The most visited post in my entire website is this one I’ve written close to 1 year ago regarding how much income it takes to live an upper middle class and upper class lifestyle in New York City.

Not surprisingly, the answer is it takes a lot to be in the upper middle class and upper class in New York City, one of the most expensive cities in the world.

Almost a year has passed since I’ve written the post, and amidst the global pandemic of COVID-19, I want to revisit this topic to see if things have changed since I first wrote about this topic.

COVID-19 has wiped out tens of millions of jobs. New York State and New York City are two of the worse hit areas.

Being referred to as the epicenter of coronavirus is a distinction no one wants. Unfortunately, it was used to describe my beloved New York City.

Hopefully, we would be able to beat this virus soon and get the economy and people’s lives back to normal.

When Forbes compiled their 2020 billionaire list back in March 2020, they counted 2,095 billionaires in the world. As of March 18, 2020 when they finalized the list, there were 58 fewer billionaires than a year ago, and 226 fewer than just 12 days earlier.

Of the remaining billionaires, Forbes noted 51% are poorer than they were last year.

If billionaires can be impacted greatly by COVID-19, how do mere millionaires and others fair in the great city of New York?

Let’s take another look at the lifestyle of the Upper Middle Class and Upper Class in New York City in 2020 during this pandemic to determine how much you really need to join them.

What Level Of Income Is Needed To Live An Upper Middle Class Lifestyle And An Upper Class Lifestyle in Manhattan?

In a top tier global city like New York, how much does a family need in order to live an upper middle class lifestyle? What about living an upper class lifestyle?

Obviously, it is a very subjective exercise in coming up with the lifestyles of an upper middle class family and an upper class family. But, never one to be daunted by a big task, I will give it a shot based on my own experience living in New York City as well as through discussions with other New Yorkers.

First off, this is my definition of what the lifestyle is like for the two classes of family living in New York City, specifically in Manhattan.

Manhattan is very expensive and the numbers below can feel out of sort if you don’t live in New York City or in another high cost of living area.

I believe the cost of a lifestyle is dependent on geography. If you live in a location where you can have the same lifestyle, but spend a fraction of what a New Yorker would need to spend, then you should be happy about it.

Taking housing for instance as a point of comparison.

A 3 bedroom 3 bathroom 2,000 square foot apartment routinely run $2,500 a square foot in a full serve building in Manhattan.

The median size of a single family house in America is about 2,400 square feet and the median house price according to Zillow is approximately $228,000. That comes out to $95 a square foot.

This means the Manhattan family living in a new development condo apartment pays $2,400 more per square foot for housing than the average American.

Or put another way, to get an apartment of comparable size to the median single family house, the Manhattan family needs to spend $6,000,000 on housing.

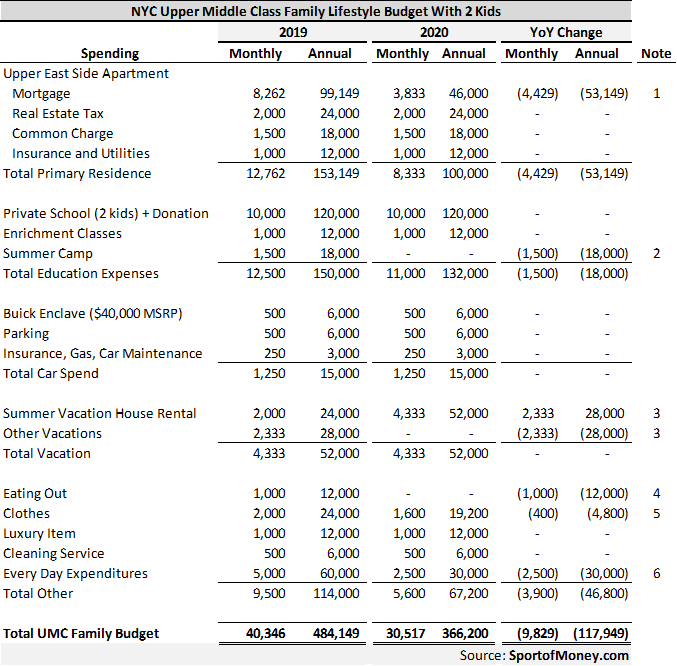

Changes in Upper Middle Class Spending For A Family Of 4 In Manhattan

It has gotten less expensive to live an upper middle class lifestyle in Manhattan for a family of 4 (parents and 2 school age children) in 2020 when compared to 2019. The difference of $118,000 is quite significant.

The change in spending is further explained below:

Note 1

Let’s examine what I would consider a home that fits an upper middle class lifestyle in Manhattan for a family with 2 kids.

The home should be at least 1,500 square feet with 3 bedrooms and 2 bathrooms.

Back in 2019, a quick search on StreetEasy shows an option on the Upper East Side. It is a 3 bedroom 2 bathroom condo with 1,750 square feet. The asking price is $2,300,000. The monthly real estate tax is slightly over $2,000 and the common charge (equivalent to HOA) is slightly over $1,500.

For all the talks of gloom and doom in the real estate market, I don’t see much movement in the prices of properties not in the luxury market. The luxury market is defined generally as around $4 million in NYC.

From my observation, a 3 bedroom condo apartment in the low $2 million range is still attractive for a family who wants to remain in Manhattan.

This price is what I considered to be a starting price for such an apartment. Hence, I don’t see a lot of price movement here.

There might be one off deals to be had currently. But on the whole, I don’t see a significant price drop for homes hovering around $2 million and below.

My guess is there are a lot of sellers who believe that COVID-19 is temporary (maybe within a year or so) and can hold off on listing their property until then.

However, interest rates on residential mortgages have come down since then. There are even whispers of negative yields on Treasuries.

I know banks offering a mortgage on a primary property in the low 2%’s on an interest only 10/1 ARM. That means the monthly payments will consist of only interest and the payment of the principal is optional for the first 10 years.

The $4,400 monthly difference is due to a reduction in interest rate (3.5% in 2019 versus 2.5% in 2020) and selecting the interest only payment for 2020 (as opposed to an amortizing mortgage).

Note 2

In 2019, we had the 2 kids participating in summer activities at a camp for $9,000 per child.

With the pandemic in 2020, the family opts to not send their children to summer camp this year.

It will be tough to have the two children stay with them for July and August. But for their safety, it needs to be done.

That would cut $18,000 from their annual budget.

Note 3

Back in 2019, this family of 4 rented a Hampton pad for the month of August to spend time in suburbia and to escape the concrete jungle.

In addition to a summer home, the family went on 4 vacations a year. The vacations ranged from a week in Disneyland, to a week in a Caribbean Island, to a week in Europe.

But in 2020, with COVID-19, the family opts to not travel and fly. They also want to avoid any crowded places.

Disneyland is definitely out of the question.

But knowing the children will be with them and won’t have camp for this summer; the family decides to roll what they normally spend on the 4 vacations to extend their stay at the Hamptons.

This way, the family has more indoor and outdoor space for 2 months at a spend of $26,000 per month to rent a pad at the Hamptons.

The Hamptons rental might have to be slightly smaller than what they are used to in order to stretch their $52,000 budget. But this sure beats being in a 1,750 square foot apartment in the peak of summer with nowhere to go.

Note 4

In 2019, the family spent $1,000 a month to eat out and enjoy the restaurant experience.

With the pandemic, the family, in keeping with their decision to not be in crowded areas, decides to forego eating out.

This move saves the family $12,000 a year in dining out expenses.

Note 5

Clothes are currently at a discount compared to 2019. I see many flash sales happening to premium brands and online clothing stores.

Tens of millions of Americans are currently unemployed. There is very little need for them to buy new clothes.

Additionally, millions more are working from home or are following stay-at-home orders. They, too, have less need for clothes.

I currently have a rotation of 4 outfits I’ve been wearing over the past 4 months.

With less demand for clothes, retailers are offering sales and discounts.

Note 6

Everyday expenditures are sliced in half when compared to 2019.

Haircuts, manicures, trips to driving ranges, movies, dry cleaning and a whole host of activities are now no longer part of the schedule.

Gone are those days.

All that means is less spending on everyday expenditures.

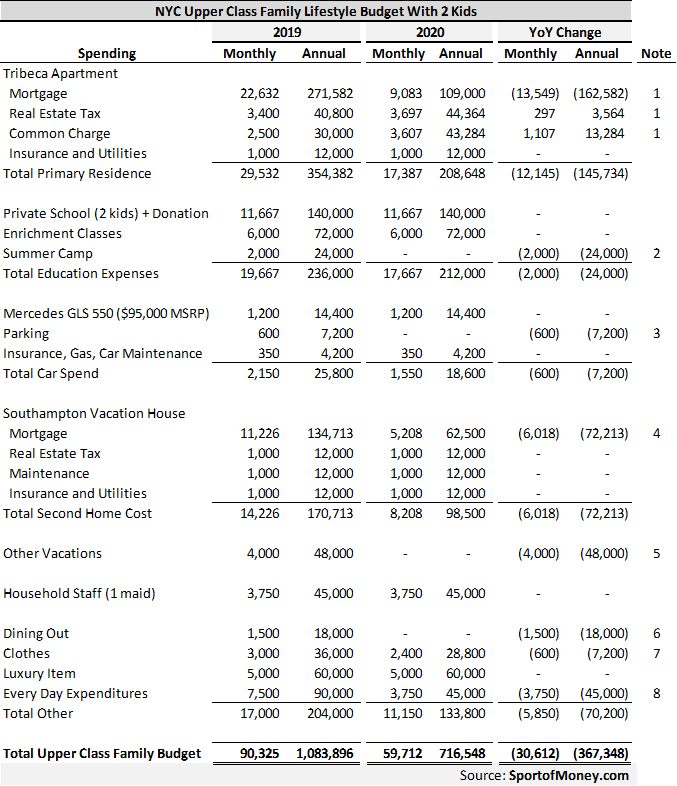

Changes in Upper Class Spending For A Family Of 4 In Manhattan

In line with the decreased spending of an Upper Middle Class family, the budget of an Upper Class family also experiences a significant drop to the tune of $367,000.

Now, let’s examine the changes in an upper class lifestyle in Manhattan for a family with 2 kids.

Note 1

Unlike at the lower price point of under $2.5 million, I do see that the upper end of the Manhattan real estate market has taken a beating.

I am not sure how much of it has to do with the pandemic versus just the overall glut of supply against a backdrop of decreasing demands.

Last year, this upper class family of 4 moved into a full amenity, luxury new development condo with 3 bedroom and 3.5 bathrooms in Tribeca. The total square footage of the apartment amounted to 2,200 square feet.

It was listed with an asking price of $6,300,000 with monthly real estate tax and common charge of $3,400 and$2,500, respectively.

Currently, by doing a quick search on Streeteasy, I was able to identify a 2,500 square foot apartment also located in Tribeca. The building is a luxury new development with full amenities as well.

It happens to be a 4 bedroom, 4.5 bathroom apartment listed at $5,450,000.

To contrast the two apartments, you gain 300 square feet, an extra bedroom and an extra bathroom for $850,000 less.

Now that is quite a difference year over year.

The real estate tax and maintenance charge do add up to be $1,400 more a month.

As previously mentioned, interest rate on the mortgage is also lower for 2020.

When factoring in a 2.5% interest only mortgage for the 2020 purchase as opposed to an amortizing mortgage at 3.5%, this family saves $13,500 a month on the mortgage payment.

The family saves $145,000 in cash this year versus last year on house cost alone.

Note 2

This is the same story here as with the Upper Middle Class Family.

In 2019, the 2 kids participated in summer activities at a camp for $12,000 per child.

With the pandemic, the family opts to not send their children to summer camp this year.

It will be tough to have the two children stay with them for July and August. But for their safety, it needs to be done.

That would cut $24,000 from their annual budget.

Note 3

This family has opted to spend the time in their vacation home away from New York City.

It is the smart and prudent thing to do.

What better way is there to enjoy a vacation home than to spend months in it? How often do you get to really work from home for months at a time?

A monthly parking spot at a Manhattan garage won’t be necessary given the family has taken the car out to their vacation home.

This results in an annual savings of $7,200.

Note 4

Home prices in the Hamptons have been dropping over the past few years.

The Hamptons is running into the same issue as the high end market in Manhattan. There is a lot of supply but less demand.

I am not sure if the pandemic is a net positive or negative for the Hamptons just yet.

Based on my recent searches, I do see some price adjustments down. But interestingly enough, I also see some homes which have been taken off the market a month ago get relisted at a higher price.

Maybe those realtors are banking on higher demand now that New Yorkers with financial means are leaving the city.

I’ve left the home price unchanged year over year for their $2.5 million Southampton vacation home. It won’t be in the nicer area of town where houses start at around $3.5 million.

But it is a good enough location for this family.

This family plans to spend a lot of time in their Hamptons home to escape from Manhattan.

Not only is the family in an area with significantly less COVID-19 cases, but there is more space both indoors and outdoors for people to roam around.

With a lower mortgage rate, the family gets to save $72,000 a year.

Note 5

Similar to the Upper Middle Class family, traveling for vacation is pretty much out of the question. Why run the risk of exposing any member of the family to the pandemic.

It’s time to just honker down at the vacation house. With the warmer weather coming soon, the outdoor heated pool will sure get a lot of usage.

The business class trips and 5 star hotel stays at Maui or the French Riviera will have to wait another year.

At least this family can save $48,000 by foregoing vacation expenses.

Notes 6, 7 And 8

This family sees reduction in these expenses very similar to how the Upper Middle Class family experiences expense reduction as well.

Dining out is to be avoided to remain prudent and safe.

Clothes can be had at a discount compared to 2019 given all the retail sales.

Everyday expenditures are sliced in half when compared to 2019.

Summary

There you have the upper middle class and upper class budgets for 2020 during the global pandemic.

It takes approximately $366,000 ($118,000 less than in 2019) to live an upper middle class lifestyle in Manhattan during the pandemic. That is a decrease of 24% year over year.

For an upper class family, the amount needed is $716,000 for 2020, a decrease of $367,000 from 2019. That is a significant decrease of 34% year over year.

These two amounts are the cash amounts needed on an annual basis. The gross income amounts run double these two amounts.

In order for a family of 4 to have an upper middle class lifestyle in 2020, the household income needs to be least $665,000 assuming a 45% income tax rate.

A household income of $1,300,000 is needed for an upper class lifestyle.

Of course, these income amounts just get you in the door. They do not account for any savings whatsoever.

To the audience: Did I miss any other expenses in my analysis? Do you agree with my analysis?

Where do you live and what do you think is the annual budget necessary to sustain an upper middle class lifestyle? What about the cost of an upper class lifestyle in your location?

Related Posts:

A Million Dollar Income ($1,000,000) – A Detailed Analysis Of The Household Budget Part 1 of 2

A Million Dollar Income ($1,000,000) – A Detailed Analysis Of The Household Budget Part 2 of 2

The 9 Reasons Why The Rich Keep Getting Richer

Many people work hard to better their physical and mental health. What about their financial health?

I started this blog back in 2019 to help people better their financial health as well.

My financial journey began with tens of thousands in student loan debt. Over the span of 20 years, I am close to achieving financial independence.

I truly believe anyone can get to strong financial health. Hopefully, this blog can help you on your financial journey to greater wealth and financial independence.

You can read more about me here.

Thank you for visiting. Come again soon!

Amazes me that a 3000 sq ft house on two acres here costs one tenth of what a NYC apartment half that size does (about $200k). Add to that the fact that almost nobody in rural areas has gotten sick and everything has already reopened and I wonder if people are going to rethink the value proposition of metropolitan life? If so those costs could be dropping a lot more. Especially if this crisis shifts more people to working remotely.

I know a few families with young kids who have moved out of New York City permanently because of the pandemic. They were renters and it was easy for them to be mobile. I do think that the pandemic will push families to move out of NYC who were already on the fence about moving to suburbia.

If my company implements remote work as a possibility going forward (even after the pandemic blows over), I might contemplate moving out of the city for more space now that one of the biggest benefits to me (short commute) is no longer on the pro ledger.

I think for the younger crowd, NYC will still be the it place to be. Once a vaccine is developed, I can picture even more young folks heading here because of YOLO mentality (you only live once) that developed over this time period.

At the end of the day, I still believe people are social beings and want to be around cultural, populated centers. Overall, I believe NYC will still continue to grow in population and demand in a couple of years after a vaccine is in place.

These numbers are borderline insane to me. But I get it. Manhattan is by far one of the world’s most expensive cities. Personally, I stay away from places like this.

It sounds like your income and net worth was was built on living there so for you it makes perfect sense.

In other places I lived in Europe and around the world, an upper middle class life can easily be supported with $200K. Even that would be too much in my opinion.

Cheers!

Yes, people can still accumulate a robust net worth even while living in NYC. For me, it was the availability of a high income earning job coupled with local real estate appreciation.

I also know of a lot of blue collar working class millionaires in NYC. It becomes a lot easier to be a millionaire when a single family home routinely runs $800,000 in middle class neighborhoods in Brooklyn or Queens. It might have taken 20 to 30 years to pay off the mortgage, but a lot of middle class people who purchased houses 3 decades ago at a significantly lower price are sitting close to a million $ in equity on their primary home alone.

Fascinating that currency is so relative. We live in a 1800 sq foot townhouse in South Africa with gardens, have a cleaner, and garden service. Eat out regularly, and definitely live an upper middle class lifestyle, comes out at around 1\18th of your table at $2k per month, but the home is paid off. We paid $200k for it 10 years ago, it’s worth around $80k now due to currency depreciation (but up in local currency). Our income was around $250k pre tax ($150k after tax). Enjoyed trips to visit Europe and skiing. This year our expenses will be incredibly low. A large house would be cheap too at around $150k for 2700 sq ft on 1/4 acre property.

The only things more expensive are cars and electronics which will set you back about 50% more in usd and financing rates which can run in the 10-15% interest rate range.

It must be nice to be making such a strong income relative to how much it takes to maintain an upper middle class lifestyle.

Have you thought about a lifestyle upgrade given you make more than 6x in after tax income than your upper middle class spending?

Yes, but what do you buy when you have everything required? I’m finding that its not very motivating to acquire more stuff when what I want to buy is time? I do feel it might be worth moving the whole family to another country, so could save for that?

How do you keep motivated past FI?

It must be a good feeling to have and be able to afford everything you want.

I am not at FI yet. I am still a few years away but as I get closer to FI, I struggle with motivation as well. I don’t have the same fire in me to excel as I did 20 years ago. I used to work very long hours in my 20’s and I don’t have the desire to work those hours now.

To keep me motivated to still achieve at a higher clip than I would otherwise aim for, I upped the lifestyle I want. This way, I need more money to achieve that lifestyle which continues to keep the flames burning for more.

I also took a self-introspection to figure out what I want to work on and came up with two items: (1) I want to improve on certain skills such as writing and (2) I want to be able to help people. Then blogging came to mind that can help me accomplish both to work on my writing and to help people live a healthier financial life.

The funny thing is that most of the Manhattan people, who live in those overpriced shoeboxes, had a pretty rough time with COVID and the lockdown. At the same time, I, living in Queens, in a pretty decent condo-house (which costs 1.5k/month, as we share with daughter’s godmother and daughter), was able to go out with kiddo EVERY DAY, have enough room in the parking lot to even play tennis (as she’s training in tennis for 2 years now), bike in the neighborhood etc.

We live off $3000, the 3 of us, have enough room and freedom to move in the area, without getting infected or worrying about anything.

As we are actually pretty ‘cheap’ with luxuries (I see no reason to waste money for a lot of the things ‘rich’ people waste time on), we’re debt-free, can afford 1-2 months of vacation in Europe, tennis lessons for the little one at Flushing Meadows, a lot of coins for husband’s collection and so on. 😀

Sometimes living in NYC can be pretty affordable depending on lifestyle. It seems like you constructed a happy lifestyle while limiting your expenses.

Thanks Rich, great to see you back posting again. More importantly, happy to hear you and your family are all safe/healthy. I used to write and pick your brain regarding where to raise a family in the New York area. It seems there is finally a tremendous amount of demand in suburbia-Westchester/ Greenwich. We have still been deciding between the city or the burbs, but seems that sales and imagine prices are finally moving for the first time in decades, at least in Greenwich. I work in finance as well, and it seems I will have flexibility to work from home at least once a week going forward even after the pandemic ends. It seems the premium associated with the city will modestly decrease for me and others in my situation with the flexibility TWFH… I have always commuted to midtown by whole career and never worked from home in over a decade before all this.

Of course, now I’m buying into a market that seems to be moving … It still doesn’t address the demographic issues in the Northeast. I’m not sure what to make of that, especially given the deficits up here will only get worse with all the spending. Seems, taxes at the state and local levels have to keep going up and up unless I’m missing something.

Hope your having a wonderful day off with the family!

J

Isn’t it funny how things seem to go up in price when you are about to buy and prices seem to come down when you are about to sell. This happens to me all the time.

I find the ever increasing income taxes and increased regulation on rental properties in New York to be concerning as a real estate investor. But so far the high taxes and rent regulations have not deterred me from buying properties in NY yet.

But I am definitely looking at other cities to put my money to work to diversify away from New York City due to the direction (more taxes and regulations) of the state and local government.

Thanks for the response Rich, appreciate it and I think that is likely prudent to look elsewhere. For me, it would be my primary residence so I (or at least my wife keeps telling me) need to view this through the view of a “lifestyle expense” relative to an investment etc. I just know my housing payment is going to go up nearly 2x when I finally pull the trigger!

I enjoyed your other posts as well…I am a bit younger than you and this was the first period of losing material money…My $2.45M went down to like $1.6Mish…many sleepless nights, didn’t do much buying or selling and am back to nearly $2.2M, but I was very much emotionally shuck up!

It wasn’t easy for me too losing 7-figure during the depth of the stock market drop in March.

As your financial nut grows, a few % point change can result in big $ change. I guess that is one of the “downsides” of having a big investment balance.

This is very interesting. Thank you for compiling and posting. I think that perhaps another big expense for both middle class and upper class families are nannies. The prices for a full-time nanny begin at around 55K per year (+ taxes) and up, up, up.

Childcare is a large expense for sure.