s and 30s so that I don’t have to work in my 40s.

One of my mottos was “I’m working hard today so that I don’t have to work tomorrow.” I aimed for FIRE (Financial Independence, Retire Early).

I never dreamed of occupying the corner office. All I wanted was to be able to generate enough passive income and be financially free.

I knew building up passive income investments is the key to the success of achieving my goal.

I didn’t want to trade time for money in my 40s.

My thought, as a newly minted college graduate 2 decades ago, was I’ll have better things to do at that age such as spending time with family/kids and starting my own business.

Over the next 20 years, I constructed a diversified investment portfolio that produces enough passive income to maintain my current lifestyle.

Based on my own experience, I am going to dig a little deeper into each of those investments and discuss what I see to be pros/cons with them as passive income-producing assets.

This way, I hope my analysis can provide you with more information as you try to build or optimize your own passive income investment portfolio.

What Is Passive Income?

Passive income is earning money while you sleep or watch Netflix or sunbathe at the beach.

There is little to no relationship between the time you put into an activity and the payout of that activity.

Money is generated even if you put in no effort.

The opposite of passive income is active income.

Active income is when you have to be actively involved in producing/earning income.

Working a job is active income. Having a second job or side hustle in which your time is required is also active income.

Starting a business is another method to obtain active income.

Generating enough passive income, not active income, to cover personal expenses is the pathway to financial independence.

My Passive Income Investment Building Journey

In order to free myself in my 40s, I knew early on that I needed to be able to build an investment portfolio that can provide passive income for me.

I need to be able to make money even in my sleep.

The first step of building an investment portfolio that throws off passive income is to earn and save money.

Being frugal and saving a good percentage of my take-home pay was instrumental in providing me with capital to make investments. I stuck to the ideal budget for financial freedom and saved at least 30% of my take-home pay. Many years, I saved a far greater percentage.

Spending the first few years at home, after college, and living under my parents’ roof really helped turbocharge my savings early on.

I busted my hump to move up in my professional career. With each promotion and step up, I made more money. That increase in pay allowed me to increase my savings rate and to make more investments.

I started investing predominately in rental properties and index funds.

Over 20 years of consistent earnings, savings, and investing, I was able to:

- Build a rental portfolio that produces enough net cash to meet my personal expenses;

- Grow my retirement account to 7 figures.

It’s nice to say mission accomplished for achieving financial freedom and for constructing a passive income investment portfolio that produces more than enough cash to maintain my current lifestyle.

I Have A Diversified Passive Income Investment Portfolio

I believe strongly in the power of diversification in asset classes and cash flow streams.

My passive income investment portfolio consists of the following investments:

- Rental properties;

- Index funds;

- Savings accounts;

- Individual listed stocks;

- Private equity funds;

- Private credit funds;

- Cryptocurrencies;

- NFTs;

- Munis;

- Fixed income mutual funds;

- Employer’s private company stock.

There are different attributions and pros and cons with the various types of investments that make up my passive income investment portfolio.

Rating Factors For Different Investments

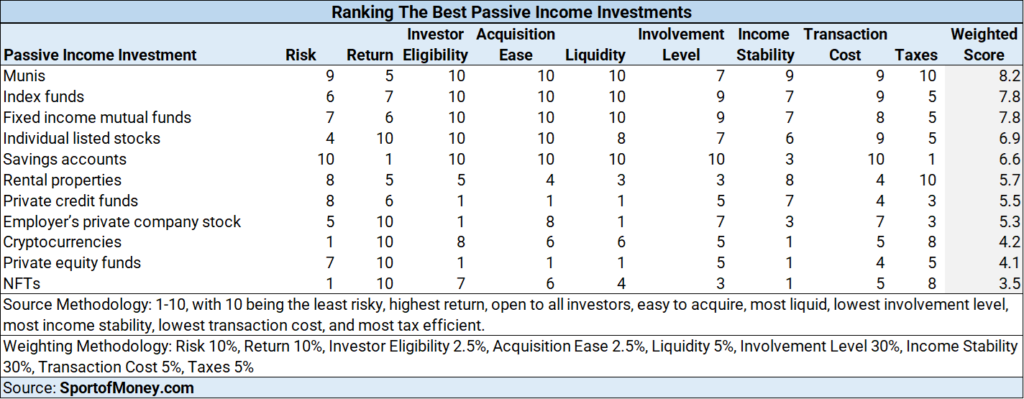

There are 9 attributes I’ve rated each of the investment types in my investment portfolio.

Each attribute is given a score between 1 – 10. The higher the score, the better.

Risk\Volatility – this attribute pertains to the price movement of the asset. How much does the price fluctuate over a one to three year period? A score of 1 means there is an extreme risk. A score of 10 means there is no risk.

Return – what is the range of positive performance for the investment? A score of 1 means there is no upside. A score of 10 means there is potential for tremendous asset appreciation.

Investor Eligibility – is the investment open to all investors? Or are there criteria that must be met before an investor is eligible to participate in the investment? A score of 1 means there are high eligibility hurdles. A score of 10 means anyone can participate.

Acquisition Ease – how easy is it to buy this investment? Are there a lot of paperwork and specialists involved in the acquisition process? A score of 1 means the acquisition process is extremely difficult. A score of 10 means a frictionless transaction.

Liquidity – how robust is the market for the investment? Can you find a buyer quickly? A score of 1 means the asset is illiquid. A score of 10 means there are a lot of buyers for the asset.

Involvement Level – how much work is needed to manage the asset? A score of 1 means there is a lot of work necessary to manage the investment. A score of 10 means the asset runs 100% independent of the owner.

Income Stability – how sticky is the passive income stream from the asset? A score of 1 means the income stream is not predictable and is not dependable. A score of 10 means the income payment is made in the amount and time as expected.

Transaction Cost – what are the costs associated with the asset including transaction costs on the purchase/sale and carrying costs during the holding period? A score of 1 means there are high transaction costs. A score of 10 means there is no transaction cost.

Taxes – how tax efficient is the investment? A score of 1 is that the asset is not very tax efficient and you get hit with your highest marginal tax rate. A score of 10 is that the asset is very tax efficient and can result in a lower tax rate than your marginal rate.

Best Passive Income Investment Ranking Chart

The attributes are weighted by the importance to an investor in assessing passive income investments.

In my opinion, the attributes most important to passive income investors based on the order of importance are involvement level (30%), income stability (30%), risk (10%), return (10%), taxes (5%), liquidity (5%), transaction costs (5%), investor eligibility (2.5%), and acquisition ease (2.5%).

Munis, index funds, and fixed income mutual funds top the rankings given the high passive nature of those investments coupled with strong income stability.

Rental properties are the core of my passive income investment portfolio but are just the middle of the tier because of the level of involvement necessary to manage the properties.

On the bottom of the list are investments such as cryptocurrencies and NFTs which are very new investments. Those asset classes are very risky since they are not regulated and are the Wild West of investing.

This chart ranks the best investments if you want to construct a portfolio to produce passive income.

I don’t have a lot of munis or fixed income mutual funds because I don’t only construct my investment portfolio for passive income purposes. Since my rental properties already cover my expenses, I like to have more upside potential with the rest of my investment portfolio.

How The Various Investments Fit Into My Passive Income Investment Portfolio And The Pros/Cons Of Each

Rental Properties

I’ve built up my rental portfolio over the past 15 years. The rental properties are made up of predominantly small multi-family buildings located in Brooklyn, New York.

Most of them are purely residential units; although I own some commercial units.

I keep my residential buildings under 6 units because I don’t want to be subject to the rent control/stabilization laws of New York. Those laws are very tenant friendly and govern the allowable year-over-year rent increase.

Rental properties make up a significant portion of my investment portfolio and are the single biggest asset class I have.

The net rental income can currently cover my personal expenses with a buffer to spare.

Multi-family residential

How is passive income generated:

Passive income is generated through rent payments from my tenants.

How does this investment fit into my passive income investment portfolio:

Rental properties is my biggest source of passive income. The net rental income (rent less expenses) is greater than my personal expenses. I achieved financial freedom because of my rental properties.

Main pros:

- Tremendous control of the asset. I determine when to buy, when to sell, how much to finance, whom to rent to, when to refinance, etc.

- A relatively stable income stream. Even when New York City took a hit from COVID, there was government relief provided for tenants. At the depth of COVID, about half my units experienced rent delinquency for a 2 month period. Then the rental payment rate recovered quickly because of government subsidies. Ultimately, I ended up collecting most of the back rent over time due to the subsidy programs.

- Many tax advantages such as annual depreciation and 1031 exchange.

- Strong staying power. When will homes be obsolete? Never.

Main cons:

- Not 100% passive income. There is work involved. I seemingly receive tenant calls at the worst possible time such as when I’m enjoying a nice vacation with my family.

- Heavy transaction costs.

- Need a decent amount of capital to start.

- New York City has tenant-friendly laws which, among other things, make evictions a long and expensive exercise.

Retail stores

How is passive income generated:

Passive income is generated through rent payments from my retail tenants.

How does this investment fit into my passive income investment portfolio:

This adds to my rental income.

Main pros:

- Tremendous control of the asset. I determine when to buy, when to sell, how much to finance, whom to rent to, when to refinance, etc.

- Many tax advantages such as annual depreciation and 1031 exchange.

Main cons:

- Not 100% passive income. While retail stores require less active work than residential units because the tenants cover all maintenance inside the store, there are areas outside of the store such as roof maintenance that I must handle from time to time.

- Heavy transaction costs.

- Need a decent amount of capital to start.

- Retail business is suffering in New York City. Because of this, I had to reduce the rent to help out my tenants. Even with the reduction in rent, they are still struggling to stay in business.

Index Funds

Most of my index fund investments track the S&P 500. I have S&P 500 mutual funds and SPY (S&P 500 ETF).

My index fund investments are predominantly in my retirement accounts.

I have heavy exposure to index funds because of the strong historical returns (approximately 10% return for the S&P 500) and because they are diversified.

How is passive income generated:

Passive income is generated through dividend payments.

How does this investment fit into my passive income investment portfolio:

Most of the income generated is in my retirement account. The value held outside of my retirement account in index funds generates a 5-figure sum on an annual basis. Since my rental income already can cover all my expenses, the dividend payments serve as a buffer in case of tenant delinquencies.

Main pros:

- Very little work and research are necessary. Who doesn’t know about the S&P 500?

- Easy to buy and low fees.

- Offers a diversified basket of stocks.

Main cons:

- Low passive income generation. The dividend yield of the S&P 500 is currently under 2%.

- Exposure to daily updates on market movement. Your emotions can be affected on up days and down days.

Savings Accounts

How is passive income generated:

Passive income is generated through interest earned on cash at a savings account.

How does this investment fit into my passive income investment portfolio:

Before the Federal Reserve started its rate hikes, the interest rate on saving accounts was basically zero. Therefore, this was not part of my passive income calculus.

Now, saving accounts can pay 4%. I have a good chunk of cash sitting in savings accounts.

I am waiting for the right time to put that money to work in buying more stocks, crypto, and real estate.

In the meantime, cash is sitting there earning 4%. Not a bad way to add to my passive income.

Main pros:

- Easy access to liquidity.

Main cons:

- Interest rate fluctuates with changing market conditions. Therefore, I cannot rely on this passive income cash flow for planning purposes.

Individual Listed Stocks

I’ve invested in companies that I believe to have enormous growth potential or the stock price is undervalued.

I have exposure to a handful of individual publicly listed stocks. They are mainly large companies in the technology sector. Apple, Inc. (AAPL) is the single biggest listed stock holding in my investment portfolio.

Individual listed stocks make up a decent part of my investment portfolio, especially given the nice appreciation of my technology stock holdings over the past 15 years.

How is passive income generated:

Passive income is generated through dividend payments.

How does this investment fit into my passive income investment portfolio:

The passive income generated is very low given most of my stock investments do not pay a dividend or have a sub-1% dividend yield. They are mainly tech stocks after all.

I view this as an additional buffer in case of tenant delinquency.

Main pros:

- Preferential tax rate on qualified dividend payments.

- Can invest in real businesses you are familiar with and use their product.

- Low transaction cost.

- A lot of transparency and information into the company given the required SEC filings, disclosure requirements, and analyst\media coverages.

Main cons:

- High concentration on a company.

- Exposure to daily updates on market movement. Your emotions can be affected on up days and down days.

Private Equity Funds

My exposure to private equity funds has increased over the past 5 years.

SEC mandated rules that private equity investments are opened to accredited investors only. An accredited investor is a person who (i) has an annual income exceeding $200,000 ($300,000 for joint income) for the last 2 years with the expectation of earning the same in the current year or (ii) has a net worth exceeding $1 million.

A private equity fund holds equity investments in a basket of private companies.

Those private equity funds are invested in middle market companies. Middle market companies are companies with revenue between $10 million to $1 billion.

How is passive income generated:

Passive income is generated through distributions made by private equity funds.

Distributions are usually made after a monetization event of a portfolio company in the private equity fund. A monetization event can happen through the sale of the company or an equity re-capitalization.

How does this investment fit into my passive income investment portfolio:

Some of the private equity funds have performed well and have made good distribution payments over the past few years. Distributions tend to be chunky.

It’s like Christmas Day when a distribution payment is received. Most of the distribution payments are recycled back into making new investments.

Occasionally, a small amount makes its way into luxury item spending.

Main pros:

- Since investments are in private companies, there is no day-to-day market value movement.

- Distributions can be sizable if the private equity funds perform well.

- Private equity managers are well compensated. That means you are having some of the best and brightest people in finance managing your money.

Main cons:

- Distribution amounts are unpredictable. There can be years in between monetization events when no distribution is received from the private equity funds.

- K-1s are provided on private equity fund investments. It makes tax planning for the year more challenging.

- Hard to invest with top-performing private equity managers. They typically vet which clients they want to take on.

- Can have high dollar amounts to invest in private equity funds. Some funds have a minimum investment requirement of $10 million.

Private Credit Funds

My portfolio exposure to private credit funds isn’t that substantial. I prefer private equity fund investments over private credit because of the upside potential of private equity.

The private credit funds hold exposure to predominantly loans made to middle market companies. Sometimes, the borrowers provide equity kickers to help juice up the overall interest on the loans.

Only accredited investors can make investments in private credit funds.

There should, in theory, be less risk in private credit funds than in private equity funds because loans have seniority over equity. But there is also less upside.

How is passive income generated:

Passive income is generated through distributions from private credit funds. The private credit funds receive interest payments from the portfolio companies. In turn, the private credit funds then make quarterly\periodic payments to the investors.

How does this investment fit into my passive income investment portfolio:

The passive income earned here is another buffer in case my rental tenants default on their rent payments.

Main pros:

- Since investments are loans to private companies, there is no day-to-day market value movement.

- Loans made to portfolio companies are high yielding.

- Equity kickers have the potential to provide enhanced returns.

- Distributions are more predictable given the fixed income nature of the investments.

Main cons:

- Can have high dollar amounts to invest in private credit funds. Some funds have a minimum investment requirement of $10 million.

Cryptocurrencies

I believe anyone well to do should have crypto exposure.

I take the dumbbell approach to crypto investments. Most of my crypto portfolio is in the blue chips such as Bitcoins (BTC) and Ethereum (ETH).

Those blue chip investments ground my crypto portfolio. Then I take swings on small crypto tokens hoping to hit some grand slams.

My crypto portfolio isn’t the same size as it was last year given the crash in the crypto market.

This makes up a relatively small part of my overall investment portfolio but can be significant if the crypto market starts roaring again.

How is passive income generated:

Passive income is generated through the staking of my cryptocurrency coins.

How does this investment fit into my passive income investment portfolio:

I am definitely not relying on passive income generated from crypto for expense payments. I invest in crypto for appreciation. I view any passive income as icing on the cake.

Main pros:

- De-intermediate from any financial institutions results in full control of my assets.

Main cons:

- The crypto industry is a young and unregulated market. It is the Wild West and investors beware. A lot of scams, con artists, and houses of cards in this industry.

- Heavy self-reliance on self-custodied assets and asset transfers.

NFTs (Non Fungible Tokens)

The NFT market has taken a big hit as well over the past year. A lot of the value in art NFTs is going to the top blue chip NFTs and the mid to small ones are basically getting wiped out.

NFTs make up a small part of my investment portfolio.

How is passive income generated:

Passive income is generated through staking or airdrops.

How does this investment fit into my passive income investment portfolio:

NFTs provide a nominal amount to my overall passive income.

Main pros:

- The concept of digital art provides another utility in addition to purely the monetary aspect.

Main cons:

- The NFT industry is a young and unregulated market. It is the Wild West and investors beware. A lot of scams, con artists, and houses of cards in this industry.

- Heavy self-reliance on self-custodied assets and asset transfers.

Munis

Income taxes are my number 1 expense.

I’m constantly looking for ways to reduce my taxes.

I gave muni investment a try since they are exempt from Federal taxation.

My exposure to munis is very small.

How is passive income generated:

Passive income is generated through interest payments on the munis.

How does this investment fit into my passive income investment portfolio:

Not really a part of my passive income investment portfolio. I am just testing the water to better understand how they work.

They don’t make sense in my retirement accounts since taxes are deferred anyway. And if I ever leave my W-2 job, and my income drops substantially, the Federal tax exemption benefit means very little.

Main pros:

- Exempted from Federal taxes.

- Low default rate.

Main cons:

- The yield is reflective of the tax benefits. If the tax benefits are not meaningful to you, then the net interest earned will be low.

Fixed Income Mutual Funds

Some of my investments are in fixed income mutual funds.

But this makes up a small percentage of the overall investment portfolio. I prefer equity investments over credit because of the higher potential upside.

How is passive income generated:

Passive income is generated from distributions by the mutual fund.

How does this investment fit into my passive income investment portfolio:

The passive income earned here is another buffer in case my rental tenants default on their rent payments.

Main pros:

- Fixed income investments should be lower risk than equity with a more steady income distribution.

Main cons:

- More conservative than equity mutual funds.

Employer’s Private Company Stock

I received company stock in my employer, which is a private company.

This helps create an alignment between employees and employer if the employee also has skin in the game.

My holding of my employer’s stock was a larger part of my investment portfolio. But over time, I was able to sell my shares back to the company to cash them out.

How is passive income generated:

Passive income is generated through dividend payments.

How does this investment fit into my passive income investment portfolio:

The passive income earned here is another buffer in case my rental tenants default on their rent payments.

Main pros:

- Intimate knowledge of how my company is performing.

Main cons:

- Owning an employer’s stock can result in too much exposure to one company since your W-2 income is from the same employer.

- Heavy concentration on one company’s performance.

Summary

Building numerous passive income streams is the path to financial freedom. Diversification of investments provides increased protection against issues with any one passive income source.

I’ve constructed a passive income portfolio over the past 20 years which throws off enough cash to maintain my current lifestyle.

My passive income portfolio consists of rental properties, index funds, savings accounts, individual listed stocks, private equity funds, private credit funds, cryptocurrencies, NFTs, munis, fixed income mutual funds, and employer’s private company stock.

I ranked those asset classes by 9 attributes to determine which one is the best passive income investment.

Also, I discuss how each investment type fits into my overall passive income portfolio and the main pros and cons of each.

Hopefully, this post can help you make a more informed decision as you look to build out or enhance your passive income portfolio.

The key is to start now in earning income, saving that income, and building assets that can generate passive income.

The goal should be over time, the passive income is enough to cover your personal expenses. Then you can have full control of your time and be financially free.

To The Audience: Do you agree with my rankings? Are there other attributes I should consider in looking at the ranking of each passive investment? Which investment is your favorite for producing passive income? Are there other passive income investments that you are a big fan of?

Other Posts That Might Interest You

The 8 Reasons Why Extreme Frugality Is Bad

10 Reasons Why It’s Hard To Quit A Job Even When Financially Independent

Wealthy? Practice Stealth Wealth For Greater Peace Of Mind

$400,000 Income, No Taxes Paid

Doing This One Thing During Your First 3 Years At Work Can Lead To Millions

Easy Math Trick To Crush Retirement Goals And Why People Have The Wrong View About It

9 Ways To Reduce Or Avoid Capital Gains Tax When You Sell Stocks

Many people work hard to better their physical and mental health. What about their financial health?

I started this blog back in 2019 to help people better their financial health as well.

My financial journey began with tens of thousands in student loan debt. Over the span of 20 years, I am close to achieving financial independence.

I truly believe anyone can get to strong financial health. Hopefully, this blog can help you on your financial journey to greater wealth and financial independence.

You can read more about me here.

Thank you for visiting. Come again soon!

Super interesting, and I just discovered your blog. On a similar path with similar goals. Would you mind sharing either your asset allocation by percentage, and/or your gross (well, really more interested in after-tax net) passive income generation by asset class as a percentage? I assume based on what you have here that the majority (in terms of net-asset values) and after-tax income is rental properties. That may be a bad assumption but I would be curious for a post on this.

second, it would be interesting to understand asset appreciation by class, and how this is growing net worth over time, as the goals of each asset class may be different (income generation versus capital appreciation).

You are correct. My main source of passive income is from rental properties. Rentals make up approximately 80% of my post-tax passive income. I happen to be sitting on a large cash balance now because I’m looking for an optimal time to deploy the cash. Cash is currently about 5% of my post-tax passive income. Index funds make up another 10% and then the rest about 5%. My post tax rental income is already greater than my expenses. Therefore, everything else is additional buffer. Private equity is really chunky for me and payments are sporadic. The annual payments can add another 100% to my passive income.

Regarding your second question about income generation vs. capital appreciation, here is how I view them:

Rental properties – passive income generation mainly + inflation hedge

Index funds – capital appreciation

Savings accounts – income generation

Individual listed stocks – capital appreciation since in mainly tech and growth stocks

Private equity funds – capital appreciation

Private credit funds – income generation

Crypto – capital appreciation

NFTs – capital appreciation

Munis – income generation

Fixed income mutual funds – income generation

Employer’s private company stock – capital appreciation

My investment portfolio is made up largely of the first 5 (rentals, index funds, listed stocks, PE, and savings).