“… in this world nothing can be said to be certain, except death and taxes.” – an excerpt from Benjamin Franklin in a letter he wrote back in 1789.

Income taxes might very well be your number one largest expense. You might face income tax at the federal level, at the state level and at the local level. Living in New York City, I am one of the few who get to pay the 3 levels of income tax. Lucky me! Income taxes are certainly my biggest expense. As someone who is highly conscience of finding ways to reduce my expenses, focusing on my biggest expense item is a great start.

I earn income in a variety of ways. I have income from work (W-2 income), income from investments and income from rental properties. It goes without saying; I would like to reduce the taxes associated with each of those income sources. Ideally, if it is permissible by tax rules, I would like to get the taxes down to zero. My focus on this post is around my rental income and how I am able to not pay any income taxes on the cash received from rent payments.

If you don’t know already, I’m a big fan of real estate. Real estate can provide a number of benefits: cash flow in the form of rental payments, appreciation, leverage, and offers the ability to add value – are just some of the few benefits. This is why I believe real estate should be the cornerstone of your investment portfolio. The numerous benefits are also the reason why I own 5 rental properties totaling to 15 residential and commercial units. There are a number of tax benefits to owning real estate properties as well. One of the tax benefits allows me to earn over $400,000 a year in rental income and not pay one cent in taxes.

Gross Rental Income

The $400,000 represents my current gross rental income. This is the amount of rent payments I collect over the course of a year. It amounts to over $33,000 a month in rental payments received from my tenants. Of course, there are a number of expenses I need to pay out of pocket on those properties. It would be wonderful if I didn’t have to pay any expenses out of my own pocket and am able to keep the entire amount. But sadly that is not the case.

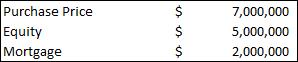

Here is a quick snapshot of the total price amount, equity and mortgage on my 5 rental properties:

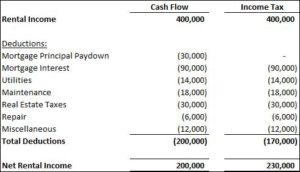

Here is a break –down of the out of pocket expenses on my rental properties (two columns, one on a cash flow basis and one on an income tax basis):

Mortgage Principal Pay down

There is a total mortgage balance of $2 million on $7 million of real estate purchases. The remaining $5 million is the equity ownership on the properties. You can view that as the down payments made on the 5 rental properties. My mortgages on the properties varied on terms but, for simplicity sake, my mortgages average out to about an interest rate of 4.5% over a 30 year term. That comes out to be approximately $10,000 a month in mortgage payment or $120,000 a year. The split between principal payment and interest on the mortgage is about a 25%/75% split early in the life of the mortgage.

The monthly principal pay down on the mortgage comes out to $2,500 a month or $30,000 a year. This is a cash outflow on a monthly basis. From a net worth perspective, I am no better off or worse off. I simply converted my cash into a higher ownership in the rental properties. But obviously, cash is king. While it is purely an asset swap (cash for more equity in real estate), I still need to take into consideration the loss of liquidity on that cash amount. While it is an annual cash outflow of $30,000, it is not a tax expense. As previously mentioned, it is net worth neutral to me, and cannot be taken as a tax deduction. Therefore, under the income tax column above, I cannot deduct the amount against my taxable income.

Mortgage Interest Payments

A rate of 4.5% over 30 years on $2,000,000 of mortgage amounts to a monthly interest expense payment of $7,500. That totals to $90,000 a year. The split of the mortgage payment of $10,000 between principal and interest will change over time. The initial split of 25% principal and 75% interest is more tax beneficial. Over time, the amount applied to the principal will be greater and the amount allocated as interest payment will decrease. This will reduce the amount of taxable expense related to mortgage interest deduction as the properties are held longer and longer. But for the near future, the split is more favorable from a tax perspective.

Mortgage interest payments are both a cash outflow and a reduction in taxable income. After applying mortgage interest deduction, my gross rental income of $400,000 per year drops to $310,000.

Utilities

There are utility expenses in operating the rental properties. Heat and gas are not utilities I cover. I like to have separate heat and gas meters and have the tenants pay for their own heating and gas usage. Early on in running my rental properties, I used to cover heat on some of my properties. It became quite a hassle during winter time. As the person paying for the heat, I would like to pre-set the thermostat to hit certain temperatures depending on the city requirement; thus keeping my heating cost at a minimum. Tenants complained that it was never warm enough for them and demanded for the heat to be turned up higher. Of course, the tenants preferred to be warm and toasty if they didn’t need to pay for the heating cost. This led to headache in managing the heating bill and constant complains from tenants. I decided I didn’t want to deal with that any longer. Thereafter, I separated all the meters on my rental properties. I allowed my tenants to control the thermostat but the tenants pay for their own usage.

Even without having to cover heating and gas, there are still two utility expenses I cover. The first one is the water and sewer bill. The second utility expense is the electricity expense to light the public spaces such as the public hallway, staircase and basement. The water and sewage bill averages to $2,000 per year per property and the public lighting bill averages $800 annually per property. The total annual utility cost for the 5 properties amounts to $14,000 per year. Utility expense payments are both a cash outflow item and a deduction to taxable income.

Maintenance

I don’t have a management company handling the maintenance of my properties. At this point and given the small number of units, it is hard for me to justify hiring a management company. A management company generally charges 5 to 10 percent of gross rent. Given each individual property is on the small number of unit size, the management fee would most likely be closer to 10% for my units. Paying $40,000 a year is too steep of a price to outsource the management work. I would prefer to handle the five or so phone calls/text messages a month and save myself the $3,300 ($40,000 a year).

But I still need people to help me maintain the properties. There are weekly tasks which would need to be performed and I do not have the time to handle them. I need someone to help me take out the trash, take out the recycling, clean the public areas, and remove snow. I usually ask one tenant in the building to act as my super and pay $300 a month for the service. This comes out to be $3,600 a year. With 5 properties, I pay $18,000 a year for maintenance.

This maintenance fee is both a cash outflow and a tax deduction for income tax purposes.

Real Estate Taxes

Most of my rental properties are located in New York City. I think the real estate tax in New York City is relatively inexpensive when compared to the market value of the property. I pay about $30,000 a year in real estate taxes (about $6,000 per property). Given the $7,000,000 in total property value, real estate tax amounts to less than half a percent of property value.

Real estate taxes are both a cash outflow and a tax deduction for income tax purposes.

Repair

With 15 rental units in total, something inevitably will need to be repaired. It can be the dishwasher over flowing with water and needs to be looked at by a repairman. It can be something wrong with the boiler, a breakdown of any of the appliances, a puncture hole on the kitchen sink pipe, clogged pipes and sewer lines, or a broken toilet. There is always something. My annual repair cost comes out to be about $6,000 in total or $1,200 per property.

The cost associated with repairs is both a cash outflow and a tax deduction for income tax purposes.

Miscellaneous

My miscellaneous expenses come out to be about $200 per month per property. With 5 properties, these expenses amount to $1,000 per month or $12,000 per year. A sampling of my miscellaneous expenses include property insurance, exterminator services, sanitation tickets if my tenants or super didn’t do a good enough job sorting recycling from garbage, professional fees paid to my accountants for handling the tax work on the LLCs, cleaning supplies, snow salt, and garbage and recycling bags and cans. There are certainly a lot of miscellaneous expenses with respect to operating 5 rental properties and 15 units of tenants.

These miscellaneous expenses are both a cash outflow and a tax deduction for income tax purposes.

Net Rental Income

$200,000 is the net rental cash flow received. This amount represents the net amount I get to pocket after clearing all out of pocket expenses on my rental properties. This averages to over $16,500 a month in cash in my pocket from my rental properties.

The taxable income after deducting for all the operating expenses is $230,000. Now remember, the difference between the $200,000 of net rental cash flow and the $230,000 in taxable income is the $30,000 of mortgage principal payments made throughout the year. That amount is not deductible for tax purposes.

With $230,000 of taxable income, you would expect a pretty sizable tax bill. But I didn’t mention one last tax deduction. This next tax deduction is the best one of all. It allows me to pocket $200,000 a year in cash without paying a cent in income tax. This is one of the reasons why I really like real estate as an asset class.

Depreciation

Depreciation is the key! The Internal Revenue Service (IRS) believes that there is a set useful life to a building. The IRS has determined, for a residential rental property, the cost of the property can be depreciated over 27.5 years. This means I can take 1/27.5 of the total cost of the building as a tax deduction even though there is no cash outflow associated with this expense. This is a non-cash expense item for tax purposes – the best kind of tax expense item.

First you have to take your purchase price and determine how much of it should be attributed to the land and how much to the actual building. This allocation of the purchase price is based on the proportion of the market value of the land and market value of the building at the time of purchase. The cost associated with the land is not depreciable. Only the cost associated with the building is depreciable.

I looked at my tax assessment records in order to come up with the land to building split. The break down, based on the tax assessment records, comes to an average of 90% to the building value and 10% to the land value. Therefore, on my $7,000,000 total purchase amount, $6,300,000 can be attributed to the total value of the buildings and $700,000 to the total value of the plots of land. The $6,300,000 can then be depreciated over 27.5 years, resulting in an approximate depreciation deduction of $230,000 per year over the 27.5 year life.

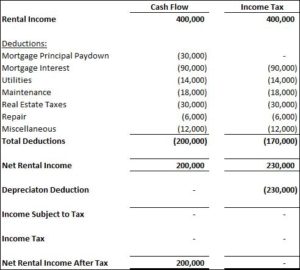

Here is a break –down of the out of pocket expenses on my rental properties with depreciation factored in (two columns, one on a cash flow basis and one on an income tax basis):

You can see from the table above that the depreciation deduction effectively takes my taxable income down to zero. Hence, there is no income tax amount due. My net rental income after tax ends up being zero as well. But here’s the magic. As previously mentioned, depreciation is a tax concept. It doesn’t involve any cash payments out. Therefore, my cash flow remains unaffected by the depreciation deduction. And given there is no tax liability, I still get to keep the entire $200,000 in my pocket. How wonderful is that. I keep $200,000 in cash and I do not need to pay a cent in income tax.

Conclusion

The not so secret secret to not having to pay taxes on $200,000 of net income in the pocket is deprecation – a tax only deduction which doesn’t involve a true cash outflow. This is why I have 5 rental properties and I am still looking for more to buy. I enjoy the ability to collect a steady stream of cash flow, take advantage of the tax code, and get to keep the entire amount without having to pay any income tax. Maybe Benjamin Franklin is only half right in the letter he wrote.

To the audience: Are there other non-cash tax deductions you like to take advantage of in the tax code? Would this tax benefit change your assessment of real estate as an asset class in your investment portfolio? Are there other ways to reduce your taxable income from rental properties you would like to share with our other readers?

Many people work hard to better their physical and mental health. What about their financial health?

I started this blog back in 2019 to help people better their financial health as well.

My financial journey began with tens of thousands in student loan debt. Over the span of 20 years, I am close to achieving financial independence.

I truly believe anyone can get to strong financial health. Hopefully, this blog can help you on your financial journey to greater wealth and financial independence.

You can read more about me here.

Thank you for visiting. Come again soon!

Nice breakdown of depreciation off-setting income. And the beauty of real estate is this math works on any real estate investment.

You are right – but there are different depreciation periods depending on the type of investment property. Rental properties with residential units have a different depreciation period than a commercial property. As a reminder to our audience – be sure to research or consult with your tax accountant.

Rich – thanks for the post! How long did it take you to acquire $7M worth of RE? You currently have $2M in mortgages, but how much did you originally finance? Where are the properties located? You mention you live in NY, is that where the properties are located?

I’m a new reader and I’m excited to dig into your other posts. I’m a fellow blogger and have aspirations of gaining entry to the deca-millionaire club.

Our goal is $10M by 48 and we are 32 now. We just entered the double comma club at the end of 2018. We too have a high income and would love to reduce our tax bill or at the very least keep adding income that is more tax efficient. RE is the next focus for us.

Dom

Hi Dom,

I started investing in real estate a little bit over a decade ago. The timing worked out well for me and I was able to ride the wave up.

I have properties predominantly in Brooklyn with a few properties sprinkled in other New York City boroughs and in New Jersey.

My financing at first was higher than where it is today. I paid off a couple of mortgages and a portion of my monthly payments went to principal pay down.

I believe real estate should be a cornerstone in your investment portfolio.

I will be posting an article in the next couple of days showing how someone I know was able to build a real estate empire with 30+ properties, tens of millions in value over roughly a 10 year span with little capital to start.

Best of luck on your financial journey to hitting deca-millionaire status!

BTW – It would be awesome if you added the ability for us readers to subscribe to the comments of a post so we can continue the conversation by being notified of replies.

Dom – thanks for the improvement point. I will look into this.

You may also want elaborate on 3 more points that the savvy readers may also be interested in and must be very aware of.

1. What happens if the expenses (including the depreciation) exceeds the gross rental income? I believe the answer is that it will be a “loss” that can be claimed with the IRS.

2. What happens when the property is finally sold? Here, I believe the IRS is going to “recapture” the depreciation over the years and subtract this from the cost-basis (resulting in larger gain) in figuring the capital gain on the sale of the property.

3. What happens when you trade up the property? This is the 1031 exchage where in you can trade up the property within a set period without incurring any tax event.

All very good points.

1. A loss can be claimed but it is dependent on if you are (i) a passive investor or (ii) a real estate professional. There are quantitative tests in order to be considered a real estate professional. A net loss can be claimed for a real estate professional. For a passive investor, only up to $25,000 can be claimed as a loss and the loss gets phased out after a certain income level. Consult with a tax professional but I believe I’ve summarized it on a high level.

2. Yes, depreciation recapture will come into play. I have the hold forever mentality when it comes to my real estate investments. Therefore, I don’t pay too much mind to depreciation recapture. Additionally, there is the 1031 exchange option if you want out.

3. 1031 exchange – another reason why I am a big fan of real estate investments. There are so many tax advantages to owning real estate.

What cap rate did you buy at?

What rates are you currently seeing, and what’s your minimum threshold for be purchases?

I purchased at various cap rates since I started investing 10 years ago. It ranged from north of 10% to around 6%.

Currently, the cap rate for the neighborhoods I look in Brooklyn is around 5%. I can be patient and I try to aim for a cap closer to 6% and have my cash on cash return at that rate as well.