It isn’t easy to break into the top 1% of net worth in America. America, after all, is the number #1 economic powerhouse in the world.

It might not always feel this way, but we, as Americans, are very lucky to be in America and all the opportunities afforded us here. We won life’s financial lottery when you look us compared to the rest of the world.

Americans Compare Favorably To The Rest Of The World On Income And Wealth

The adjusted net income per capita in the United States is approximately 6 times the adjusted net income per capita of the rest of the world.

Around 70% of the people in the United States fall into the global middle class. A $60,000 household income for a family of 4 is top 10% globally on an income per person basis.

Americans, in general, have strong earning powers when compared to the rest of the world. Sometimes, we lose sight of this when we compare ourselves to our neighbors.

I do, at times, lose sight of this. It is hard for me to appreciate how lucky I am when the people I know are buying nice vacation homes, taking expensive trips around the world, and driving $100,000+ cars.

No wonder how little I feel financially at times, it still doesn’t change the fact that I am doing well financially when compared to the rest of the world.

Not only are Americans strong earners compared to the rest of the world, Americans are some of the richest people globally when wealth is measured.

The median wealth of an American is approximately $79,000 according to the Credit Suisse 2021 Global Wealth Report compared to $7,500 for the global medium wealth per adult. The average American owns over 10 times the amount of wealth compared to the rest of the world.

When you put the numbers all together, the average person in America is doing well compared to the rest of the world. It is hard to dispute this by looking at the numbers. Once again, being American is winning life’s financial lottery!

I Want To Keep Up With The Top 1%

As a kid, I grew up in a financially poor household. But I have never looked at my situation and thought I would not be able to improve upon it. I believe in the American dream and that my potential is only limited by the amount of time, ingenuity, and determination I put into making money.

I spent over two decades working a corporate job and climbing the corporate ladder. My expenses increased at a lower rate than my earnings. I saved my money and invested in a variety of investments. The power of compounding took hold and, over time, my financial nut grew.

How do I know how well I am managing my financial nut? I like to benchmark my performance with those of the top 1%.

I am always curious to see how I am doing financially when compared to other people in a similar financial situation. Even if I didn’t gain substantial ground on people ahead of me, I never want to lose pace and have people behind me catch up.

Hence, I started my search on the internet for what the top 1% household net worth threshold is today.

There Is No Current Information On The Top 1% Net Worth Threshold

The latest financial threshold I can find regarding the top 1% household net worth is based on data going back to the end of 2019. I find that this stale net worth number is still widely quoted by financial articles over the past 2 years and by social media.

I couldn’t find a good source online that has attempted to update the top 1% net worth threshold number.

That 2019 top 1% net worth number is from Federal Reserve data that surveyed thousands of American families. The next time the Fed is scheduled to update this information is in 2024.

Waiting until 2024 to benchmark my financial net worth is too long. What if I have fallen drastically behind right now and I won’t find out until 2 years from now? It is better to understand where I stand now, adjust, if necessary, than to wait a few more years.

If I can’t find more current net worth information, then I thought to myself “why not try to update the top 1% net worth number myself”?

People’s net worth must have moved a lot over the past 2 years since asset prices across a number of markets have changed drastically. The often-cited 2019 top 1% net worth number of $11.1 million for an American household can’t be correct now, can it?

You will find out at the end of the article. A little teaser – the number went up!

My Approaches To Updating The Top 1% Net Worth Number

I looked at 3 approaches to try to come up with a sense of where the top 1% income threshold is today.

The first 2 approaches start with the premise that the $11.1 million top 1% net worth figure at the end of 2019 is the starting point.

Approach 1: Extrapolate the top 1% household net worth threshold by looking at the total wealth change of the top 1%;

Approach 2: Look at the asset portfolio of the top 1% and see how asset prices have changed since 2019; and

Approach 3: Use a 2021 survey conducted by Knight Frank on individual net worth to come up with a household net worth threshold.

Approach 1: Wealth Increase Of The 1 Percenters

The Federal Reserve releases quarterly data on the distribution of household wealth in the US going back to 1989.

According to the Federal Reserve data, the top 1% of US households held $33.8 trillion of wealth at the end of 2019. That number went up by the end of 2020 to $39.3 trillion, an increase of 16.4%.

2020 was a good year for the top 1%. And 2021 was the same. The top 1% increased their wealth by another 16% to end with $45.6 trillion.

From the end of 2019 to 2021, the wealth of the top 1% went up 35%.

Assuming everyone in the top 1% went up by that same percentage, it means the threshold to get to the top 1% by year-end 2021 is $15 million.

That is a 35% increase over the top 1% threshold in 2019 of $11.1 million.

Approach 2: Market Value Update Of The Asset Composite Of The Top 1%

Another approach to look at how the net worth might have changed for the top 1% is by looking at the assets of the top 1% and figuring out how the value of those assets changed from 2019 to 2021.

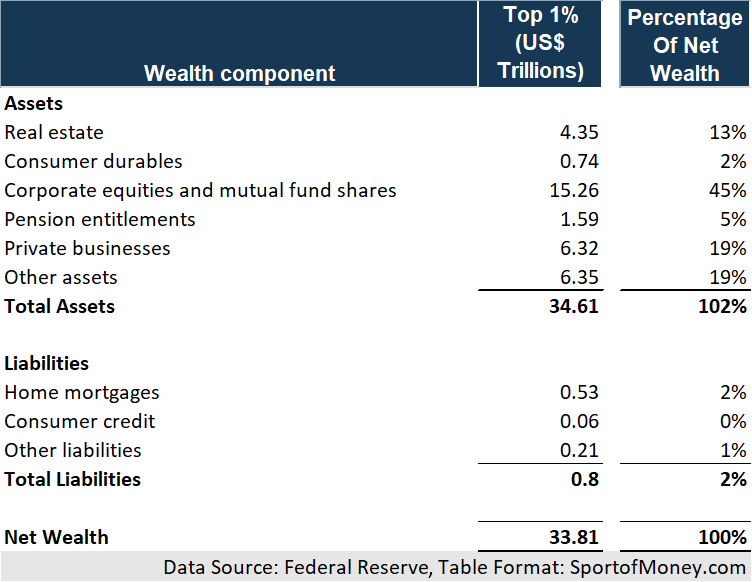

The Federal Reserve releases data on the asset composite of the top 1%. The below table is as of year-end 2019.

Equities, both listed equities and equity in private businesses, make up a large component of the assets of the 1 percenter. The two other large components of wealth are “real estate” and “other assets”.

I didn’t find a breakdown of the other assets category. My assumption is that the other assets category is mainly fixed income investments. This is based on another article I came across showing the breakdown of the assets of multi-millionaires.

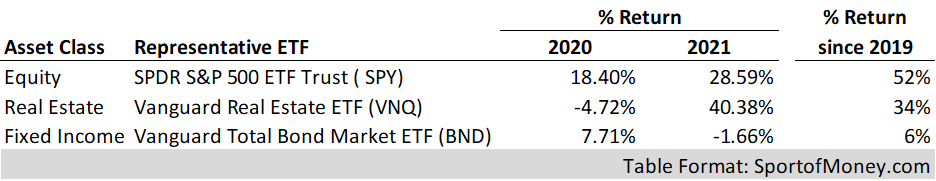

Let’s examine how the big three asset categories of the 1 percenters (equity, real estate, fixed income) have performed over the past 2 years.

Equity has done well over the past 2 years from 2019 to 2021. The same goes for real estate. Fixed income generated positive return over the 2-year period, albeit at a much lower return.

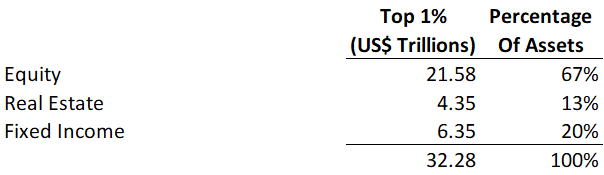

Here is the component breakdown stripping away all other assets for which market value updates are harder to determine.

Applying the returns to these 3 asset classes weighted by their respective asset composite % gives a return over the past two years of 40.6%.

Using this methodology, in order to break into the top 1%, you need $15.6 million at the end of 2021.

Approach 3: Knight Frank Survey

One of the more recent surveys I found regarding net worth in America is from Knight Frank. They conducted the survey back in 2021 and concluded that $4.4 million is the threshold to break into the top 1% of Americans.

I always thought this was a low number, especially compared to Fed number of $11.1 million at year-end 2019.

After further review of the survey, my take is that the Knight Frank survey of $4.4 million is the net worth cut-off for an individual to be in the top 1% in America. The $11.1 million Federal Reserve number is the net worth for the entire household.

Based on the latest Census, there are 2.6 persons per household. Assuming in order to obtain 1% net worth on a household basis, each member of the household needs to be in the top 1% as well.

Applying this assumption, the top 1% household net worth needs to be $11.4 million at year-end 2021 ($4.4 million multiplied by 2.6 persons). That number is around the 2019 number and seems very low, especially given the increases in the equity and real estate markets.

We can eliminate this approach since I believe the number is too low and the assumptions used to obtain the top 1% household net worth is most likely flawed.

Top 1% Net Worth At The End Of 2020, 2021, And Q1 2022

Based on the first two approaches, here is what you need in order to be in the top 1% household net worth at the end of 2019, 2020, 2021 and after the first quarter of 2022:

| 2019 | 2020 | 2021 | Q1 2022 | |

| Top 1% Net Worth Threshold | 11,099,166 | |||

| Approach 1: Wealth Increase | 12,918,378 | 14,980,590 | 14,750,726 | |

| Approach 2: Market Value Update | 12,562,201 | 15,605,789 | 14,805,884 | |

| Average Of Approaches 1&2 | 12,740,290 | 15,293,189 | 14,778,305 |

The Top 1% Net Worth Threshold in the United States is:

At Year End 2019: $11,099,166

At Year End 2020: $12,740,290

At Year End 2021: $15,293,189

At End of Q1 2022: $14,778,305

Top 1% Net Worth At The End Of 2nd Quarter 2022

The Federal Reserve did not release the 2nd quarter 2022 wealth information yet. Hence, the only approach I can use to update the net worth information to June 30, 2022 is based on approach 2.

Updating the benchmark ETF indices for the performance of the second quarter 2022, the YTD return for our top 1 percenters went down 18% for the year.

That means by June 30, 2022, the cutoff to get to the top 1% net worth in America is $12,777,085.

I can back-test the validity of my approaches when the Federal Reserve releases the 2023 numbers in 2024 to see how good my analysis is.

As for how well the performance of my financial nut compares to the top 1% – I am happy to report that I did not lose ground and might have passed a few people ahead of me.

To The Audience: How well did you do since the start of the pandemic? Are you close to the top 1% net worth? Did you outperform the top 1%?

Related Articles

Average Income In New York City: What Salary Puts You In The Top 50%, Top 10%, And Top 1%?

Here’s What You Need To Be Upper Middle Class And Upper Class In NYC & It’s A Lot

How Rich Are Americans On A Global Scale? Very Rich!

Many people work hard to better their physical and mental health. What about their financial health?

I started this blog back in 2019 to help people better their financial health as well.

My financial journey began with tens of thousands in student loan debt. Over the span of 20 years, I am close to achieving financial independence.

I truly believe anyone can get to strong financial health. Hopefully, this blog can help you on your financial journey to greater wealth and financial independence.

You can read more about me here.

Thank you for visiting. Come again soon!

Welcome back! Impressive growth on the net worth, and congrats on the achievement.

I’m amazed at how high the US numbers are, my own country you only need $250k to reach the top 1%. Obviously all incomes are multiples lower than the US, but I find that although achieving the top 1% was relatively easy, $250k net worth isn’t enough to stop working. In fact I’m at multiples of that and even then it is too low. I suspect it’s because there are just a large number of poorer households pulling down the numbers unrealistically. However, on an absolute basis, I would think $10m-$15m would easily support a lifestyle? Do you find that people in the top 1% of wealth in the US would be able to support their lifestyle with that level of assets?

Reddit has a FatFIRE forum which I frequent. I think people there list $5 million as the entry point for FatFIRE with some people putting the entry point at $10 million. I do believe that investable assets of around $10 million to $15 million can produce a very good lifestyle, even in a high cost of living area.