I have a passion for personal finance. My belief is that passion developed early on in my childhood.

I grew up in a financially poor household. Despite having a very happy and content childhood, I also witnessed firsthand how challenging life can be without money.

That set me on the course to want to do better financially in life and my passion for personal finance was born. My passion for personal finance is also one of the reasons why I work in the financial services industry.

I enjoy reading financial articles and perusing personal finance blogs in my spare time. From my readings, I come across a lot of “financial truths”.

Some of those “financial truths” I agree with and some I don’t. I have also established a few financial truths of my own.

Include below are some actions to take. Everyone has their own unique financial situation. Therefore, you have to decide if those actions are right for you.

Here goes and not in any particular order of importance:

Financial Truth #1: Financial Literacy Is Important To Your Financial Success.

Unfortunately, financial literacy is not taught in schools and most Americans are not well versed in basic financial concepts. Only 37% of respondents were considered to have high financial literacy based on a National Financial Capability Study Financial Literacy Quiz. Take the financial literacy quiz here and see how well you do. Building strong personal finance knowledge is one of the most important things you can do if you want to be rich. Be part of the 37%.

Actions To Take: Continue to read this blog! 🙂

Financial Truth #2: Always Spend Less Than You Make.

In fact, try to push yourself to save as much as possible, up until the point you can’t save anymore. Shoot to save more than you spend. Focus on tackling the 2 biggest expenses you have: housing and car. Live at home with your parents for the longest time possible when young. Buy a smaller house. Instead of 1,000 square feet of living space per person in a typical new house, shoot for 750 square feet. Buy a used car instead of a new one. Better yet, try to keep the max purchase price of your car to 10% of your gross income.

Actions To Take: Live at home longer, buy a smaller house, buy used instead of a new car and only spend up to 10% of gross income.

Financial Truth #3: Investing Early Turbocharges Your Financial Wealth.

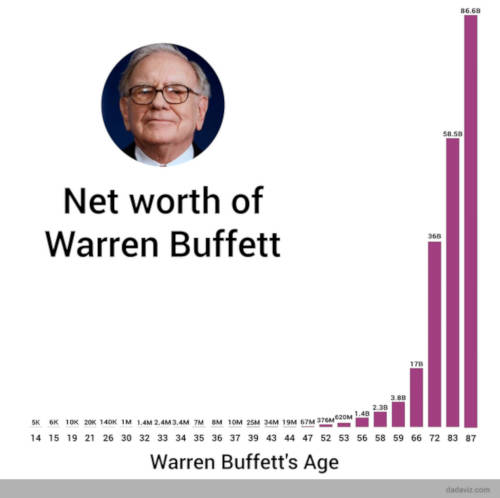

Compound return is the most powerful force in the known investment universe. Enough time can turn any average Joe into Jeff Bezos in wealth. $1 invested with a 10% return per annum will be $2.59 in 10 years. In 40 years, that same $1 invested at a 10% annual return will become $45.26. See the multiplier effect time has on investing. Warren Buffett made over 99% of his wealth after the age of 52. He was no slouch to begin with and started making money at a very young age. The trajectory of his wealth just highlights the power of compound return.

Actions To Take: Max out your 401(k) contribution now.

Financial Truth #4: Invest For The Long Term.

I don’t believe any get rich quick schemes. They are more like scams to me. If there are such schemes, then there wouldn’t be any poor people around. The best investments I’ve made are the ones I’ve held onto for a very long time. This includes real estate properties that I’ve owned for 10 years. This also includes stock holdings in the S&P 500 index or individual stocks which I’ve owned for a number of years. When I think about building wealth, I think in terms of decades. Investing for the long term maximizes the power of compound return and reduces transaction costs.

Actions To Take: Designate a pool of capital as capital for long term investing. It is money you won’t touch for years or decades. Keep on adding to the pool of long term investing capital.

Financial Truth #5: Leverage Is Good If You Know How To Use It.

There is nothing wrong with borrowing money to invest as long as you know the economics and how to use leverage to your benefit. Real estate investors do it all the time. I think the ability for leverage in real estate is one of the main benefits of owning real estate. Interest rates and the cost of funds are very low right now. Is there a wonder why even Apple, with billions on its balance sheet, still went to the bond market to issue debt? Leverage can turbocharge your investment return profile.

Actions To Take: Explore putting a HELOC in place for liquidity. For real estate investors, review properties with low LTV and see if you can do a cash-out financing.

Financial Truth #6: Paying Down Cheap Debt Is Bad.

There is good debt and there is bad debt. You want to keep good debt and reduce/eliminate bad debt. In my mind, good debt is any debt that charges an interest rate that is lower than what you can reasonably get in your investments. If I can make $10 out of every $100 invested, and it costs me $3 to borrow $100, I would borrow as much money as possible. Why wouldn’t I if I can make $7 on every $100 borrowed? Mortgage rates are really low right now. The 30 year fixed rate is at its historical low. Why would I want to pay that down as quickly as possible?

Actions To Take: Choose a 30 year mortgage instead of a 15 year mortgage. Look at your borrowings and determine which ones are good debt (interest expense < investment return) and which ones are bad debt (interest expense > investment return). Pay down the bad debt and keep the good debt.

Financial Truth #7: Follow The Masses For Average Results.

If you want the average results, just follow the masses. The median American household income is around $63,000. And the median American household net worth is around $97,000. The median is the halfway point with half the people doing better and half the people doing worse. There is nothing wrong with being average. But if you want to do better, especially significantly better, then know that you must do things differently than the masses. This is a mindset shift. To be rich, you need to think differently than the masses and that will make you an outsider to the general population.

Actions To Take: Observe what the general population does in their financial lives such as how they earn and spend their money. Don’t follow them.

Financial Truth #8: Most People’s Financial Advice Isn’t Worth Much.

This is along the lines of financial truth #7. The majority of people are just average by definition. Therefore, their financial advice would only produce average results. Once again, if you want to be average, then go ahead and ask away. If you want better financial results than average, then only solicit financial advice from someone you know with certainty is rich or has an expertise in a particular area you have a question about. Otherwise, you are just wasting your time in asking people for financial advice or feedback.

Actions To Take: Have one or two people at the next wealth level (next wealth level = adding a zero at the end of what you have) from you on your contact list that you can turn to for financial advice.

Financial Truth #9: Practice Stealth Wealth For A Greater Peace Of Mind.

Stealth wealth is the practice of keeping your true wealth hidden from others – including your friends and family. I would include not just wealth but also income into that practice. In general, people are envious animals. We envy what others have. Additionally, you know the saying misery loves company. When we are down, we want other people to keep us company. Therefore, if you are doing better financially than the next person, that person will more likely than not develop envy and try to put you down a peg or two. Practice stealth wealth for a greater peace of mind.

Actions To Take: Review the benefits and ways to practice stealth wealth here.

Financial Truth #10: Finding The Right Partner Is Important.

You know the saying “we are only as strong as our weakest link”. That saying applies to personal finance as well. Always look for the right partner, rather it be in business, to provide you with a service, or even in life. A bad partner can cost you dearly. A great partner can help multiply your wealth and make you rich.

Actions To Take: Make sure to have financial discussions with your significant other. Work to develop financial goals together and keep each other accountable in achieving those goals.

Financial Truth #11: You Need To Outwork Everyone To Get Rich.

No one gets rich simply by thinking about being rich. Rich people work hard on building and accumulating wealth. Is there a surprise the best performers in your company are also the people who tend to work the hardest? Tim Cook, the CEO of the most valuable company in the world Apple, wakes up before 4 AM each day. The 9 to 5 work hours and working 5 days a week is good for the average person. If you want to get rich, look to do double that and outwork everyone else.

Actions To Take: Use your time to start a side hustle, preferably an online business. Why do you think I created this blog? 🙂

Financial Truth #12: You Are Responsible For Your Own Finances.

There are always athletes and celebrities who popped into the news for their difficult financial situation despite making tens or hundreds of millions. In 2018, New Orleans Saints Quarterback Drew Brees filed a lawsuit against a jeweler for selling him diamonds that were not quite as advertised. He paid about $15 million for diamonds appraised at $6 million. Johnny Depp also sued his money manager for mishandling his funds after he got into liquidity issues a few years ago. Don’t be like those people. It doesn’t matter who you are and what you have, you are still responsible for your own finances. Ultimately, your finances affect you the most.

Actions To Take: Understand your income and expenses. Create a budget and monitor your performance against that budget. Keep track of your assets and liabilities.

To the audience: What do you think about the financial truths above? Do you agree with them? Do you disagree with them and why? What are other financial truths you hold dear?

Related Posts

Financial Tough Love And A Dose Of Reality

Financial Rant: Americans, We Can Do Better Financially

The 11 Numbers Everyone Should Know Better In Their Personal Finance Life

Many people work hard to better their physical and mental health. What about their financial health?

I started this blog back in 2019 to help people better their financial health as well.

My financial journey began with tens of thousands in student loan debt. Over the span of 20 years, I am close to achieving financial independence.

I truly believe anyone can get to strong financial health. Hopefully, this blog can help you on your financial journey to greater wealth and financial independence.

You can read more about me here.

Thank you for visiting. Come again soon!

Agree with just about all of this list. If you just stick to #2 and #4 you’ll probably put yourself ahead of the majority of the population!