How much does it take to be middle class, upper middle class, and upper class in New York City?

I think it is largely dependent on who you ask.

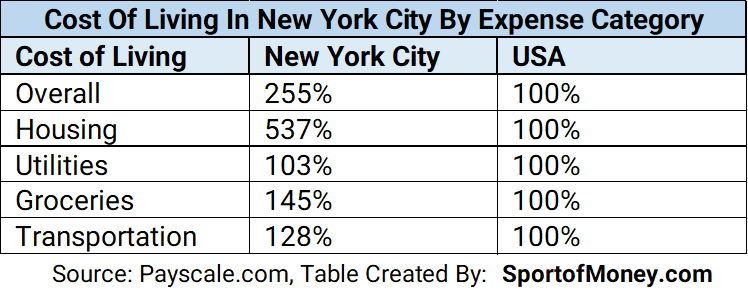

We all know that New York City is a very expensive city. NYC is over twice as expensive to live in when compared to the national average.

But what is lost on most people is that the average New Yorker (median household income of $67,997) actually makes less than the average American (median household income of $70,784).

Additionally, New York is the state with the highest taxes among the 50 states when factoring in income, sales, and property taxes.

The high cost of living, high taxes, and below-average wages make for a very challenging financial situation.

You need grit, determination, and resourcefulness to be able to carve out a life in New York City.

Like the song goes: if you can make it there [in New York], you can make it anywhere.

Pew Research’s Definition Of Middle Class And Upper Class Income

Pew Research defines middle class income as those whose annual household income is two-thirds to double the median.

And upper class income is double the median.

That puts the middle class income range in NYC at $45,331 to $135,994. The upper middle class income is at the higher end of the range say from $115,000 to $135,994.

And anything above an income level of $135,994 will put you in the upper class in New York City.

Now, this is the technical answer using Pew Research’s definition of the middle class and upper class determined by income.

Any New Yorker will tell you that a $135,994 income will not be considered upper class in New York City.

As a native New Yorker, I don’t feel $135,994 is close enough to be able to support an upper class lifestyle. Keep in mind that $135,994 is pre-tax income.

Pew Research, in my mind, has set a low bar for the definition of upper class.

Town And Country’s Definition Of Wealth

A few years ago, I came across an article published by Town and Country Magazine.

Town and Country Magazine’s definition of wealth is on another level. The article is titled “Here’s Exactly How Much Money You Need To Be Happy.”

The article takes a typical wealthy New York family, a married couple in their forties with two teenage kids, and calculates how much wealth they would need to feel content and happy.

Surprisingly, one wealth figure that was mentioned was $190 million but there seems to be some consensus around at least $100 million as a starting point to live a content life for such a family.

As I said, it depends on who you ask when it comes to different class levels in New York City.

$100 million+ is a crazy high number and this article was written 5 years ago which didn’t take into account the explosive inflation we are experiencing today.

The Content Life Style Of A Wealthy New York Family According To Town And Country Magazine

Here is what living a wealthy life looks like according to the Town and Country Magazine for a married couple in their 40s with 2 teenage kids:

- They have an apartment on Fifth Avenue facing Central Park with 8 to 12 rooms which the article mentions is appropriate for a family of 4. An apartment like this goes for $18 million. Then another $2 million is needed to decorate the apartment. The cost of the decoration makes sense to me; you can’t buy an $18 million apartment and furnish it with Ikea.

- They also need a weekend house in the Hamptons at $10 million and a vacation spot in the Caribbean for another $10 million. That is $40 million worth of real estate in total for the 2 vacation spots and the primary Central Park residence.

- There is a private school for the kids, private tutoring, music lessons, sports, enrichment activities, trips abroad, and, ultimately, 4 years at an Ivy League. They pegged the total cost at $1.7 million per kid. That is $3.4 million for two kids.

- You can’t forget about the staff to manage the household and family. The family needs a chef, a driver and a maid. A driver, who can multitask, such as helping out with parties, can cost $100,000 a year. The salaries for the maid and the chef can run $90,000 per year combined. That is $190,000 in annual salaries for the household staff.

- There are also private jet trips, parties, art purchases, philanthropy, and incidentals.

The household and living expenses associated with such a lifestyle are estimated at $3.2 million a year.

To achieve that, plus set aside $1 million per year for art (of course, who doesn’t need to spend $1 million per year on art) and $25 million in cash for each of the children (nice, there is no need to teach your kid to be a millionaire when you can just give him $25 million to start), the net worth this couple need is $190 million (I’m going to check my couch to see if I have that laying around).

What Level Of Income Is Needed To Live An Upper Middle Class Lifestyle And An Upper Class Lifestyle in Manhattan?

The next level of wealth and lifestyle highlighted by Town and Country appear to be over the top. And the Pew Research definition appears to be too low.

The answer must be somewhere in between the two studies.

It does beg two questions for me when examining wealth and income in a high-cost-of-living city such as New York: (1) how much does a family need to live an upper middle class lifestyle and (2) how much does a family need to live an upper class lifestyle?

It is a very subjective exercise in coming up with the lifestyles of an upper middle class family and an upper class family. But, never one to be daunted by a big task, I will give it a shot based on my own experience living in New York City as well as through discussions with other New Yorkers.

My Definition Of Middle Class And Upper Class

There’s Pew Research’s definition of classes and then there’s Town and Country Magazine’s definition.

Alternatively, there is my definition of upper middle class and upper class.

My definition of wealthy means being able to enjoy a nice vacation and not worry about paying for a nice meal out or making the mortgage payment. Retirement funds and college savings are either taken care of or well on their way.

To State The Obvious, Money Doesn’t Go As Far In New York City

First off, this is my definition of what the lifestyle is like for the two classes of families living in New York City, specifically in Manhattan.

Manhattan is very expensive and the numbers below can feel out of sorts if you don’t live in New York City or another high-cost-of-living area.

I believe the cost of a lifestyle is dependent on geography. If you live in a location where you can have the same lifestyle, but spend a fraction of what a New Yorker would need to spend, then you should be happy about it.

For instance, take housing as a point of comparison.

A 3 bedroom 3 bathroom 2,000 square foot apartment routinely runs $2,500 a square foot in a full-service building in Manhattan.

The median size of a single-family house in America is about 2,400 square feet. The Zillow Home Values Index puts the typical home value in the United States at $357,810 as of September 30, 2022. That comes out to $150 a square foot.

This means the Manhattan family living in a new development condo apartment pays substantially more per square foot for housing than the average American.

The price difference can be in the magnitude of over 16x on a price per square foot basis.

Or put another way, to get an apartment of comparable size to the median single-family house, the Manhattan family needs to spend $6,000,000 on housing.

“Wait”, you argued, “isn’t the Manhattan family living too lavishly in a full-service building with doormen and porters, on a high floor with a view, and other amenities such as a gym and playroom?”

Benefits Of An Average American House Over A Manhattan Full-Service Condo

Despite the amenities that could be found in a full-service building such as a gym, rooftop terrace, or a playroom, the typical American house has more private space such as the unfinished basement, a garage, and yard space.

There are other benefits a single-family house has over a New York City apartment in addition to space.

Take the garage for example. Having a personal private garage is extremely important and convenient, especially for transporting a family with kids.

You have access and usage of the car whenever your heart desires. This is a freedom taken for granted by many with this “luxury”.

Take my situation for instance. I live in Manhattan and have a car. I pay to park the car in a garage 3 blocks away from my home.

I have to call 20 minutes in advance to be able to pick up my car.

Over the weekend, I try to look for street-side parking instead because of the inconvenience of having to call in advance to pick up my car.

There are other benefits in addition to having a private garage that an average American single-family house has over an apartment.

There is yard space. You can actually barbecue, set up a swing set, install a pool or just hang with the kids outside. There is no need to share space with anyone else.

In an apartment building, there are usually neighbors above, below, to the right and to the left. There has to be quieter, lighter walking, and less noise for fear of disturbing the neighbors.

You might also be living next to neighbors who are inconsiderate, nasty, noisy, or dirty. It is a mixed bag in apartment living.

An Apple To Apple Comparison Of Housing

To capture some of the benefits of living in a single-family house, the New York family can look to buy a townhouse in Manhattan.

Affording your own townhouse in Manhattan will run at least $6 million; but it is most likely a lot more if the townhouse is in a good location and renovated. And the townhouse will most likely not have its own parking.

So a typical single-family house in Middle America which runs $360,000 costs $6 million plus in New York City. And it most likely is an attached house (with houses on both sides) without a garage space.

With slightly over 1/3 of a million dollars, you can pay all cash for a 2,400 square foot house in Middle America and never have to worry about a mortgage payment again.

However, in Manhattan, a million-dollar down payment on a townhouse results in paying PMI in addition to an incredibly large monthly mortgage payment.

Once again, I am using housing to illustrate how expensive it is to live in Manhattan and what the cost disparity can be when looking at a high-cost-of-living area versus a middle tier cost of living area.

The difference is staggering and, hence, the amount needed to maintain an upper middle class or upper class lifestyle is a lot larger than what you find in other less pricey locations.

My Definition Of An Upper Middle Class Lifestyle In Manhattan

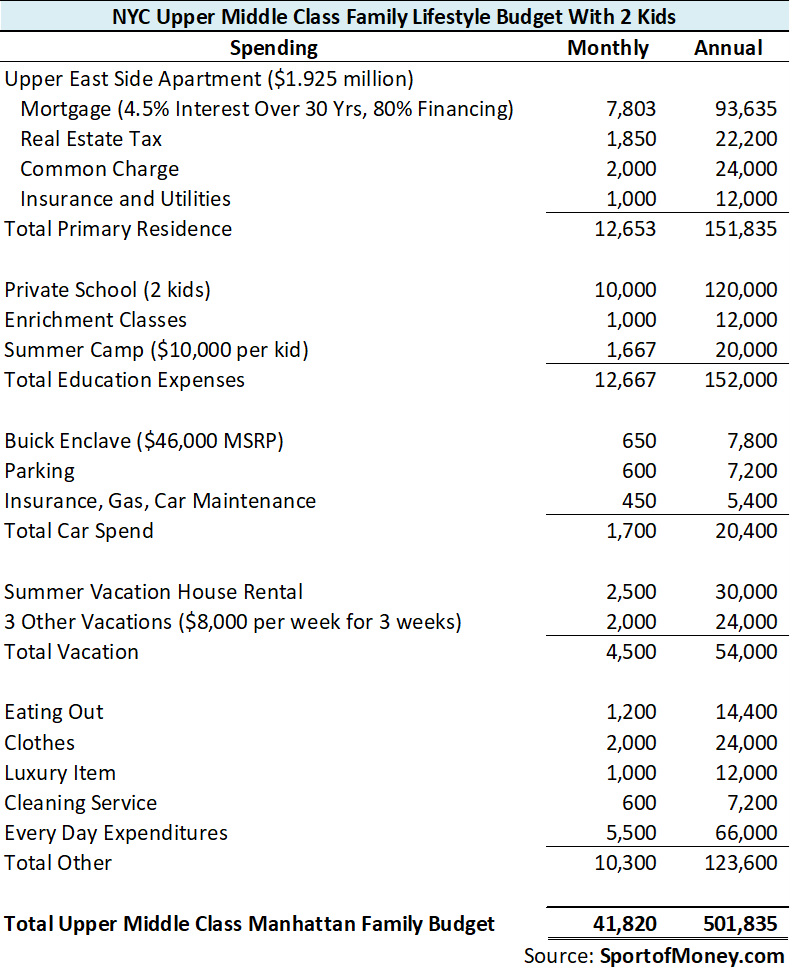

Let’s examine what I consider an upper middle class lifestyle in Manhattan for a family with 2 kids.

For an upper middle class family in Manhattan with 2 kids, the home should be at least 1,500 square feet with 3 bedrooms and 2 bathrooms.

A quick search on StreetEasy shows an option on the Upper East Side. It is a 3 bedroom 2.5 bathroom condo with 1,550 square feet. The asking price is $1,925,000. The monthly real estate tax is slightly under $2,000 and the common charge (equivalent to HOA) is about $2,000.

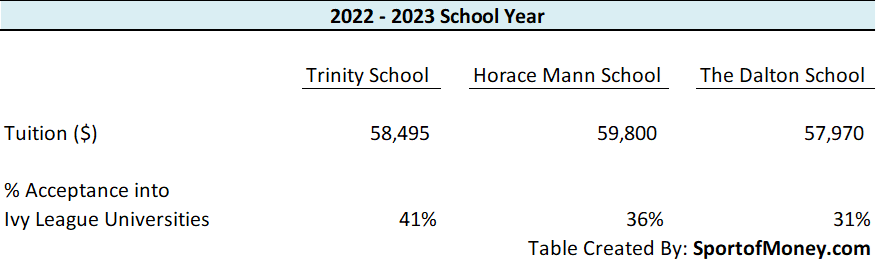

There are decent public elementary school options in Manhattan, especially in the area where this family lives. However, as the kids move up from elementary school to middle school and then to high school, the competition is fierce to get into some of the best public programs.

More likely, when taking the public school route, the kids end up going to a middle-of-the-road middle school and middle-tier high school.

Therefore, for the kids to have a leg up in their education, the parents need to spend money on private schools for the kids. Some of the best private schools charge close to $60,000 per year.

The kids also get tutoring and enrichment classes to supplement their everyday schooling. Additionally, the kids go camping over the summer.

A car is needed for this family. There is an SUV, a Buick Enclave with MSRP of $46,000, to take the kids from soccer practice to their piano lessons. Also, it is a lot more convenient to drive the family over the summer to their vacation home instead of having to rent a car every time they want to get away.

Speaking of a vacation home, this family rents a Hampton pad for the month of August to spend time in suburbia and to escape the concrete jungle.

In addition to a summer home, the family goes on 3 vacations a year. The vacations range from a week in Disneyland, to a week in a Caribbean Island, to a week in Europe.

There is also the budget for eating out, clothes, occasional purchases of luxury items, and everyday spending.

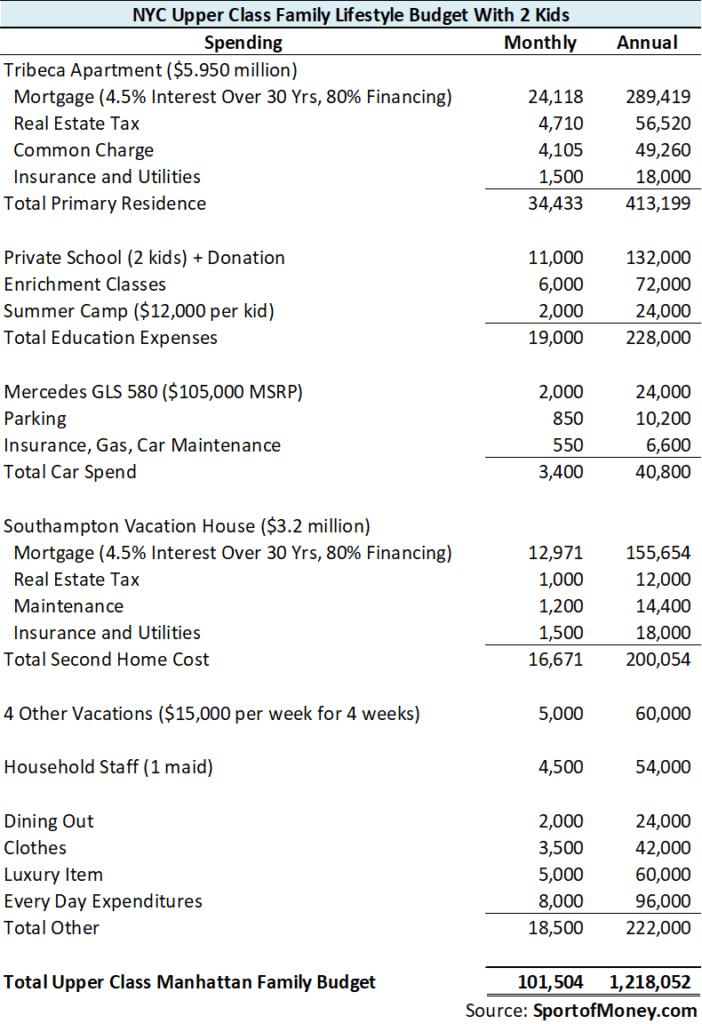

My Definition Of An Upper Class Lifestyle In Manhattan

Now, let’s examine what I consider an upper class lifestyle in Manhattan for a family with 2 kids.

For an upper class family in Manhattan with 2 kids, the home should be around 2,500 square feet with 3 bedrooms and 3 bathrooms in a luxury full-service and full amenity building. The apartment should also be located on a high floor and is newly renovated.

I see a condo currently on the market in Tribeca at a new development building. It has 3 bedrooms plus a den and 4 bathrooms. It is listed as slightly over 2,700 square feet. The asking price is $5,950,000 and the monthly real estate tax and the common charge is about $4,700 and $4,100, respectively.

The kids go to private school and they have since pre-school. They also get private one-on-one tutoring and enrichment classes as supplements to their private school education.

They go to sleep-away camp over the summer.

This family also has a luxury car to transport the family from place to place, including to their summer house in the Hamptons. They lease a Mercedes GLS 580, a 7-seat SUV with an MSRP of $105,000.

This family owns a Southampton pad close to Main Street. This second house costs $3.2 million and contains 7 bedrooms, 6 bathrooms, and 5,000 square feet of living space.

There is also the cost of maintaining the house. Maintenance includes getting the pool cleaned, maintaining the lawn, and hiring maid service to keep the house clean. Not to mention the cost of real estate tax and insurance.

In addition to a summer home, the family goes on 4 vacations a year. The family flies business class on their trips and enjoys staying in 5-star hotels such as the Ritz Carlton or the 4 Seasons.

The family has a maid to help clean up the apartment as well as help prepare meals and laundry.

They also have a robust budget for dining, shopping, and everyday purchases.

Summary

There you have it.

It takes $502,000 to live an upper middle class lifestyle in Manhattan and $1,218,000 to live an upper class lifestyle in Manhattan.

These two amounts are the cash amounts needed on an annual basis. The gross income amount runs double these two amounts.

To have an upper middle class lifestyle for a family of 4, the household pre-tax income needs to be at least $912,000 assuming a 45% income tax rate.

A household pre-tax income of $2,200,000 is needed for an upper class lifestyle.

Of course, these income amounts just get you in the door. They do not account for any savings whatsoever.

To The Audience: Did I miss any other expenses in my analysis? Where do you live and what do you think is the annual budget necessary to sustain an upper middle class lifestyle? What about the cost of an upper class lifestyle in your location?

Other Posts That Might Interest You

It Takes A Lot To Be In The Top 1% In Net Worth In America Right Now

Average Income In New York City: What Salary Puts You In The Top 50%, Top 10%, And Top 1%?

How Rich Are Americans On A Global Scale? Very Rich!

The 9 Reasons Why The Rich Keep Getting Richer

Many people work hard to better their physical and mental health. What about their financial health?

I started this blog back in 2019 to help people better their financial health as well.

My financial journey began with tens of thousands in student loan debt. Over the span of 20 years, I am close to achieving financial independence.

I truly believe anyone can get to strong financial health. Hopefully, this blog can help you on your financial journey to greater wealth and financial independence.

You can read more about me here.

Thank you for visiting. Come again soon!

Really enjoyed the post. This is about as entertaining/interesting as it gets for me especially as a fellow New Yorker. I have often gone through this exercise to figure out what’s necessary moving forward. My wife and I have 1 child (hoping/planning for at least 1 more) and I would tend to concur w/ these numbers, albeit the discretionary expenditures are all very personal in terms of where families derive incremental happiness from etc.

Not that it is overly relevant to this post, as stated in previous comments, I feel really conflicted regarding whether to raise our family in the city or go to the burbs for many of the reasons stated in this post particularly bc these figures do not include any savings other than the mortgage princ. payments etc.

I previously didn’t really think we would stay in the city, but your previous comment really resonated regarding the exercise you and your wife went through about what was most important-time w/ family and ultimately deciding to stay in the city.

The nut required to live a comparable “upper class” lifestyle in a suburb (Scarsdale, Greenwhich, etc) would seem to require considerably less.

The 2 enormous variables seem to be public/private schools and housing related expenses. The lack of city taxes and difference in child care (daycare) costs are also nice benefits.

Private school seems like the likely scenario assuming we stayed in the city. I’m not sure my wife and I are wired to deal w the stressful ongoing application process for the more desirable city public schools or just don’t know enough about it, at least yet. Alternatively, there are robust public school options just a 35 minute Metro North ride away.

Housing is the other major variable as you can get a ton of house/land for a relatively reasonable price compared to the city. Moreover, there has been little to no appreciation in many parts of WestChester/Fairfield county over the last decade and I imagine that will only get worse after the SALT cap, particularly for WC county. It is now very possible to spend sub 1.5M and get 4K plus square footage and be relatively close to the town/metro north. Assuming one works in midtown, a (door to door) commute from Scarsdale could be very comparable to living in the Tribecca apt example.

I guess all of this all goes back to what one ultimately values and priorities. Either way, a very generous amount of income is necessary to live a middle-upperish class lifestyle and also save.

Thanks again for the content.

You are right. Housing and private schools are the two big expenses with living in NYC. If you strip out these two expenses which are disproportionately larger than other non-high cost of living areas, then the income needed to be Upper Middle Class and Upper Class becomes more reasonable.

This is for a family .. from my own personal experience ,a single guy in his 30s or 40s would be considered upperclass if he made around 40k per month cash. This would be for a 5th Ave 1 bed rental in midtown ($7k), an owned Mercedes c class benz ($60k), parking garage ($700), takeout food ($3000), cleaning and pampering services ($1000), personal expenses and fun money ($6000), and lastly a couple of gorgeous gold digging girlfriends who will do anything you want ($20k). If you omit the girls then that’s your savings.. but why would you want to if your a young rich guy living in Manhattan 😉… enjoy …

Yes, this is for a family of 4. A single person would need to make less to afford an upper class lifestyle, especially in today’s environment with real estate (purchase price and rent) down in Manhattan.