Hopefully my financial tough love and a dose of reality post did not scare you away from this blog. Sometimes reality can hurt but it doesn’t make it less true.

Ever since I started my first job out of college, I’ve had retirement on my mind. I strived to save as much as possible as early as possible in hopes to one day escape a corporate job and to sail away into the sunset sipping Mai Tais at a beach in Hawaii.

This desire to have a comfortable retirement is what drove me to save and invest the maximize amount in my retirement account since my first full time paycheck. That is how I achieved being a 401(k) millionaire before the age of 40. Now if the stock market can perform in the next 50 years similar to how it performed in the past 50 years, I should be in line for a comfortable retirement.

Even though I worry less about my retirement now, I still enjoy reading articles on saving for retirement. After all, I do have a passion for personal finance. One of the personal financial goals for most people is saving for retirement. I recently came across this article on Yahoo Finance sourced from Market Watch:

Kevin O’Leary: This easy math trick helps you crush retirement goals

Article Summary

Kevin O’Leary of Shark Tank fame offered up some retirement advice. He said that by putting away 10% of your income at the age of 21 or so, you can get to $1 million of retirement savings by 65. He preaches a few other things: take action now, be wary of impulse spending, utilize compound interest, and use low –cost index ETFs.

It is hard to argue with his points. In fact, I agree with him and have preached those points as you’ve read time and time again on this blog. Those points are how most people can get to $1 million or more in their lifetime.

My Thought Regarding Yahoo Finance

Now in honesty, I am not a big fan of most Yahoo Finance articles. I believe most of them are written by authors who don’t really understand personal finance. Since this one is basically an interview with Kevin O’Leary, a person reportedly worth $400 million, the advices given are sound.

Most of the time I go to Yahoo Finance not for the articles, but to read the comments. The comment section is how I gain an understanding of how people think about a topic. Those comments provide me great insight into the thoughts and opinions of the general population.

The comments from the Yahoo readers rarely disappoint. I will use this post to help provide some of my thoughts on the questions, comments or concerns people had regarding the article and the points Kevin O’Leary brought up to hit the million dollar number by retirement age.

People Who Think Saving For Retirement Is A Joke Will Lose Out At The End

Note: Yahoo reader comments are italicized.

“I’m currently working on my second million . . . I’ve long since given up on my first”

Saving for retirement is important, especially if you are young. It is no laughing matter. American employees in decades past can count on the 3-legged stool for retirement: pension coverage, social security and personal savings.

Now, pension coverage is all but non-existent for private sector employees. In 1975, 88% of private sector employees have pension coverage with defined benefit plan. In 2018, the number of private sector employees with pension coverage declined to 17%. The number of employees with pension coverage declined over 70% in under the span of 45 years.

It isn’t hard to see that the trend is a downward line. There will be fewer jobs in the future with pension coverage in the private sector as employers are shifting the retirement responsible onto their employees. That leg of the retirement stool is all but gone for most private sector employees.

Then there is the social security leg. Despite what you might have heard, social security will be around for a long time, albeit at a reduced payout. At some point, the US Government will need to take action to shore up social security for the future. The action might include reducing the payout, reducing the inflation adjustment component, increasing the age, increasing the social security tax, lifting the income limit on the social security tax or a combination of the options. Do you really want to depend on the whim of the Federal Government for your retirement livelihood?

Therefore, for most employees, retirement is really more of a 2-legged stool which wobbles because one of its legs (social security) is weak. The best way to ensure you don’t topple over is to fortify your own retirement savings.

Saving for your own retirement is more important today than ever given the weakness or non-existence of the other two legs of the traditional 3-legged retirement stool. Do not take retirement savings lightly.

Take Time To Research Investment Options – Do Not Just Throw Your Arms Up In The Air

“..now tell me where I can get a guaranteed 7.5 percent return every year for the next 40 years like in your example.”

No one can guarantee a 7.5 percent return for the next 40 years. The yield on the 30 year treasury is sub-3%. If you want something risk free or as close to it as possible, then invest your money by buying US Treasury. But, obviously, your return will reflect the riskless nature of the investment.

The S&P 500 for the past 40 years have returned north of 11% with dividend reinvested. Obviously, past performance is not indicative of future performance. But the bottom line is that instead of just writing off the advice because a 7.5% annual return might seem difficult to achieve, do some research and figure out what investment options are available and see if it fits within your risk tolerance parameters.

Don’t Forget Inflation

“…a million then won’t be as much as a million now.”

This commenter understands the impact of inflation. A million dollars 40 years from now does not have the same buying power as a million dollars today. That is the case in an inflationary environment. At a 3% annual rate of inflation, a million dollars in 40 years will have the same purchasing power as $300,000 today.

This shouldn’t discourage you from savings. This should hopefully encourage you to set a higher target. Don’t just aim for one million dollars in retirement. Aim for $3 million when you retire.

Don’t Make Excuses For A Lack Of Income – It Is A Simple To Solve Because You Don’t Need To Earn A Lot To End Up With A Lot

“LOL. The problem is NOT the 6th grade math involved, it is finding a job with a decent wage, if you do not have a college degree or a high demand skill (electrician, plumber, HVAC, etc., so one can set substantial money aside”.

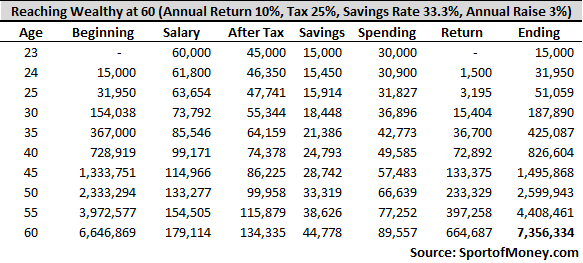

Don’t make excuses for the lack of a high income. It doesn’t take much to be able to accumulate a lot over time. Refer to my blog post titled “Anyone can be wealth in America – are you?” It doesn’t take a high income to get to $7+ million if you are willing to save a good amount over 40 years.

There are many ways to make extra money. In fact, if you google “making extra money” or “making side income” the search results totaled in the hundreds of millions. The question isn’t about finding a job with a decent wage; it is about the desire to earn extra money. As shown in the table above, you don’t need to make $300,000 a year to be able to save and accumulate a lot.

The table illustrates making $60,000 a year (and in subsequent years the $60,000 is adjusted for a 3% annual raise in line with inflation), you can save (and invest) your way to $7.3 million in less than 40 years.

Find ways to get your income higher through side hustles. If you are determined and want to put in the effort, I think it is really easy to make enough money to get to $60,000 a year.

If all else fails, then either get a college degree or train to be a plumber, electrician or HVAC technician.

Accumulating Wealth Involves Patience

“Most 20 year olds are not willing to wait 45 years to make 1 million.”

Rome wasn’t built in a day. For most rich people, wealth isn’t as well. Building wealth is a long term game, and you have to keep at it.

It’s unfortunate, but most people don’t understand the power of compounding. The earlier you start the greater the effect of compounding. That is why I am a big fan of teaching my kids early about financial literacy so that hopefully they can be wealthy one day.

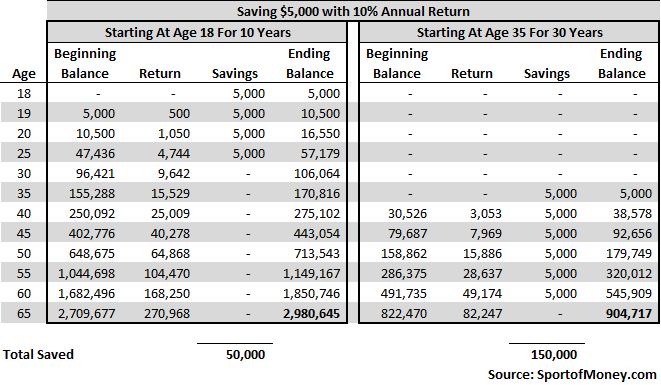

Pass the below table to someone in their early 20s. The left hand side shows a person who started saving $5,000 per year at the age of 18 for 10 years. The person stopped saving at the age of 28. The $5,000 is put into the S&P 500 each year. Assuming a 10% annual return, the $50,000 of total savings turns into about $3 million at the age of 65.

Now compare that to the person on the right. The person started saving at the age of 35 for 30 years. Assuming the same 10% annual return on the savings, the person ends up with less than a million dollars at age 65.

Think about that. The person on the left put in only $50,000 and ends up with $3 million. The person on the right put in $150,000 (3 times the amount) and ends up with 1/3 of the total. The only difference is that the person on the left started saving and investing 17 years earlier. That is the power of compound return!

Stick With A Process Which Has Proven Itself To Work

“Wealth is more a matter of what you started with and luck rather than preparation. These same folks who are wealthy couldn’t replicate their success if they started out with $0 today. That’s why you never see a wealthy person say,” I’m going to show you it’s possible for anyone get wealthy by using none of my wealth to do it again.” They just tug on the poor mans heart strings to think he can do it, all in the name of getting themselves wealthier.”

First off, I think most wealthy people will say luck is a factor. Of course luck is a factor. But it is not a factor that can be controlled. Focus on the things within your control.

No one wealthy will want to start off with $0 to do it all over again. The beauty of wealth is that it builds upon itself.

There are reasons why the rich get even richer. I’ve worked hard (and of course was lucky as well) to accumulate over $10 million in net worth in my 30s. Now with this financial nut, I can look to earn even more in the next 20 years. If nothing else, just given the power of compounding, my net worth should continue to increase significantly.

Why would I want to start from scratch again? This doesn’t make any sense.

Instead of being critical, this commenter should listen to the process. It happens to be a process which can be repeated and have worked many times before. Earn as much money as possible as soon as possible, save as much of the earning as possible, and invest the savings.

EARN ASAP + SAVE ASAP + INVEST ASAP = GREATER WEALTH

This is a proven process for great wealth building. Many people have employed this and have been very successful in accumulating wealth. Stick with a process that works and let’s not just attribute people’s success to only luck.

Here Are People Who Get It!

“Best money advice I received when I went to work at a large consumer products company, “The company matches up to 10%, put in 15% if you can.” I eventually bought some stock options, because it seemed like a good deal. I did and I never touched the money again. I retired at 53 years old and still do not touch that money. I love watching it grow.”

The person retired at the age of 53 by taking full advantage of the company match and being a long term patient investor.

“Some people are meant to be poor. This article spells out exactly how to get fairly wealthy, yet many people want to criticize rather than listen”.

People who have an open mind, are receptive to suggestions from successful people, and take action will do well. Close minded negative people will not do well.

“Those of us who have consistently invested for decades and are now seeing the effects of compound interest fully understand that it does work. Thus the record number of 401k millionaires – mostly due to compound interest and not any special active stock trading abilities”.

Maximize the full effect of compound interest by investing early.

“Funny how the person always giving advice is megarich. Like they know how someone just making it is supposed to save. Here’s some advice from someone not rich but retired at 49. Work hard, don’t spend. Save it all, invest it all, and when your friends buy new trucks, BBQ’s, pools, and boats – don’t. Keep your eye on the prize. I’m not working and living a happy life, they’re still getting up by the alarm clock. And because I saved hard and didn’t buy a bunch of stuff my whole life, retirement “budgeting” is a walk in the park. Wash, rinse, repeat”.

Nice comment. See, the process does work. “Work hard, don’t spend, save it all, invest it all” – very sound advice and it worked for this person. It worked for me too and a few other people I know who are multi-millionaires in their 30s.

“Was a toolmaker. Saved $50 a week for 46 years. All . money invested in S&P 500. Retired and it keeps on growing. Go with Vangard. They get it.”

Once again, nothing fancy here. This commenter consistently saved and invested the money into the S&P 500. Even at $50 a week, if you do it long enough (like 46 years), you will make out really well (over $2 million).

To the audience: What are some comments or feedback you have heard about saving and investing for retirement? Have you crushed retirement and how have you done it?

Many people work hard to better their physical and mental health. What about their financial health?

I started this blog back in 2019 to help people better their financial health as well.

My financial journey began with tens of thousands in student loan debt. Over the span of 20 years, I am close to achieving financial independence.

I truly believe anyone can get to strong financial health. Hopefully, this blog can help you on your financial journey to greater wealth and financial independence.

You can read more about me here.

Thank you for visiting. Come again soon!

Interesting. I read comments on fellow personal finance blogs but not on Yahoo Finance. I guess you probably had a few good chuckles from this. Too many people don’t get it, that’s why many choose to become finance bloggers to educate the public. One thing my spending friends like to say is you got to spend while you can enjoy it (i.e. in your 20s instead of your 60s). However, spending like there’s no tomorrow in one’s 20s can have a detrimental impact on your retirement because you miss out on a good amount of compounding. It’s important for young people to prioritize the spending on what gives them the most happiness in order to meet savings goals for a comfortable retirement.

Agreed. I think it should be easier for young people (in their 20s) to save given they never had money to spend to begin with while going to school and college. It doesn’t have to be either spend in your 20s or wait until 60. People can increase their lifestyle spending by using some of the interest generated from the financial nut in their 30s, 40s and 50s.

The numbers work out that it is extremely important to get an early start to saving.

Very solid article, thanks for sharing. I am also a large advocate of compounding interest and creating that “snowball effect” as early as possible. This (and your previous posts) do a very good job of simplifying the process of wealth accumulation.

I imagine it’s easy for some to make excuses given patience/time are such large ingredients in the process. No instant gratification.

It is really critical to start the process earlier in life for a variety of reasons. One that is not discussed much is that lifestyle inflation (at least for those around me) issues seem to accelerate as you get into your 30’s and you want that nicer house/car etc as you are making more coin than your 20’s as are those around you etc.

Thanks again for the insightful content!

Thank you for your comment. I think you make a valid point about lifestyle inflation in the 30s. I think I might write a blog post about that – how to address lifestyle inflation without breaking the bank. But my initial though is that it doesn’t have to be all or nothing. Save in your 20s, and increase your lifestyle along with increasing pay and using some of the interest from the savings.

Let me run some numbers to illustrate better. But good food for thought.

Another fantastic article, Rich.

>>now tell me where I can get a guaranteed 7.5 percent return every year for the next 40 years

This is a big reason I blog. Education. People simply don’t understand “the market”. It’s sad how much statements like this get repeated. While history doesn’t guarantee the future, I feel pretty confident saying over a 40 year period, you WILL see those kinds of returns.

>>a million then won’t be as much as a million now

The sad part of this statement is in the future, people will be even MORE broke. And unfortunately, the only people who spout off stuff like this are the ones who don’t save now either.

>>luck rather than preparation

“Luck”. My absolutely most despised word. If you WORK hard enough at luck, you’ll eventually get some. I think I just found a title to a new blog post…

Your insight and feedback is always appreciated here.

“And unfortunately, the only people who spout off stuff like this are the ones who don’t save now either.” – yes, this is unfortunate. They are giving themselves an excuse to not save by discounting what a million can buy in the future. By doing that, they will most likely end up with very little savings and inflation will eat away the buying power of that little savings.