It shouldn’t surprise anyone that my money beliefs have evolved since I was younger. Many things tend to change as one acquires more experience and accumulates more wisdom.

The way I view money isn’t exempted from such changes. Not only have my views about money changed throughout the years, they have also changed because of my different financial stations.

First off, let’s go over my background briefly since that has a strong influence on how I view money and directly impacts my money beliefs.

Growing Up

I grew up in a financially poor American household. One example to illustrate the financial struggle experienced by my parents is that our family of 5 lived in an apartment that was smaller than 400 square feet.

That comes out to under 80 square feet of personal space per person. Now contrast that with the average new house in America. Round numbers – the average new house size is 2,500 square feet with an average family size of 2.5 people, amounting to 1,000 square feet of personal space per person.

I can’t imagine having over 10 times the personal space I did when growing up. After all, my bathroom in that apartment was so small that my bathtub needed to be in the living room. Suffice it to say, there was no singing in the shower for any of us.

Despite growing up financially poor, I had a very happy childhood.

I experienced firsthand how things can be challenging without money. But at the same time, I didn’t need money to be truly happy.

In hindsight, I believe that growing up financially poor actually provided me with a number of benefits later on in life in building my financial wealth.

Still, if you give me the option of growing up financially poor or not poor, I would choose not poor 10 times out of 10.

Out In The Work World

I started out with the mindset of how important money is because of seeing firsthand how hard it is to make ends meet without money.

I knew education would be a great equalizer and also knew the importance of going into a high earning practical field of work. I studied as a student, graduated from college and entered into the financial services industry.

After 20 years of work, I’ve been able to accumulate a nice financial nut in the millions. It took years of earning an above average pay, aggressive savings, and investing to get to where I am today in terms of net worth.

In fact, I was able to get to a 7-figure retirement balance through contributing early, saving consistently, and predominantly investing into the S&P 500 index fund. I crossed the million dollar mark in my retirement accounts in my 30’s.

I was also able to marry well. My wife is a like-minded person when it comes to personal finance. We continue to earn, save and invest our money.

Don’t discount how important your life partner is in impacting your financial well-being. A bad partner can easily tank you and cause you to end up in the poor house. Conversely, a great partner can produce a multiplier effect on wealth production.

I believe I am about 2 years away from reaching financial independence. But I have no goal of retiring at this point even after crossing the FI line. Ironically, I found that the closer I get to financial independence, the less likely I want to quit my job.

We are fortunate to be in a position now where our household income puts us in the top 1% of all American households. The same goes for our household net worth.

Money Beliefs In My 20’s When Starting Out

I had a set of money beliefs after graduating from college and through my 20’s. My net worth was basically zero at the time.

Money Doesn’t Only Buy Goods And Services – It Can Buy Freedom

Money is a necessity in order to acquire goods and services. This was obvious to me growing up when other kids were able to come in with new clothes from the GAP and new book bags and I had to wear non-brand name clothes until they either didn’t fit or got worn out with holes in them.

In my early 20’s as a newly minted college graduate out in the workforce making my own living, I realized then that I didn’t want to work forever. In fact, I wanted to work hard, save and hope that in a decade or two, my passive income can match my expenses. Then, I can walk away from a corporate job.

I guess I was an early practitioner of the FIRE (financially independent, retire early) movement before even realizing there is a snazzy name for it.

The only way to be able to unshackle myself from the corporate handcuff is to accumulate money – the more the better. I wanted to be financially free sooner rather than later, and I believe money was the means to get me there.

Saving And Investing Is A Big Part Of Wealth Creation

I graduated college in debt. When starting out with nothing (or in a financial hole) it is best to develop a plan to build financial wealth.

The way I thought about wealth building was to save as much of my money as possible and then to invest that money. I knew that the power of compound return will do the rest.

The 3 biggest American household expenses are housing, car and food. To cut down on my expenses and to maximize my savings, I lived at home for the first few years after graduating from college. I was able to reduce my housing expense to zero, use my parents’ car, and bum off of them for breakfast, dinner and even bagged lunches.

Most of my savings went into either a 401(k) account in which my employer matched the contribution or went to an online brokerage account. I purchased stocks, mainly by dollar cost averaging into the S&P 500 index fund.

That turned out to be a wise move early on because I was able to accumulate over $1 million in my retirement account in my 30’s.

Plan Decades In Advance

I took the long term view with money. I didn’t look at a dollar as only one dollar. A single dollar can turn into many dollars, even hundreds of dollars when given enough time.

It wasn’t how much I have saved up now. It is how much can this savings turn into 10 years from now or 20 years from now when invested.

People are motivated by success. The more successful you become, the more you want to continue and get better. It results in a very positive cycle of reinforcement.

The same goes with savings. But, unfortunately, it takes a long time for it to take hold. Maybe that is why it becomes so hard for the average American to save.

Hitting the point of being in a successful loop takes time because compound return is at its most powerful at the later years and is barely noticeable in the early years.

My long term view of money and being able to think about my personal finances in terms of years and even decades laid a nice financial foundation for me.

Hard Work Will Pay Off / Outwork Everyone

I grew up believing that hard work will pay off. The direct correlation between the level of effort I put into my studies and the grades I ended up receiving wasn’t lost on me.

That mantra stuck with me. When I started my corporate job out of college, I didn’t mind the work that was necessary to be successful.

I put in major hours and didn’t want anyone else to be able to outwork me. I did not end up as the top of my new hire group, but it surely wasn’t due to a lack of effort.

In addition to putting in tremendous hours at work, I also spent time outside of work on a few side hustles. The paycheck from my corporate job paid for my expenses and then some. And any income earned from my side hustles went straight into savings.

It is nice to be young because there is no way I can put in the same number of hours today as I did in my 20’s.

Need To Act Differently Than Most People

A lot of Americans live paycheck to paycheck. Obviously, as someone who was eyeing to be financially free one day, I took a different approach.

I earned and saved. Even though I didn’t earn much starting out, I was able to save over 50% of my take home pay. Having the benefit of living at home definitely helped tremendously.

That frugal gene hasn’t left me in the last 20 years. I still save over 50% of my post tax cash flow.

I brown bagged lunch every day during this period. I lived with my parents the first few years of work even though most professionals immediately strike out on their own renting an insanely expensive apartment in Manhattan.

I didn’t mind being super frugal relative to my peers because I knew I needed to act differently than most people if I want to build wealth.

Money Beliefs In My 30’s After 10 Years Of Work

When given time, my money beliefs, like all things, evolved and changed in my 30’s. This was after years of being in the work force and having a bit more wealth and wisdom.

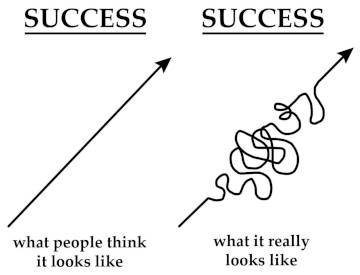

Payoff Is Not Always A Linear Path

I’ve picked up along the way that payoff doesn’t always follow a linear path. This includes both payoff from hard work and payoff from investments.

My belief that hard work will pay off is obviously on point. But it doesn’t mean that the payoff is always immediate. There is often times a delayed compensation effect with the hours put in.

For instance, there were times when I burned the midnight candle on projects without any increase in pay to show for them. But over the years, the time spent on acing those projects allowed me to advance in my company which resulted in larger and larger paychecks. The payout wasn’t immediate but eventually I got paid.

The same can be said for investments. Take the first property I’ve purchased for instance. It went down not too long after my purchase because of the Great Recession.

But I held onto it despite sitting on a depreciated asset. Over time, the real estate market in New York City rebounded from the depth of the Great Recession and blazed new highs. I ended up selling that property for a very nice gain.

Multi-millionaires Are Not All That Special; Anyone Can Be Wealthy In America

As my wealth and network grew in my 30’s, I came to the realization that multi-millionaires are not all that special. They are not superhuman. They get up in the morning and have to put on their pants one leg at a time.

Most multi-millionaires are pedestrian when it comes to smarts and intelligence. The one thing they are good at is that they understand the rules to the game of money. And they are able to pay that game well.

Most people can learn the rules and do well in the game of money. That is why I truly believe anyone can be rich in America. You just need to get educated on the rules of money and then master playing the game according to those rules.

Have One Steady Passive Income Cash Flow Stream

It feels great to know that the hard work and planning in yester-years set me up for financial success later in life. The decisions I made 20 years ago with my philosophy around money have resulted in a financial nut which continues to grow and give today and, hopefully, for many more years to come.

During this period in my 30’s, after some accumulation of wealth, I really started plotting out how to escape the corporate handcuffs. In order to walk away from my job, I needed a steady passive income cash flow stream to replace my work income.

That is when I decided to move in on building up my real estate portfolio. I set up realistic goals and devised steps to get there.

I projected out what my future household expenses would be and how many properties I would need in order to generate enough net rental income to cover those expenses.

I then thought about how to earn and save enough to get me to that number of properties I need.

Believe Things Will Work Out Even With Bumps Along The Way

Just as payoff might not be a linear path, the path to success is filled with ups and downs. There are bumps and obstacles along the way.

But even with challenging times, I carried the belief that things will work out at the end.

I lived through 3 major economic financial crises during my career. The first was the dot com bubble burst along with the 9/11 attacks. The second was the Great Recession. And the third is the current situation with COVID-19.

My finances took a hit after the dot com bubble burst and the Great Recession. But my finances were able to recover and reach new highs after. I, too, believe that my finances can reach new highs in a post COVID-19 world.

Have Liquidity

One thing of focus during this period of my life is having liquidity. It was important to be able to get cash when investment opportunities arose.

I put a home equity line (HELOC) in place. I can tap my HELOC for capital whenever I need it. And if I didn’t need the cash, I can always pay down my HELOC. I believe this is a great option for most people to have liquidity in a very inexpensive way.

I also looked for online brokerage firms which can provide very good rate of borrowing. Interactive Brokers was one such firm. I had most of my stocks with that firm.

I drew on margin borrowing a few times in order to raise the cash needed for a few real estate transactions. It was a quick and cheap way to borrow against my stocks.

Having liquidity is always a big plus in my mind. I really never started thinking about this seriously until this period when I wanted to buy more real estate properties.

Money Belief Now After Accumulating A Multi-Million Dollar Financial Nut

After 2 decades in the workforce and getting close to financial independence, my money beliefs and priorities have evolved some more.

It Is Essential To Build Multiple Cash Flow Streams

This is self-evident given today’s environment. Tens of millions of Americans have lost their jobs when the state and local government decided to enforce shelter-in-place to stop the spread of the pandemic.

Without a job, many people are put in a very tough spot when it comes to putting food on the table and paying their rent. Depending on only one cash flow stream (i.e. from employer) is crazy given there were 3 major economic disruptions over the past 20 years.

Therefore, having multiple cash flow streams is essential. Everyone should shoot to build out three significant cash flow streams with each one being able to support a comfortable enough lifestyle.

My three significant cash flow streams are my corporate job, my wife’s corporate job, and rental income.

Think About Value Instead Of Cost

I think more about value when buying an item as opposed to cost. Cost is what I need to pay for an item. Value is what I get from the item.

For example, when I go grocery shopping, I focus less on the dollar amount of the item and more is that something I would enjoy eating.

I apply this to when I book a vacation, to which car to lease, and what luxury items to acquire. I think a lot more about value and less so about the cost.

Aim To Scale My Investments And Reduce The Time Managing Investments

I own over 20 rental units but they are spread across a portfolio of small multi-family houses. It can be a bit of a headache to manage all those properties. The increased headache with adding another property to the portfolio is one of the reasons why I plan to slow down my investments in rental real estate.

Now, I want to figure out a way to scale my properties and limit my time involvement. That is the only way I can continue to build up my real estate portfolio. I don’t want the more properties I add to result in more time I need to spend on them.

I also want to find investment options in which I can put a big amount of money to work with limited involvement from me. I need to do more research but I plan to increase my allocation into private equity funds.

That way, my money can be in a truly passive investment as opposed to rental properties.

As I’ve gotten older, my time becomes more and more valuable to me.

To the audience: How have your money beliefs evolved over time? Were there beliefs you held at a younger age you no longer hold today? Are there beliefs you hold today that you never thought about at a younger age?

Related Posts

Small Action – Big Financial Impact

Financial Truth Bombs: 12 Financial Truths To Make You Rich

Many people work hard to better their physical and mental health. What about their financial health?

I started this blog back in 2019 to help people better their financial health as well.

My financial journey began with tens of thousands in student loan debt. Over the span of 20 years, I am close to achieving financial independence.

I truly believe anyone can get to strong financial health. Hopefully, this blog can help you on your financial journey to greater wealth and financial independence.

You can read more about me here.

Thank you for visiting. Come again soon!

Nuggets of wisdom here. I appreciate the comparison of presumed path to success v the reality. The value factor is also important as we evaluate investments and time. As I get older and as our kids are small, time with this is more valuable than my nursing job became at this stage of life, so I just left my job to teach them during pandemic time.

The pandemic has definitely forced us to re-evaluate some of our priorities. After accumulating a healthy financial nut, I found it was still hard for me to want to spend the money. I am frugal by nature; but after this pandemic I do plan to loosen up the wallet a bit more going forward to enjoy life.

Hi Rich,

Thanks for your content, I really appreciate the insight and depth that you bring you to this topic. I’m 24 and have just reached the six figure salary mark with a bit over twice that invested due to working multiple jobs and investing since I was 10. It’s insightful to see how your life progresses and the decisions you make. It helps many people develop a better money and life mindset.

Thanks!

Appreciate the positive feedback. Readers like you are why I continue to push out content despite days when I don’t feel like writing.

You are doing well and seem well on your way to achieving a very healthy financial life.

I didn’t grow up in a poor household but we were pretty middle class. I had all I needed in my childhood but money was always a taboo subject. Investments, wealth and other subjects were non-existent.

Anyways, I think I’m somewhere in the middle here after 10 years in the corporate world. Definitely agree with your money beliefs here 🙂 Regarding liquidity, I was actually looking at Interactive brokers for a while now. How was your experience with them for margin borrowing?

Cheers!

My experience with Interactive Broker was quite good although it has been a few years since I’ve drawn upon the margin line for cash.

I left enough buffer there for me to feel comfortable that it would take a big market move down in order for the margin call to kick in. Based on my research of their services, they are not that great with customer service on margin calls so I didn’t want to put myself in that situation.

But overall – it was easy to access the money, interest rate was low, and it was easy to pay the borrowing back. I will not hesitate to tab the margin balance again if I need cash for a real estate investment deal but at the same time want to hold onto my stocks.

Hi Rich,

I found the post very informative and couldn’t agree more with the three income stream approach. I’m currently at two with both my wife and I having corporate salaries, but am intrigued at the possibility of creating a third real estate income stream. The biggest hurdle I’ve initially encountered has been the challenge of securing mortgages for rental properties. Do you have each mortgage in your name (unless you pay all cash up front) or have you found a way to structure the investments through an LLC or similar vehicle where the entity is the named borrower on the mortgage?

Thanks!

Steve

Hi Steve – I have certain properties under my name and others under an LLC. The mortgage rate is cheaper when you have it under your name versus an LLC. The difference is 0.25% to 0.50%. I have an umbrella policy to protect myself.

If you are having trouble securing a mortgage, try to reach out to a mortgage broker. The mortgage broker will reach out to his/her network to figure out which lender will be willing to underwrite the mortgage.

Thanks!

Thank you for a very interesting, and most importantly – honest article. I’ve also noticed that beliefs about money change over the years. Each has its own story, but I had about the same stages as you describe. It is very interesting to hear this from the side of another person.

Thank you, it was interesting and informative!

Agreed. Different people have different money beliefs and different evolution paths of those beliefs.