Achieving financial freedom isn’t an easy path. Only a select few can make it.

63% of Americans are living paycheck to paycheck according to a recent LendingClub report.

Higher-income earners, those making more than $200,000, aren’t immune to living paycheck to paycheck as well. 28% of such higher-income earners live paycheck to paycheck.

It isn’t just how much you make that matters; it is how much you can keep.

Take the alarming financial stats for professional athletes who have made millions:

NFL players: $3.2 million is the median income of an NFL player. 16% of NFL players will go bankrupt within 12 years of retirement.

NBA players: On average, NBA players who declare bankruptcy will do so within 7.3 years after retirement. 6.1% of all NBA players will go bankrupt within 15 years of retirement. The median career earnings are $12.67 million.

Other research pegs a grimmer financial picture for professional athletes. 78% of NFL players and 60% of NBA players face serious financial hardships after retirement.

Ultimately, the takeaway is that regardless of income, you have to keep your expenses in check.

It doesn’t matter if you make $10 million per year if you spend $12 million annually. You will still end up in the poor house.

The key is to monitor your expenses. And you can do that by developing a budget and keeping to that budget.

What is the ideal budget for how to spend your money?

Let’s take a look below. If you stick with the ideal budget breakdown, you will achieve financial freedom in no time.

The Mainstream Budget Advice: Follow The 50/30/20 Rule

You might have heard of the highly touted 50/30/20 rule. This rule is found in a lot of financial advisor sites.

The 50/30/20 rule is meant to be a simple budgeting framework. The rule states: (a) allow up to 50% of your after-tax income for needs, (b) leave 30% of your income for wants, and (c) commit 20% of your income to savings and debt repayment.

Some of the items in the 50% needs category are:

- Housing

- Groceries

- Basic utilities

- Transportation

- Insurance

- Minimum loan payments. Anything beyond the minimum goes into the savings and debt repayment category.

- Child care or other expenses you need so you can work

Some of the items in the 30% wants category (nonessential expenses) are:

- Clothing

- Restaurants

- Monthly streaming subscriptions

- Gyms

- Movies

- Travel

Some of the items in the 20% savings category are:

- Savings accounts

- Retirement contributions

- Loan repayment

- Credit card payments

In my opinion, the 50/30/20 rule only works if you make a few modifications to it. Otherwise, it is not very helpful in helping you achieve financial freedom.

You Need To Make Two Adjustments To The 50/30/20 Rule For Financial Freedom

The mainstream rule only works if two modifications are made to it.

The first one is that the 20% savings category is for savings only and should not include loan repayment or credit card payments.

Loan repayment and credit card payments should come out of the other 80% expense budget.

And the second one is that the 20% savings need to be invested at all times. Let the power of compounding get you to financial freedom a lot earlier.

Why make the 2 adjustments? It is simply math.

To achieve financial freedom, you need to generate enough returns from your savings to pay for your expenses.

Taking 20% to pay off debt does not provide for assets to earn a return.

Also, the power of compounding on the savings results in a very powerful effect over time.

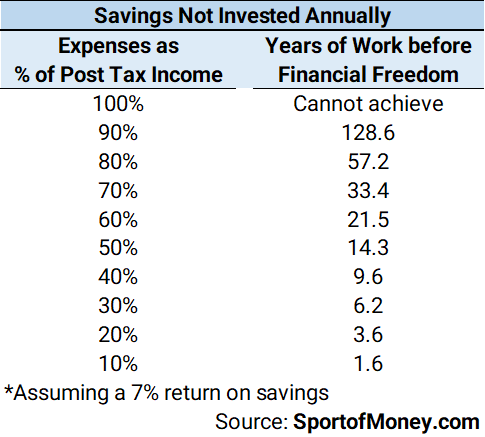

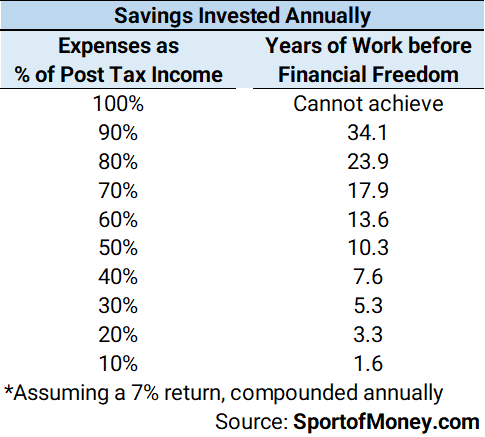

See the below two tables – the first one is if the savings are sitting idly in cash and the second table shows the savings being invested annually generating a 7% return.

Without investing the savings, even spending 80% of income (and thus saving 20%) will only lead to financial freedom after 57.2 years of working.

Even starting at age 22, you cannot achieve financial freedom until the age of 79.

I don’t know about you, but I certainly have no intention of working until that age.

But with your savings put to work, you can achieve financial freedom in under 24 years. That is a huge difference.

Now, even if you completely goofed in your 20s, you can still achieve financial freedom by your mid-50s.

How Do Americans Spend Their Money?

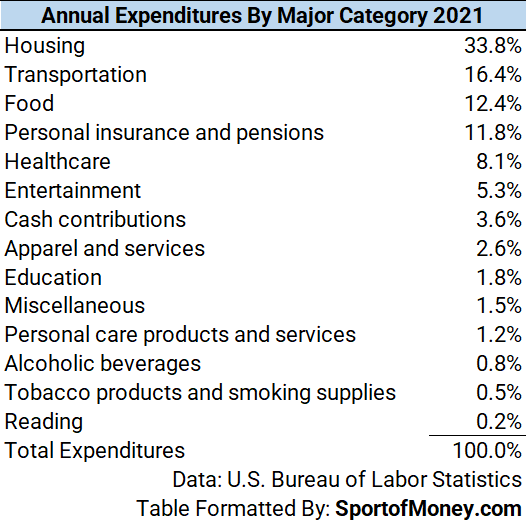

The U.S. Bureau of Labor Statistics published the consumer expenditures for 2021.

The average annual expenditures in 2021 were $66,928, a 9.1% increase from 2020.

During the period, the Consumer Price Index rose 4.7% and average income before taxes increased by only 3.7%.

It does not bode well for savings when the percentage increase in spending outstrips the increase in income by over 2 times.

The 4 biggest expenditures for the American household in 2021 are (i) housing at 33.8% of the budget, (ii) transportation at 16.4%, (iii) food at 12.4%, and (iv) personal insurance and pensions at 11.8%.

It doesn’t surprise me that housing, transportation, and food are the top 3 expense categories.

How does the actual spending of an American household compare to the 50/30/20 rule?

Not that well if the goal is to save as much as possible.

The American household spends too much in the needs category. That percentage is closer to 75%. That means there is just a lot less room for savings, after paying for wants as well.

Americans are just not saving much. Hence, over 60% live paycheck to paycheck.

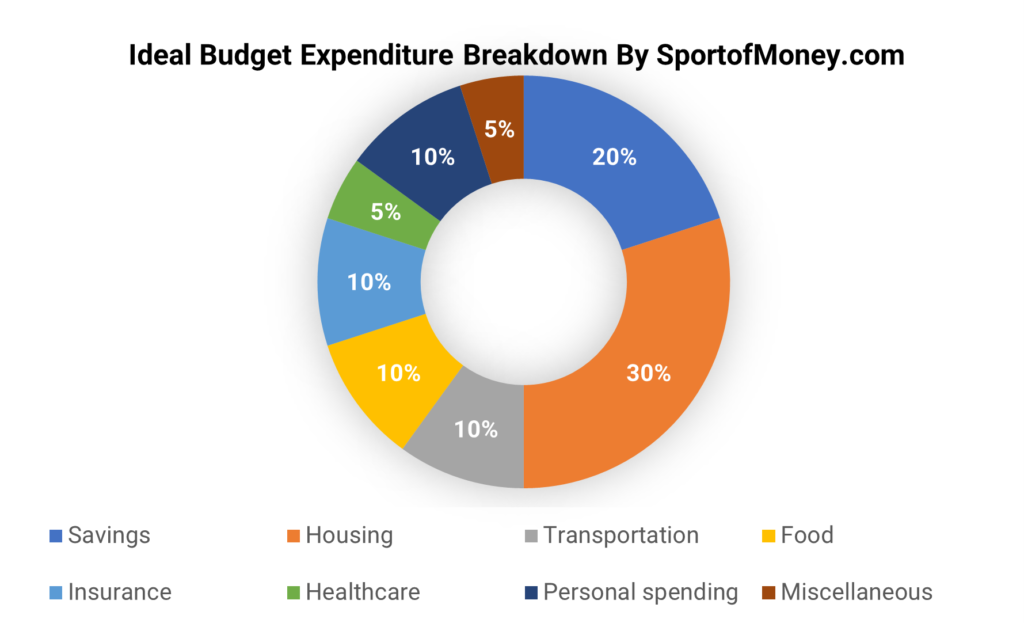

The Ideal Budget To Achieve Financial Freedom Sooner

Now you know what the typical American budget is and where money is spent.

Let’s examine how we can modify that budget to get to the ideal budget to achieve financial freedom sooner.

The priority is to increase the savings rate. The savings percentage needs to go up.

The aim should be a minimum 20% savings rate. This allows for financial freedom in under 24 years.

Ideal Budget

Savings: 20%

Necessities:

Housing: 30%

Transportation: 10%

Food: 10%

Insurance: 10%

Healthcare: 5%

Total necessities: 65%

Wants:

Personal spending: 10%

Miscellaneous: 5%

Total wants: 15%

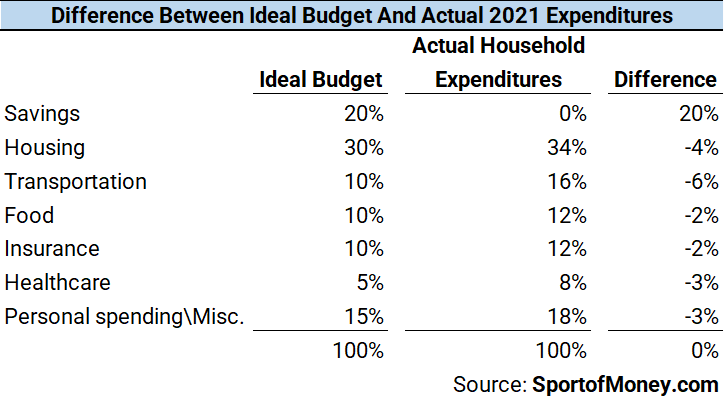

The biggest difference between the ideal budget and the 2021 actual American household expenditures is the increase in the savings rate to 20%.

How do we make room for a 20% savings rate? By decreasing the spending on other expenses.

Housing and transportation expenses are the top 2 adjustments. Housing expenses should go down by 4% and transportation costs should go down by 6%.

All the other expenses should each be decreased by 2% to 3%.

Sacrifices in spending need to be made in order to have money left over.

Reduction In Housing And Transportation Costs Can Yield The Best Result

Americans spend the most money on housing and transportation.

Unsurprisingly, a reduction in spending on these two expense items can yield the biggest results.

Some of the actions below can juice up your savings.

Reduce Housing Costs By Living In A Smaller House

In 1980, the median size of a new house in the U.S. was 1,595 square feet. Today, the median size of newly constructed homes is 2,386 square feet.

Most of the newly constructed homes in the U.S. have 4 or more bedrooms and multiple bathrooms.

Over these 40 years (from 1980 to today), house size increased by close to 800 square feet.

House sizes grew by approximately 50% during this period despite the average household dropping in size.

The average number of people per family in the United States in 1980 was 3.29 compared to 3.13 today.

Back in 1980, each family member occupied 485 square feet of space. That number is up to 762 square feet of space per person today. That is close to a 60% increase in space per person.

A 4% budget reduction in housing spending equates to spending 12% less on housing costs (4%/34%).

That can correlate to buying a house 12% smaller in size. Instead of buying a house that is 2,386 square feet, aim to buy a house that is 2,100 square feet.

It still results in 670 square feet of space per family member which is still 40% more space per person than what your parents had in 1980.

Not only will your mortgage or rent go down with a smaller house, but all the other ancillary expenses will also be less too.

Your insurance, utility bill, maintenance costs, and real estate tax should all decrease with a smaller house.

Other Ways To Reduce Housing Costs

One good way to save on housing costs when starting is to continue to live at home with your parents for as long as possible.

Living at home has other benefits as well. You can reduce your transportation expense by borrowing your parents’ car.

You get home-cooked meals without having to spend money eating out. There is no additional cost for laundry service.

Or if you have to move out, don’t just rent out an entire place by yourself. Try to look for roommates to share the rent burden.

Another way to cut housing expenses is to buy a multi-family house. You can live in one unit, and rent out the rest.

That way, you can receive some rental income to offset your housing costs. This is a good strategy for living in a high-cost area such as Brooklyn, New York.

Reduce Transportation Costs

Unlike a house, a car is a depreciating asset. Yet, transportation is the second largest expenditure of the typical American household after housing.

To save money, spend less on your wheels. Transportation costs should only be a maximum of 10% of your total budget.

This includes all the costs associated with owning a car as well. Lease payment/financing payment, gas, oil changes, and regular maintenance in total should be capped at 10% of your budget.

The 10% budget might mean getting a 3-year-old Subaru Forester instead of a brand-new BMW X7.

But that money saved will pay huge dividends in the future.

Save Money By Shopping For Deals

When shopping, look for deals to help save money and cut down on spending.

Take booking a vacation for instance. Airfare and hotel rates are different depending on the time of year you visit a tourist location.

If you go to the Caribbean during Christmas week, be prepared to pay double or more for airfare and resort accommodations. Everyone is looking to escape winter in the United States and look to go somewhere close and warm during that time.

Try to stay flexible with your trip locations to save money. When everyone is looking to go to the Bahamas, maybe explore hitting a place in Canada instead.

Look to travel to a location during the low season. You can experience huge monetary savings that way. A smaller crowd is another benefit to traveling during the low season.

Use an app like PayPal Honey when shopping online for coupons and discounts on items.

Living in New York City, things can get expensive here. I am always on the lookout for deals at the local CVS store.

Additionally, I try to visit Costco once a month for savings instead of buying items from Amazon or Fresh Direct.

Keep In Mind Private School And College Education Is A Financial Decision

I know parents want to do everything in their power to give their kids a leg up in life. That includes providing their kids with the best education possible.

You might think private school tuition be damned. If my kid wants to go to New York University, I’m going to find a way to make it happen. Who cares if tuition is $58,000 per year and room and board is another $20,000?

Well, that is the wrong thinking.

Attending private school is a financial decision first and foremost. It has to make economic sense to pay such an exorbitant amount.

Are the benefits worth the cost? If not, then don’t go to private school or attend a private university.

Go to a state school.

Take Binghamton University, which is a public school in New York State. The 2022-2023 tuition is only $7,000 for in-state residents. Add in room and board, and other fees, and the total cost of attendance is $28,000 for the year.

That is an enormous saving for attending a great public school ($28,000) versus going to a private school ($78,000).

Don’t Forget To Set Money Aside For Emergency Expenses

Part of your miscellaneous budget should be money set aside for emergency expenses.

Major appliance repairs or replacements, last-minute travel, unexpected tax bills, medical emergencies, car breakdowns, and job loss can be unexpected expenses.

Your emergency fund should grow each year unless there is an emergency usage.

Don’t drip into it because you don’t know when an emergency might happen.

Upgrade Lifestyle Only If Income Goes Up And Is Steady In The Foreseeable Future

As your income grows, try to keep the expenditures consistent in dollar terms.

This way, you can continue to increase your savings.

Treat it like a game – how much can you save over the span of a year?

Try to get to a savings rate of 25%. Then shoot for a savings rate of 30%.

20% is a good starting percentage. But to really turbocharge your path to financial freedom, that rate should go higher.

Increase your lifestyle only when you can save up to 30% of your take-home pay and you believe your income is ss and stable in the foreseeable future.

Reward Yourself For Keeping To The Budget

Lastly, reward yourself for keeping to the budget over time.

It isn’t easy to save 20% of your income. That is why almost 2/3 of all Americans live paycheck to paycheck.

Even high-income earners and athletes making millions per year can run into financial trouble.

Once you can save 20% of your income for over 3 years in a row, then reward yourself a little. Use some extra money for that vacation.

Next, once you can save 30% of your income for over 3 years in a row, then reward yourself again.

After all, having a little extra reward allows you to appreciate why you chose to save in the first place.

To The Audience: Do you agree with the ideal budget breakdown? What savings rate do you target? How much of your budget is spent on housing and transportation costs?

Other Posts That Might Interest You

The 8 Reasons Why Extreme Frugality Is Bad

10 Reasons Why It’s Hard To Quit A Job Even When Financially Independent

Wealthy? Practice Stealth Wealth For Greater Peace Of Mind

Many people work hard to better their physical and mental health. What about their financial health?

I started this blog back in 2019 to help people better their financial health as well.

My financial journey began with tens of thousands in student loan debt. Over the span of 20 years, I am close to achieving financial independence.

I truly believe anyone can get to strong financial health. Hopefully, this blog can help you on your financial journey to greater wealth and financial independence.

You can read more about me here.

Thank you for visiting. Come again soon!

Your numbers look dead on to me. We saved on housing by living in a LCOL area and by staying in the same house for these last 40 plus years. Transportation costs were very low with only an eight minute commute for me and a free company car with free gas, insurance and maintenance. So we were able to live a rich life with a good savings rate and become financially independent in our fifties. I didn’t track savings rate, I know it was usually in the 20% range but at the end of my career when my compensation shot way up it was more like 50-60%. We just did/do not spend according to our income or assets, we spend on what we value and most of that is not expensive.

It’s great to get confirmation regarding the ideal budget from someone who has achieved financial independence in your 50s. That’s the best of all worlds to hear that you were able to increase your savings rate when your compensation went up because the things you value didn’t cost much.

I actually don’t understand the housing vs loan/debt category. If I pay 3800 a month for our home, lets say 2000 is principle, 800 interest, 1000 taxes (for easy round numbers). Is the $3800 in total in the 50% category? Or does this model mean we need to break it out? Same goes for car. If the car payment is $500 a month is that 50% OR 20%

Everything related to housing including principal paydown should be in the housing category. Same goes for car payments.

In the ideal budget, you should keep your housing expenses to 30% or lower of your take home pay. That 30% includes paying down the principal on the mortgage, interest, real estate tax, etc. Your transportation costs (including car payments) should be 10% or less of your take home pay. If you take home $10,000 per month, don’t spend more than $3,000 on housing and $1,000 on car.