I believe anyone can be wealthy in America.

In my opinion, this is still the greatest land of opportunity.

I’ve been fortunate enough in the past 20 years to go from zero to over $10 million in net worth, even when living and working in an expensive city such as New York City.

People talk about how hard it is to make it in today’s environment. There are talks about the lack of mobility in America and how the game is stacked in favor of the rich.

I don’t disagree the rich certainly have an easier time to add to their net worth compared to people with less means.

After all, there are perfectly good reasons why the rich get richer.

But that doesn’t mean a young person starting out today doesn’t stand a chance to make it in America.

Actually, it’s quite the reverse. To me, the time to accumulate millions over a 20 year span hasn’t been easier.

When else in the history of the world can you create a multi-million dollar business from the comfort of your own home needing nothing else but hard work, ingenuity and a small fee for internet connectivity?

Heck, even kids before 10 can make millions.

My kids are addicted to watching a toy review show called Ryan’s World hosted by Ryan Guan. Ryan is a 9 year old boy who earned $35 million last year.

Even if you are not as entrepreneur as young Ryan, accumulating wealth and achieving financial independence/early retirement (FIRE) is still well within your grasp.

Simple Formula For Wealth Accumulation And FIRE

There is not much of a secret to wealth accumulation in my mind. It follows a very simple formula and I’ve written about that formula in this blog before.

Earn + Save + Invest = Wealth

It is pretty obvious right?

The more you earn, the easier it is to accumulate wealth and reach financial independence. Someone making millions a year should have an easier time being a millionaire than someone making $50,000 a year.

Earning is only part of the wealth equation. Saving is the next part.

Even if there is strong earning, there would be no wealth accumulation unless you save a portion of the earning. The higher the savings rate, the better.

There are plenty of athletes who made millions, even hundreds of millions of dollars, in their lifetime and end up with nothing because of overspending.

Check out Mike Tyson who made over $300 million in his career and still ended up declaring bankruptcy. But at least he has learned from his financial woes and is trying to make a comeback with his net worth.

Simply put, the more you save, the more you have.

The last piece is to invest that savings. Make money work for you instead of the other way around.

Simple Formula For Greater Wealth And Faster Path To FIRE

Investing is tremendously powerful if you have time on your side.

Compounding starts off slow and takes time to build up momentum. But once it hits an inflection point, it can turbo charge your net worth by exponential amounts.

It takes $1 over 11 years to double to $2 given a 7% annual return. It takes only 6 years to make the next dollar.

Then it takes a bit over 4 years to make the next dollar. I think you get the picture.

Because compounding is such a powerful force and time is the key component to get the most out of compounding, I like to modify the simple formula above:

Earn ASAP + Save ASAP + Invest ASAP = Greater Wealth

ASAP stands for as soon as possible and takes the component of time into the equation.

The earlier you earn money, the earlier you save and the earlier you invest, you will achieve greater wealth and a faster path to financial independence.

My Path To Wealth Accumulation

Unsurprisingly, I followed the simple formula to reach my 8 figure net worth over the span of 20 years.

Earn

First, on the earnings part of the equation:

I work in the financial services industry which pays relatively well compared to other industries. I’ve been in this industry since graduation from college.

I looked for ways to maximize my income while working in this industry.

I’ve made a few jumps within the industry to different companies. Each jump provided me with more money, increased responsibilities, and a better job title on my resume.

I also had very early on an eye to gain financial independence one day. Therefore, I didn’t sit idly by after my corporate hours.

I looked for other opportunities to generate income including starting an online business and real estate.

Save

Next came the savings part of the equation.

I saved a large percentage of my income ever since I started working a full time job. Even as my income increased in dollar amount, my spending would hardly even budge.

I was living significantly below my means and routinely saved over 50% of my after tax income.

My first car was a used car purchased for $5,000 when I was making hundreds of thousands of dollars a year.

Sam, at FinancialSamurai.com, has the 10% rule for your car. He recommends you should only limit the cost of your car to 10% of your overall income.

I was able to get within his band with flying colors as the cost of my first car was less than 2% of my income.

Invest

The last part of the equation was the magic for me.

I invested most of my savings into real estate and equities. I also started very early and didn’t wait to invest my first dollar.

In fact, even today I still feel a strong sense of uneasiness if I have cash sitting in my bank account not earning me a return.

My real estate investments have done really well and are generating strong monthly cash flows. Additionally, the properties have appreciated quite nicely helping to boost my net worth.

My equity investments are mainly in individual big capital stocks and the S&P 500 index. These equity investments over the past 20 years have also performed very well.

That is how I got to a 7 figure retirement account balance in my 30’s.

What If I Have To Build Wealth While Earning A Modest Salary?

Now the general population might be skeptical of people who can build millions in wealth over 20 years.

You might have the same reservation over how I accomplished my net worth building as well.

I work in a high income earning industry and have made a relatively high income compared to the average American.

You might think “of course you’re able to accumulate a large financial nut because you’re a high income earner. Try making an average salary and see how that goes.”

Well, I hear you.

Let’s put aside the fact that I got to over $10 million in net worth while raising a family of 5 in New York City, one of the most expensive cities in the world.

What would I do if I want to build a healthy net worth while earning a modest salary?

Here’s a look at how I would try to accumulate wealth and set myself along the path of financial independence if I have to start all over again while earning a more modest income.

No different than what I did 20 years ago, I plan to employ my simple formula (Earn ASAP + Save ASAP + Invest ASAP) to help build wealth and financial independence over a 20 year time horizon.

The Earnings Part Of The Equation -> Accountant Salary

Let’s assume I work in a field with a modest pay.

Accounting comes to mind.

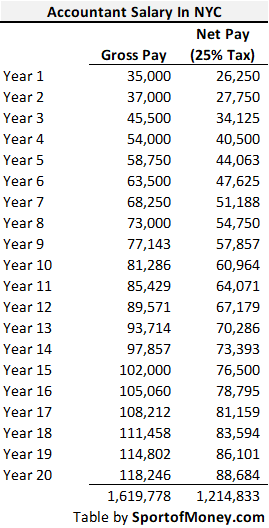

Extracting salary information from Payscale.com, the medium pay for an accountant during a 20 year span in New York City is summarized in the table below:

The medium salary for an accountant over a 20 year span working in New York City is $1.6 million.

This comes out to $80,000 a year on average. It might seem like a lot at first brush but this is before income taxes and living expenses.

After factoring in a 25% income tax, the take home pay for an accountant amounts to $1.2 million. This is an average post tax pay of $60,000 annually over 20 years.

The Savings Part Of The Equation -> Limiting Expenses

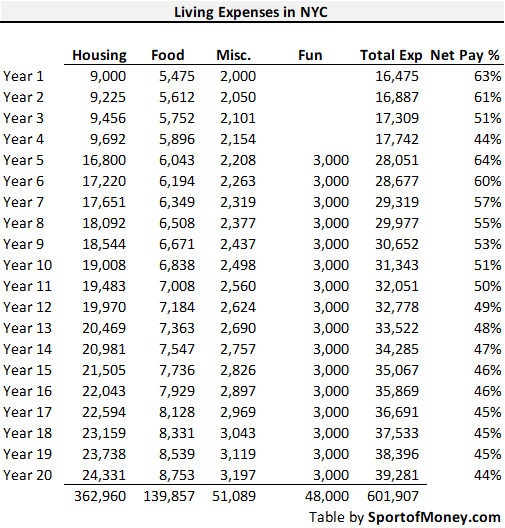

I would try to live a Spartan lifestyle for the first 4 years in order to build up some investing capital.

Housing is expensive in New York City.

Undoubtedly, in order to really save money, I need to cut down on the biggest expense with living in NYC.

The easiest way to cut down on the cost of rent is to (1) get roommates and (2) live away from Manhattan.

Buying food, clothes, toiletries and public transportation should be my other expenses.

The budget for fun should be nominal.

There are plenty of free options in New York City to spend a day of relaxation. Take a stroll in Central Park, or check out the Highline, or hit one of the beaches here.

After a few years of work with some money saved and a bigger salary, I would spend a bit more on rent and set aside a small budget for fun activities.

At the end of the day, I know it would be hard to live a Spartan lifestyle for an extended period of time.

Overtime, my goal is to drop my spending to less than 50% of my take home pay.

The Investing Part Of The Equation -> Real Estate

Savings alone won’t do the trick for great wealth accumulation and making significant progress along the FIRE path.

The savings need to be invested.

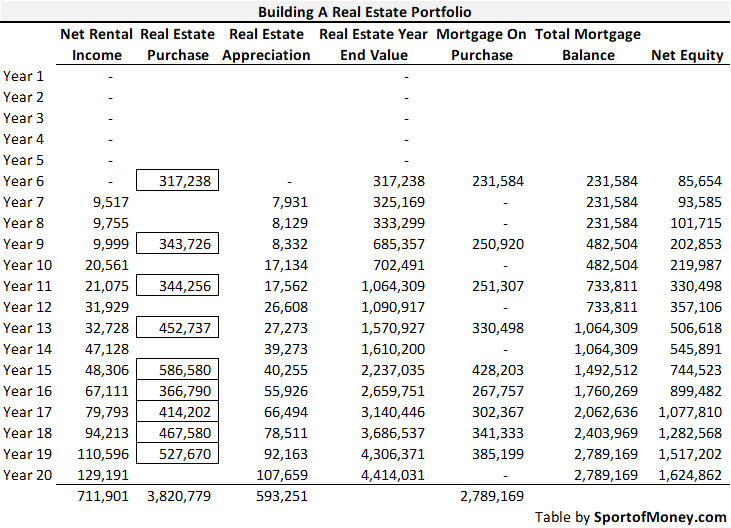

In this case, I would build a real estate portfolio.

There are many benefits to real estate including the ability to use leverage (in the form of a mortgage) and the creation of a cash flow stream (in monthly rental income).

My plan is to acquire as many properties as possible at the fastest rate possible.

I need to save up enough for a down payment in order to make my first real estate purchase.

After 5 years of working and saving, I would be able to make my first real estate purchase.

Given the low interest rate environment, I would try to obtain as high of a mortgage amount as possible.

Additionally, I would aim to take out an interest-only adjustable rate mortgage (ARM).

For a period of time, an interest-only mortgage requires only payment of interest on the mortgage and does not require the payment of principal.

The interest-only mortgage will produce the highest cash flow for me.

After buying the first property, I would continue to save money. The goal is to buy a property whenever I have about $100,000 saved up.

As you can see from the table below, it takes 5 years to save up enough to buy the first property.

After the purchase of the first property, there will be rental income coming in which should make it easier to save money for another rental property purchase.

In keeping with buying a property whenever I get to $100,000 in savings, the second property is purchased 3 years later.

The third property takes only 2 years of savings to purchase.

And then you can see that by year 15, I would have enough money to purchase one property per year.

It really takes off after that.

By the end of 20 years, I would have a real estate portfolio consisting of 9 properties valued at $4.4 million.

The total mortgage amount is $2.8 million resulting in a net equity of $1.6 million across my real estate portfolio.

That is a nice nest egg.

Not to mention, each year, I would be receiving over $100,000 of rental income.

With living expenses of only $40,000 a year by year 20, I would be considered financially free and can retire early.

Note: Feel free to skip this section. I’ve listed the assumptions used in the table above to build my real estate portfolio:

Net rental income is based on a 10% cash on cash return which is consistent with the cash on cash return of the last few properties I purchased.

I assumed a 3% closing cost and 27% down on each of the 9 real estate purchases.

I used 2.5% for the inflation rate. Hence, rental income and real estate prices both appreciate at 2.5% per year.

Conclusion

In conclusion, don’t forget the very simple formula for wealth creation, accumulation and financial success.

Earn + Save + Invest = Wealth

For the greatest outcome, start as early as possible.

Earn ASAP + Save ASAP + Invest ASAP = Greater Wealth

Even someone making an average salary in NYC can get close to $2 million in net worth in 20 years.

To the audience: What do you think is the hardest part of the simple wealth equation to execute (earn, save, or invest)? How did you do over the past 20 years in building your net worth? If you were able to save 7 figures or more over the past 20 years, how did you do it?

Related Posts

One Way Warren Buffet Got Rich And How You Can Apply It To Your Financial Situation As Well

Doing This One Thing During Your First 3 Years At Work Can Lead To Millions

How Rich Are Americans On A Global Scale – Very Rich

Many people work hard to better their physical and mental health. What about their financial health?

I started this blog back in 2019 to help people better their financial health as well.

My financial journey began with tens of thousands in student loan debt. Over the span of 20 years, I am close to achieving financial independence.

I truly believe anyone can get to strong financial health. Hopefully, this blog can help you on your financial journey to greater wealth and financial independence.

You can read more about me here.

Thank you for visiting. Come again soon!

I think the easiest part of the equation is earning money. The hardest part is not falling into the hedonic treadmill trap. That’s why you see people making hundreds of thousands a year and still living paycheck to paycheck. My opinion at least.

Not entirely related. I am just a bit curious to know if your networth was built on your income alone or both you and your wife. If you don’t mind sharing of course.

Cheers and great post!

You seemed to have done a great job of getting off that treadmill and traveling the world.

To answer your question, the assets are commingled in our household and include my wife’s income as well. That is why I think it is important to find the right partner and to have a open dialogues around financial goals.

As poor immigrants, as I like to call us, we also believe in keeping a lid on our costs. Our friends have squandered millions in the past 20 years (earning about 20 grand/month) and now have 3 houses, but they are still morgaged. Expensive cars, useless junk bought on a whim, a small boat, eating out too much etc. Trying to stand out like people who have money.

I find it a little ludicrous for us, ‘regular folks’ to do this, as there’s no way we can compete with the rich people on this. My husband works as a doorman now in Manhattan, until he can get an engineer job he was supposed to start this June, and told me that one of the people there ordered few bottles of wine that cost 30,000. 30 grand was our income the entire year and a guy drank wine costing this. Come on, how can you compete?

So, we just get what we need, we save as much as possible, keep debt free and try to grow from here.