Note: This post will contain harsh words and language. Continue at your own risk. You have been warned. This is financial tough love and a dose of reality. I do this because I care.

I believe anyone in America can achieve great wealth. I’ve even written an article about how that can be achieved titled “Anyone can be wealthy in America- Are you?” Quite simply, it comes down to 3 things:

Earn + Save + Invest = Great Wealth

I’m going to have to repeat that again. It is just that important and you will see that as a recurring theme across my posts.

Earn + Save + Invest = Great Wealth

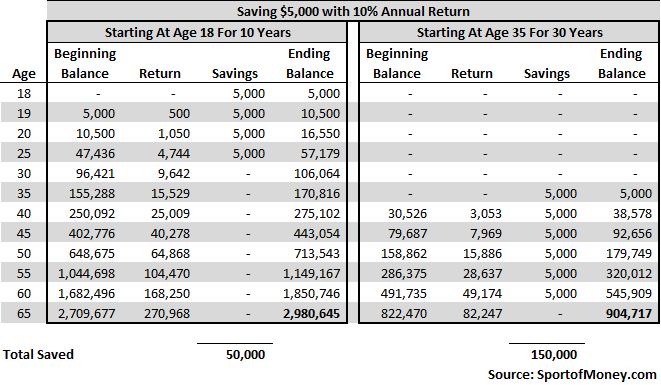

The other factor is to do it as early as possible. You need to earn, save and invest immediately in order to maximize the power of compounding. Compounding is the greatest weapon you have on achieving financial freedom and great wealth.

I will modify the above line to include in this very important element of time.

Earn ASAP + Save ASAP + Invest ASAP = Greater Wealth

That is how I was able to save my way to over $1,000,000 in my retirement account before the age of 40. Don’t overthink it. It’s that simple and it works. I’ve seen it work for me and a number of others. We are able to reach multi-millionaire status in our 30s.

Make money as soon as possible. That’s self-explanatory. Make as much money as possible. This is when side hustle can be very useful. Side hustle adds more money to your pocket above and beyond your normal pay. Spend the time increasing your pay.

Save as much as possible at an early age. Live like a college kid if you have to for the first few years working. Stay with your parents if you must. The money saved early on can pay tremendous dividends later down the line.

Don’t just hold onto the money, invest the money and utilize compounding to juice your net worth. Don’t be scared to put your money to work. You have to do this or inflation will eat away at the value of your money.

Look at the difference in outcome when saving and investing early (at age 18 for 10 years vs. starting at age 35 for 30 years). $3 million when starting early versus $1 million – look at the math!

If you don’t follow Earn ASAP + Save ASAP + Invest ASAP, it will be near impossible for you to get rich. But it isn’t impossible. This leads to my next point.

The World Isn’t Always Fair

The world isn’t fair, it just isn’t. As a parent, I tried to teach my kids to be fair and to expect fairness from others. I’ve seen many parents do this as well. I think we are just optimistic and want to strive for an ideal.

But in reality, the world just isn’t fair. There are people born into families with great wealth, reputation and connections. Those people will get a leg up. Of course it is tremendously easier for Jeff Bezos’s kids to earn millions or billions. Their parents have a combined net worth of $150 billion+. Asking the bank of mom and dad for a billion here or a billion there is just a rounding error for their parents.

There are reasons why the rich keep on getting richer.

There are also lucky people out there. They might win a $500 million Powerball or invest $2,000 on a whim in Bitcoin when it was worth pennies and now have millions. Those people got very lucky.

There is nothing you can do about that. Don’t sulk over it. Don’t complain how the world isn’t fair because no one cares about your complaints. I have not seen one single person get rich by complaining their way into wealth. Just accept that the world isn’t fair and move on.

Not Everyone Wants To Be Rich

Let’s get real here. Not everyone will be rich. I wholeheartedly believe anyone can be rich but not everyone will be rich.

Look I grew up in a financially poor household. For the first 7 years of my life, my family of 5 lived in a less than 400 square foot apartment. Our bathtub was located in the living room since there wasn’t any space in the bathroom to fit it. You can kiss singing in the shower goodbye unless you want an audience staring back at you.

Now I am a multi-millionaire in my late 30s with a household net worth of over $10 million. I believe anyone can be rich and accumulate great wealth because I am living proof of it.

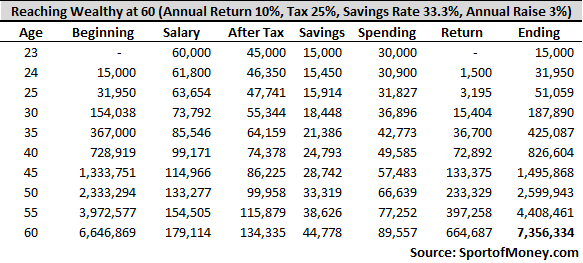

But the reality is that not everyone wants to be rich. They might think they want to be rich, but in actuality, they want to be given money. If I tell you that saving 1/3 of your income at age 23 and investing the savings into the S&P 500, there is a very good chance you will be a millionaire in 20 years, a multi-millionaire in less than 30 years and will have over $7 million at the age of 60, would you do it?

There are a lot of people who want to be rich but don’t want to do the work to get there. If you don’t want to do the work necessary but want the money, then you are really asking for a hand out. You don’t really want to be rich.

If you want to be rich, you need to tell yourself I will work to get there. I will do it. Get that into your mindset. I want to be rich and I will work to get there!

Don’t Make Excuses – No One Gives A Crap About Them

It’s unfortunate, but society today loves to make excuses for people’s actions. It is never the fault of the person actually responsible; but rather, it is the fault of everyone else. Wait, you scored a 1,000 (average score) on your SATs. Why didn’t you score higher? It can’t be your lack of work ethic. It must be something else. Let’s adjust the score based on the adversity you had to face (low income household, poor school district, etc.).

Many people make excuses for their lack of success. I am _________, that’s why I didn’t get the promotion/raise/job/sale/whatever. People tend to fill the blank with whatever they see as the slight of the world.

Here’s a little dose of reality, no one gives a crap about your excuses. It is either you can get it done or you can’t. Excuses don’t matter. Howard Schultz of Starbucks, Lloyd Blankfein, former CEO of Goldman Sachs and Oprah all became billionaires despite growing up in housing projects and dirt poor.

“I can’t save because I live in a high cost city.”

“Rent is so expensive.”

“I have kids. It is impossible to save money with kids.”

“I only make $60,000 a year. It is impossible to save on this amount. If I can make $500,000 then I will have no problem with savings.”

Notice all those are just excuses. It is either you save or you don’t. No one will say to you “oh you have $200 in your bank account, but I understand, you have 2 kids with a mortgage and a $60,000 salary. It is tough to save.” No one cares about your finances, only you do – so your excuses are only fooling yourself.

Most People’s Advice Is Probably Worthless

Would you ask Warren Buffet to fix the brake issue on your car or ask a brake mechanic? Would you trust Jeff Bezos to perform a root canal on your kid or go to the dentist for the root canal? Would you go to Bill Gates to repair a leak coming from your roof or would you go to a roofer?

I think in each of those cases, you would ask the subject matter experts. Interestingly enough, when it comes to personal finance, many people tend to ask their significant other, family members or friends.

Should I invest in this rental property? Let me ask my parents for feedback.

Should I take this job? Let me ask my significant other.

Should I buy Bitcoin? Let me ask my friend.

Unless the person you ask for feedback has done it before or is successful at it, then most likely the person’s advice is worthless. It is okay to hear the opinion of someone you trust as a sounding board. But at the end of the day, you have to analyze how much the person knows of the topic and discount the feedback accordingly.

I have mentioned in this blog numerous times that I am a big fan of real estate and why I believe real estate should be the cornerstone of your investment portfolio. When I look at a property to purchase, I seek the opinion of someone who has purchased over 30 properties over the past 10 years and have been successful in making millions from those purchases.

I don’t ask my parents or my friends about a potential rental property purchase. It isn’t because I don’t respect them. On the contrary, I respect them a lot. But I don’t respect their knowledge in the rental market space given they have never purchased or managed rental properties before. What true insight or value can they really add?

Not Everyone Will Be Happy For Your Success

I am a big proponent of stealth wealth in life. I know it’s ironic that I go around informing my readers of my deca-millionaire status (net worth of over $10 million) every chance I get online. I do this online to let my readers know more information about me so that they weight what I write on this blog against my background to judge for themselves my credibility in the topic of personal finance.

But in person, I believe in keeping my level of wealth a secret and I try to downplay my wealth and income every chance I get. I do this because I don’t want to (i) breed resentment amongst my friends and family members and (ii) I don’t have to deal with uncomfortable situations such as when a relative asks me to borrow money or my friends deferring to me to pay for a meal out.

The reality is that not everyone, even people who are close to you, will be happy for your success. That is why this saying exists: “misery loves company”.

Guess what? Your friends who are financially struggling living paycheck to paycheck might not be very happy that you are killing it financially. They might even feel resentment and negativity towards you. They do this to deflect from the fact that they are the ones who are failures and it is easier to be mad at your success than to admit that they’ve failed. They might even try to dissuade you from pursuing your financial goals.

Try to reduce the number of interactions you have with those people who are not truly happy for your success because they will eventually pull you down. If you can’t reduce your exposure to them (ie family members) or don’t want to, then keep your mouth shut about your level of financial success and to also not discuss your business or investments with them.

Wanting Money Is Not Greedy Or Evil, It Is A Conduit For Growth

Too many people grow up without learning anything about personal finance. There is a financial literacy crisis in America. That is why I am a big proponent of teaching the young as early as possible about personal finance. Hopefully, one day my kids can be successful financially as well.

I believe too few people want to discuss money with their kids because they believe the desire for money is bad. Many people probably think it is either greedy or evil to want to covet money. This cannot be further from the truth.

When a kid says I want to be a doctor or teacher when I grow up because I want to help people, everyone can get behind that and cheer the kid on for being so altruistic. But guess what, you can help or save many people with money as well. I don’t think anyone can dispute the good the Bill and Melinda Gates Foundation with a $50 billion endowment has done over the past decades.

It will be hard for people to grow if they are constantly fighting just to survive day to day every day. Having money helps alleviate the daily burden and worries about how to pay for the next meal or the next rent payment. This allows an opportunity for better personal and professional growth.

You can travel more with money to expand your horizon on how other people live and gain exposure to other cultures. You can eat at expensive Michelin starred restaurants which can help refine your palate. Having more money can enable you to progress in your hobby.

Money can pay for the things that provide growth. It is important to understand that wanting money is not greedy or evil; it is a conduit for growth. Conversely, if you don’t want money, then you are restricting your own development and ability to grow.

Take Action Now

No one gets rich by daydreaming their way to success. If day dreaming works, I would be a perennial Superbowl winning quarterback with a supermodel wife, and hundreds of millions of dollars to my name. Wait, I think Tom Brady has that life and he still busts his back to improve.

You have to take action in order to get rich. You cannot dream your way into a $1 million. You cannot read your way into a $1 million. You cannot sleep your way into a $1 million. You cannot watch TV your way into a $1 million. You cannot couch potato your way to a $1 million.

You must take action!

Only by doing can you achieve financial success. Only by doing can you earn more. Only by doing can you save more. Only by doing can you invest more. Only by doing can you achieve great wealth.

You need to take action and you need to take action now!

To the audience: Do you agree with my tough love financial advices? Are there any additional tough love financial advices you have for the readers?

Many people work hard to better their physical and mental health. What about their financial health?

I started this blog back in 2019 to help people better their financial health as well.

My financial journey began with tens of thousands in student loan debt. Over the span of 20 years, I am close to achieving financial independence.

I truly believe anyone can get to strong financial health. Hopefully, this blog can help you on your financial journey to greater wealth and financial independence.

You can read more about me here.

Thank you for visiting. Come again soon!

100% on board with this post. Love it.

>>But the reality is that not everyone wants to be rich. They might think they want to be rich, but in actuality, they want to be given money.

I laughed out-loud when I read that. It’s so true.

I am SO tired of people whining about money, but doing NOTHING to change their outlook and/or circumstances.

Having money isn’t about greed. It’s about choices and freedom. I, too, came from poor to lower middle class (we once literally ate only beans, rice, and cornbread for 6 months!!!). Thank God, my mom could make an awesome cornbread, but still…

Sometimes I find myself quite thankful for my childhood hardships. It made me “hungry” for hard work and financial success. In an upcoming post, I plan on sharing all the crazy things I’ve done sacrificed to be where I am today. For example, I slept in a closet my first year and half of college. I moved into a 2 bedroom apartment with two roomates, and I didn’t have a room. I put a twin mattress on a closet floor and slept there (and I was happy to just be surviving and bettering my life!).

Good stuff, Rich.

That’s dedication to wanting to be successful and bettering your life. Your choices have gotten yourself to where you are today – a multi-millionaire. The path isn’t always easy and fun but one just need to keep at it. Over decades, the reward can be greater than imagined.

I agree with tough love. You have to take action. Planning and dreaming won’t get you far.

Excuses too. Everybody has them. You just have to power through the adversity.

Tough post!

Joe – yes, the unsuccessful people seem to have a lot of excuses. The successful ones take action. I’m sure you didn’t get to retire by the age of 40 by just wishing and hoping it will happen. You took steps to make it happen. Excuses are not for winners.