To begin the new year, I figure let’s look up some financial motivational quotes.

I always like to gauge how I think about personal finance and investing and see how other people think about these topics.

My background colors the way I think about the world and how I think about personal finance.

Other people have different perspectives on how to be financially successful in life because of their upbringing.

I never want to have blinders on and think my way is the only way.

But at the same time, my view of the world is shaped by my own experiences and knowledge.

Below are some financial motivational quotes that are in line with my philosophies around personal finance and investing.

“Rich people believe ‘I create my life.’ Poor people believe ‘Life happens to me.’”

— T. Harv Eker, Secrets of the Millionaire Mind: Mastering the Inner Game of Wealth

Life isn’t fair. It never was and will never be.

There are people born with great advantages on day 1. At the same time, there are also many people born into challenging environments on day 1.

That is life.

But it isn’t necessarily how you start, but what you do to try to reach your goals that matter.

After all, you can’t control where you start.

What you can do is take action on things you can control.

Hard work, constant improvements, building up your financial education, start saving and investing early, and moderating your expenses are all actions anyone can take.

Control the things you can control and don’t worry about things you can’t.

That is why even at a young age, I worked hard to obtain a good education. I knew having a strong education was the key to my financial success in the future because of the job opportunities available to me after college.

I also saved as much as I can after graduation by living at home with my parents for the first few years.

Saving early allows the power of compounding to work its magic. This was instrumental in helping me achieve my net worth today.

It also helps create good saving habits early on that carry over to even now.

Then I worked to climb the corporate ladder with each promotion increasing my take home pay.

I wanted to be financially free and built a rental portfolio over the past 15 years that can meet all my day to day personal expenses.

While I grew up financially poor, I am financially free today. I didn’t let my start dictate my financial outcome.

My mindset has been to never rely on others for my financial success and, by the same token, blame others for my financial failures.

At the end of the day, no one cares more about my finances than I do. Therefore, I believe no one should be as involved in ensuring my financial success as me.

“To get rich, you have to be making money while you’re asleep.”

— David Bailey

It’s great to be able to make money while you sleep. It means you don’t have to trade money for time.

Ever since I graduated college, one of my financial goals is to achieve financial freedom.

I never wanted to be beholden to anyone, not the government or not my corporate employer, to make my mortgage payment or put food on the table.

The yearning to be financially self sufficient is especially true as I’ve gotten older.

The way to accomplish this is by detaching the notion that I need to trade time for money.

I need to be able to earn money even while I sleep.

This led me into building my real estate rental portfolio over the past 15 years. Now my rental income covers all my expenses.

Rental income isn’t entirely passive income. There is definitely work involved to manage my rental portfolio.

But the work is nominal compared to the cash flow I receive from my rentals.

Regardless if I’m on vacation, sleeping, or watching the latest movie on Netflix, my tenants still pay their rent to me on the first of the month.

I don’t need to trade my time for money with my rental real estate.

Additionally, I am trying to build more revenue streams that do not involve direct trading of time for money.

That way, I can continue to earn money while I sleep.

“Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas.”

– Paul Samuelson

I agree with Paul’s take on investing.

That is why when I was building my nest egg, I focused primarily on two major asset classes with a long term investment horizon.

Real estate and S&P 500 index funds are my two main nest egg investments.

I invested mainly in the S&P 500 with my retirement savings.

S&P 500 is one of the widely used benchmarks for how the US stock market is performing. My investment goal for my retirement account isn’t lofty.

I seek to only track the stock market return.

I also dollar cost average into the S&P 500. A portion of every one of my paycheck went into the S&P 500 index.

It wasn’t exciting, but over time, my retirement investment balance grew into 7 figures.

Also, real estate investing was equally as unexciting.

There was no instant hit or massive gain, especially when it comes to investing in New York real estate. Transaction costs alone put me in a loss position on day 1.

But I kept at it, and over 15 years, I curved out an 8 figure real estate portfolio.

Investing shouldn’t be exciting. In fact, having it be emotionless can lead to more objective and analytical thinking.

If it becomes exciting, that means you are dealing with more money than you can afford to lose.

“An investment in knowledge pays the best interest.”

– Benjamin Franklin

In my opinion, building your financial knowledge base provides the greatest return in the long run.

My educational background as well as my professional background is in the financial services industry. That does provide me with a leg up on having solid knowledge of personal finance.

Additionally, I have a passion for personal finance which leads me to read books, online articles, personal finance blogs, and listen to podcasts on all personal finance topics.

Having strong financial knowledge has helped saved me money.

Because income taxes are my number 1 expense, I try to spend time understanding the relevant tax codes and spend time to review my tax returns. I’ve found costly mistakes made by my tax accountants.

I’ve read that around 85% of actively managed funds do not beat the S&P 500 index fund after factoring in the low fees for an index fund. Therefore, instead of wasting time trying to find that 15%, I just put my money into the S&P 500.

Spending money to obtain knowledge is the best investment for the greatest return.

“Develop success from failures. Discouragement and failure are two of the surest stepping stones to success.”

– Dale Carnegie

No one bats 1000% on investing.

Even some of the greatest investors have made poor investments.

Look at Warren Buffett’s investment in Kraft Heinz. He took a multi-billion dollar write-down on that investment a few years after investing in that company.

It is important to evaluate each failure to figure out what went wrong and how to prevent the failure from happening again.

Failures provide learning opportunities and highlight areas for improvement.

Being comfortable with failing is important to achieving success.

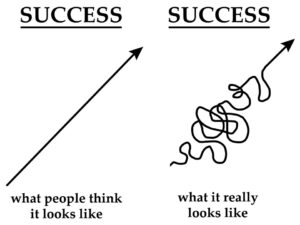

Most people envision success to be a straight line. But it rarely is.

There are many ups and downs in achieving success. The ability to navigate those downs is very important.

About 10 years ago, I decided to dabble in options.

I made a relatively small investment in writing an option that expired worthless which netted me a $2,000 gain.

With that small win, I decided to go bigger. I ended up buying a put option that expired worthless. I lost $30,000 on that trade.

That is when I realized that options trading wasn’t for me.

I don’t have enough knowledge to engage in options trading and the volatility was too much for me.

I’ve learned that to make profitable investments, I need to be better educated on those investments. And that I shouldn’t invest in options if I don’t spend the time getting educated about that product.

And I haven’t invested in options since that loss.

“If you think nobody cares if you’re alive, try missing a couple of car payments.”

– Earl Wilson

Taking on too much debt is stressful.

Creditors will hound and hound until they get their money back. After all, who can blame them?

All they want to do is to protect their own investments. I would do the same if I were in their situation.

For the most part, I’ve been conservative in utilizing debt in my life.

My overall loan to value of my rental portfolio is under 50%. That means for every $1 of equity I have, I’ve taken out less than $1 of mortgage.

Compare that to the 20% down scenario with an 80% mortgage. That is borrowing $4 for every $1 of equity.

But there was one time I came across a great real estate deal that I couldn’t pass up.

It was an all-cash deal in which the seller needed to close quickly and I didn’t have enough cash sitting in my bank.

I decided to tap my HELOC to help with the purchase.

At the time, I felt fairly comfortable in tapping the HELOC for this investment because of my W-2 income and the cash flow from this rental property.

However, I still felt the stress of having to consistently make the monthly HELOC payments which at the time increased my monthly cash outflow substantially.

Fortunately for me, over the next 6 months, I was able to completely pay down the HELOC balance.

After that, I felt a weight lifted off my shoulders.

Having a lot of debt creates stress, even when you feel comfortable with it.

When you feel stressed about the level of debt taken out, it is time to start paying them off.

“Most people work just hard enough not to get fired and get paid just enough money not to quit.”

– George Carlin

As a comedian, George Carlin is great with observations and equally as great with words.

He just described the classic hamster wheel that most Americans are on.

If you want average results, follow the crowd. To achieve superior results, you need to act differently.

In this case, work harder than your peers.

Put in the work to move up as quickly as possible at your corporate job to increase your income.

Additionally, dedicate time to building out more income streams.

Construct a real estate portfolio or start a side business.

Start to work towards financial freedom.

Putting in the minimum won’t cut it. You will never be able to escape the hamster wheel with only the minimum effort.

To achieve financial success, you have to do things differently from the crowd.

“Never spend your money before you have it.”

– Thomas Jefferson

This is very wise advice from the 3rd president of the United States.

The irony is that Thomas Jefferson actually died in debt.

But that doesn’t mean his words are not truthful.

The key to wealth accumulation is savings.

No matter how much money you earn, if you cannot save, you cannot create and keep wealth. It is as simple as that.

It isn’t just how much you make that matters; it is how much you can keep.

Take the alarming financial stats for professional athletes who have made millions:

NFL players: $3.2 million is the median income of an NFL player. 16% of NFL players will go bankrupt within 12 years of retirement.

NBA players: On average, NBA players who declare bankruptcy will do so within 7.3 years after retirement. 6.1% of all NBA players will go bankrupt within 15 years of retirement. The median career earnings are $12.67 million.

Other research pegs a grimmer financial picture for professional athletes. 78% of NFL players and 60% of NBA players face serious financial hardships after retirement.

Ultimately, the takeaway is that regardless of income, you have to keep your expenses in check.

It doesn’t matter if you make $10 million per year if you spend $12 million annually. You will still end up in the poor house.

The key is to monitor your expenses. And you can do that by developing a budget and keeping to that budget.

Don’t pay with your credit card if you don’t have the money to pay off the balance in full on the statement date.

Most importantly, do not spend money you don’t have.

To The Audience: Do you believe the motivational quotes above are good ones to follow? Who is your favorite financial guru to follow? What is your favorite motivational quote on money and investing?

Other Posts That Might Interest You

Here’s What You Need To Be Upper Middle Class And Upper Class In NYC – It’s A Lot!

It Takes A Lot To Be In The Top 1% In Net Worth In America Right Now

Average Income In New York City: What Salary Puts You In The Top 50%, Top 10%, And Top 1%?

How Rich Are Americans On A Global Scale? Very Rich!

A Million Dollar Income – A Detailed Analysis Of The Household Budget

Many people work hard to better their physical and mental health. What about their financial health?

I started this blog back in 2019 to help people better their financial health as well.

My financial journey began with tens of thousands in student loan debt. Over the span of 20 years, I am close to achieving financial independence.

I truly believe anyone can get to strong financial health. Hopefully, this blog can help you on your financial journey to greater wealth and financial independence.

You can read more about me here.

Thank you for visiting. Come again soon!