Are you interested in how a household with a $1,000,000 income spends its money?

I put together a hypothetical budget for a household making $1,000,000 a year and how that amount might be spent.

This is based partially on my own household budget with certain modifications to incorporate other high income families I know.

Even with a $1 million income, it might still be very challenging for a family to save enough money to one day be financially free given their spending level.

There is also the societal expectation of what being financially successful means.

The big house, nice cars, and exotic vacations are what come to mind for a large number of the population in picturing the lifestyle of the rich.

What the high-income earners imagine as a measure of success can cause them to spend a large portion of their income.

It Is Hard To Save – Even For High Earners

Saving a high percentage of your income is one key to achieving financial independence. This is one way you can achieve financial independence no matter how much money you make.

People whom I have seen pushed back on the idea of savings are people who rationalized that it would be hard to save a high percentage of a middle class income ($50,000 – $75,000).

They think that there are just too many expenses for a middle class family that prevent them from saving a large percentage of their income.

When confronted with an article about someone who has achieved financial independence in his or her thirties while making $150,000 in peak earnings, a common reaction I’ve seen is along the lines of: “of course, it is easy for the person to make it, look at that income. If I made that income, I can also achieve that level of financial success.”

While a higher income can produce a higher savings amount, it is not a certainty that will happen.

A lot of the reasons why a high earner might have difficulty saving are similar to a middle class family – except with bigger numbers.

For instance, a middle class family making $50,000 a year might spend $5,000 on vacation (10% of income). A household with an annual income of $500,000 might spend $50,000 on vacation.

28% of higher-income earners (those making more than $200,000/year) live paycheck to paycheck according to a recent LendingClub report.

We have all heard stories of bankrupted professional athletes and they made millions to tens of millions per year in their prime.

It isn’t just how much you make that matters; it is how much you can keep.

Don’t assume just because someone has a high income, that equates to a high net worth.

Million Dollar Household Background

Background of this theoretical family (the Smiths) making $1 million a year combined:

⇒ It is a dual income household.

⇒ The family lives in a high cost of living area. In this case, since I live in New York City, it is easier for me to use New York City as the home for this family.

⇒ There are 4 members of the Smith household. There are the 2 working adults (John and Jane Smiths) and their two school-aged children (Michael and Michelle).

⇒ John works for a major retailer and Jane works in financial services.

Note: This post is part 1 of a 2 part post examining the household budget of a family of 4 making $1 million a year. Given the level of detail I want to provide on their household expenditures, I’ve decided to break the post into 2 parts.

This post covers the pre-tax deductions, taxes paid by this family, and the family’s non-discretionary expenses. Part 2 covers the discretionary expenses and other miscellaneous expenses of the family.

Taxable Income after Pre-tax Deductions

As previously mentioned, the household income of the family is $1,000,000 a year.

John and Jane elected a few pre-tax deductions.

They are items they would have otherwise spent money on, but now they can pay for those items using pre-tax money.

401(k) Contribution

The 2022 contribution limit to a 401(k) plan is $20,500 per person.

The total tax deferred amount that can be contributed to a 401(k) plan for the married couple is $41,000 per year.

There is a $6,500 catch-up contribution amount added to the limit for a person over the age of 50. John and Jane are both under the age of 50 and they have decided to contribute the maximum into their retirement account.

Their employers do not offer a pension. This is not a surprise considering less than 1/3 of Americans are retiring with a pension today.

They are also anticipating the worse when it comes to government help during retirement and are not counting on there to be any social security payments despite having contributed to social security for decades.

Additionally, John and Jane can defer the taxes on the contributed amount and also enjoy a 50% match from their employers. That is a guaranteed 50% return on their money on day 1. It would not be smart for John and Jane to forego taking maximum advantage of the employer match.

Childcare Flexible Spending Account (FSA)

With both John and Jane working, they know they need help caring for their two kids after school.

Childcare is costly, especially in New York City.

Fortunately, there is a $5,000 deduction for qualified childcare expenses of which the Smiths take advantage.

The deduction helps alleviate the financial burden on a working family for childcare services.

Healthcare Premium

Both employers offer subsidized healthcare coverage.

The Smiths decided to go with the one offered by Jane’s company since the plan is better and the employee premium of approximately $500 per month is a better price than John’s employer.

This is in line with the KFF study which shows that the annual family premiums for employer coverage average $22,463 in 2022. The employee covers $6,106 and the employer covers the balance.

The premium amount is taken out of Jane’s paycheck on a pre-tax basis.

Commuter Benefit

Since both John and Jane live in Manhattan and work in Manhattan, they usually take Uber or another car ride service to work.

Each person can take $280 per month ($3,360 per year) pre-tax to help pay for the Uber rides. $280 a month amounts to only $14 a workday and $7 per trip.

It wouldn’t be surprising for the monthly commuter cost to be higher than $280 per month. But on nice spring, summer, or fall days, they like to walk to and from work to get their daily steps in.

Total Pre-tax Deductions

The total pre-tax deductions amount to close to $59,000. This leaves approximately $941,000 of income subject to income taxes.

Net Income After Income Taxes

Taxes

The tax hit is a large one with around $941,000 in income subject to tax.

New York City has some of the highest income tax rates in the U.S.

There are taxes at the federal level to pay the Internal Revenue Service, at the New York State level, and at the city level.

Not to mention, there is the Social Security tax and Medicare tax which eat into the total take-home pay.

On such an income, the Smiths would pay around 29% in federal tax and approximately 10% in state and local taxes.

Social Security tax is another 6.2% but is applied to only the first $147,000 of income. Since both John and Jane work, each of them pays 6.2% on their first $147,000 of income.

The Medicare tax is 1.45% with no limit to the wages subject to this tax. Wages paid in excess of $250,000 for married filing jointly ($200,000 for a single filer) in 2022 are subject to an extra 0.9% Medicare tax.

In total, the Smiths pay roughly 4% of their taxable income in Social Security and Medicare taxes.

All in all, about 43% of the income is taken away to pay for taxes, leaving the Smiths with a take-home pay of about $536,000.

While a million dollars sounds like a large number, the ultimate take-home pay is slightly more than half of that.

Non-Discretionary Spending

Home Cost

Manhattan Is Home

Outside of taxes, the home cost is the second biggest expense item of this family.

This probably doesn’t come as a surprise for many as homing costs are the top expenditure for the average American family.

John and Jane work 10-hour days in their respective jobs to be able to make a combined million-dollar income.

They both work in Manhattan.

When deciding on where to call home, they considered the pros and cons of living in New York City compared to moving to the suburb.

Ultimately, they decided to live in Manhattan to be closer to work in order to save on commute time.

This also allows them the ability to step away from work briefly to attend school activities with their children.

The Manhattan Apartment

They live in the Upper East Side, which is one of the family friendly neighborhoods in Manhattan.

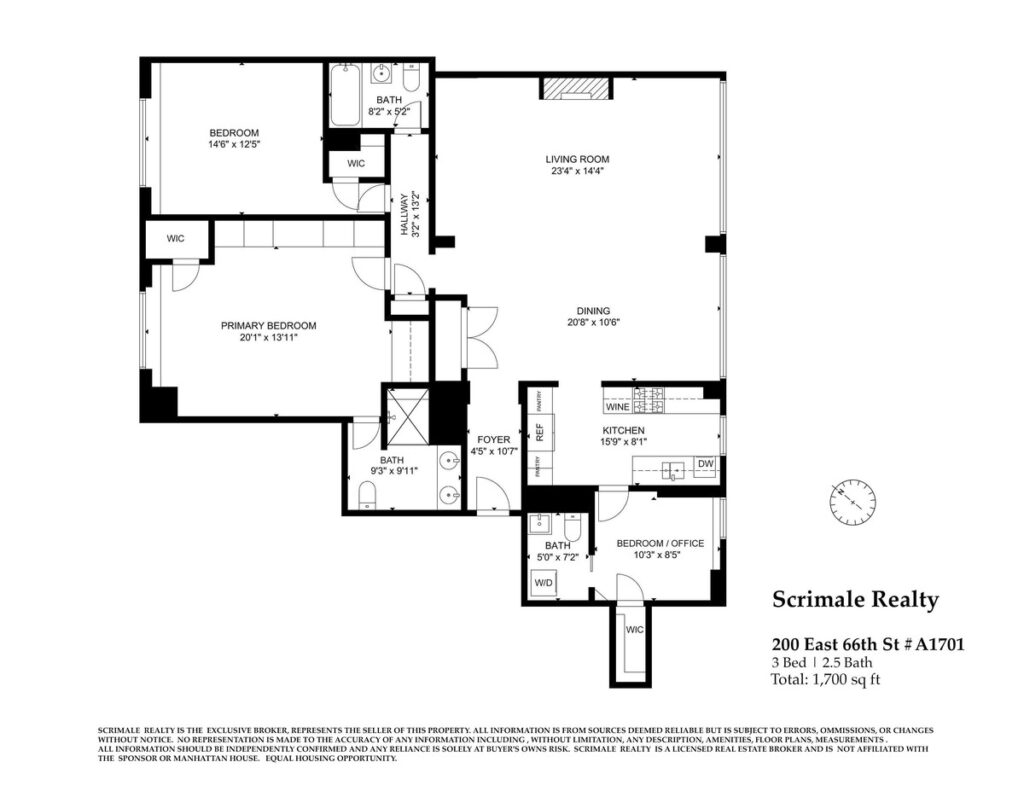

Their apartment is a 3 bedroom 2.5 bathroom condo located in a full-time doorman building. 25 200 East 66th Street #A1701 is similar to the apartment the Smiths own.

200 East 66th Street #A1701 is currently in contract with a listing price of $3.395 million. It is a 1,700-square-foot home.

Despite the purchase price being 8 times the average cost of a house in America, the size is only about 70% when compared to an average American house. Additionally, there is no outdoor space or a private garage.

They aimed to limit the total home purchase price to 3.5 times their annual income.

They put down 20% and obtained a mortgage for the balance at an interest rate of 4.5% on a 10-year adjustable rate mortgage paying interest only. The mortgage amounts to approximately $10,000 per month.

The common charge (equivalent to HOA in other places) is paid every month. The common charge is used to pay for shared services in the building.

The real estate tax is separately paid for by each condo owner. In this case, the common charge and real estate tax amount to approximately $4,000 a month.

The utilities and maintenance of $500 a month are to pay for electricity and other services to upkeep and maintain the appearance of the home.

The homeowner’s insurance is insurance coverage on the apartment itself and for personal liability protection within the home.

The total home cost is $180,000 a year.

Household Items

Household items include toiletries, supplies for the home, and clothes for the adults as well as the children.

With a family of 4, household expenses can rack up fast. Dry cleaning of professional clothes alone for the two working adults can run $300 a month.

The Smiths spend in total $2,000 per month on household items, amounting to $24,000 a year.

Food

This includes stocking up drinks at home, Fresh Direct or Amazon deliveries, snacks for the children, and home-cooked breakfasts and dinners.

It also includes the cost of lunch for John and Jane at work. They spend on average $20 per lunch meal per person. Over the span of one month, lunch meals alone amount to $800.

The total food cost is $1,800 a month amounting to $21,600 a year.

This amount does not include the budget for dining out as that is in the discretionary spending portion of the budget.

Childcare

This is the cost to hire a full-time nanny to look after the two children.

The nanny starts the day at 8:00 to ready the kids for school and ends the day at 7:00.

This leaves time for one of the parents to come home to relieve the nanny.

That is a good 10-hour day.

At $20 per hour, the total amount paid to the nanny is $4,000 a month or $48,000 a year.

$5,000 was already put into a childcare FSA with the remaining balance to be paid out of pocket from them.

Net Amount After Non-Discretionary Spending

In total, $268,000 was spent on non-discretionary items.

Half of the after-tax income is spent on non-discretionary spending.

A lot of financial advisors like to tout that 50% of your after-tax income should be used for needs.

The Smiths’ spending budget happens to line up with this highly touted advice.

The remaining amount after addressing the non-discretionary spending is $268,000.

This amount needs to cover the discretionary spending, as well as, miscellaneous expenses.

Discretionary expenses include a car, entertainment, travel, and education.

I will dig into greater detail in the next post regarding those expenses and how much the Smiths end up saving in a year with a million dollar income.

Part 2 contains the discretionary expenses and other miscellaneous expenses of the family.

To The Audience: Does the after tax take home pay of about half of $1,000,000 change your perspective of how much a million dollar income actually is? Are there any other pre-tax expenses I might have missed? Do you see any missing non-discretionary expense items? How does this budget stack up against your own budget?

Other Posts That Might Interest You

Here’s What You Need To Be Upper Middle Class And Upper Class In NYC – It’s A Lot!

It Takes A Lot To Be In The Top 1% In Net Worth In America Right Now

Average Income In New York City: What Salary Puts You In The Top 50%, Top 10%, And Top 1%?

How Rich Are Americans On A Global Scale? Very Rich!

Many people work hard to better their physical and mental health. What about their financial health?

I started this blog back in 2019 to help people better their financial health as well.

My financial journey began with tens of thousands in student loan debt. Over the span of 20 years, I am close to achieving financial independence.

I truly believe anyone can get to strong financial health. Hopefully, this blog can help you on your financial journey to greater wealth and financial independence.

You can read more about me here.

Thank you for visiting. Come again soon!

Having looked at quite a few of these breakdowns it seems like lots of people don’t drink! I ended on +$40k was on going out which most of these breakdowns never seem to address. Aiming to curtail that a bit this year as the hangovers are getting worse. I would have thought NY is easy to blast through cash even on light nights? Here in Jakarta a good night out with dinner, bar afterwards, club, after club is an easy $2k. I suspect that it’s considerably more there.

The household budget is for a family of 4. It is unlikely a father or mother of 2 will go out after dinner to hit a bar or a night club. The budget does leave money for a nice dinner and occasional night out on the town to catch a Broadway show.

Now, if we look at a single person with a $1 million income to spend, I’m sure the spending will look very different.

That’s a pretty hefty mortgage…

This article series is one of the best I’ve seen! Extremely thorough and realistic.

Thanks