US politicians are, unfortunately, in a perpetual state of campaigning. No sooner is the 2016 presidential campaign over, the 2020 presidential campaign starts in earnest in 2018. There are already at least half a dozen declared candidates looking to challenge presumably President Donald Trump in the 2020 presidential election. In today’s media environment, outrage sells. The more outrageous the remarks, the more coverage and airtime you will get from the media. That is why there is so much media coverage on Donald Trump. He consistently tweets out or says inflammatory things. Who can blame them when there is so much competition for the audience’s time?

Attacking a minority group of people in which the majority might not necessarily like or are jealous of is an easy way to endear oneself to the masses or to get media coverage. The bigger the anger against the “hated” minority group, the bigger the exposure and the more prolific as a topic for water cooler talk. Maybe that is why certain members of Congress are railing against millionaires and billionaires. It feels that the millionaires and billionaires are a minority group in which the majority can get behind in attacking.

First, Alexandria Ocasio-Cortez, a newly minted congresswoman from NY, proposed increasing the marginal income tax rate to 70% on income above $10 million. The highest marginal federal income tax rate today is 37%. That is an additional 33% of income tax, practically doubling the highest marginal tax rate, for an amount earned above $10 million. Elizabeth Warren, the senior United States Senator from Massachusetts and a 2020 presidential hopeful, did not want to be overshadowed by Alexandria Ocasio-Cortez on her disdain for the rich. She came out with her own proposed tax plan aimed at the super rich.

Elizabeth Warren wants households with over $50 million in assets to pay a 2 percent tax on their net worth every year. The tax rate would increase to 3 percent on assets over $1 billion. Warren’s plan would affect just 75,000 households in total. That group comprises only a small minority of the American household. Plus, they were most likely not a big supporter of Elizabeth Warren to begin. Ocasio-Cortez and Warren released their tax plan placing a significantly greater tax burden on the rich all in the name of fairness. “Why shouldn’t the rich pay their fair share of taxes” so the thinking goes.

Of course, Ocasio-Cortez and Warren are just the start. Not to be out done and have someone take the spotlight, the United States Senator from Vermont, Bernie Sanders, who self identifies as a democratic socialist, came out with his own tax proposal. He wants to lower the current threshold for exemption from the estate tax to $3.5 million from the current amount of $11 million. He also wants to have an increasing scale on the estate tax with the maximum marginal rate of 77% for assets over $1 billion. Sanders must have thought: Ocasio-Cortez, I see your 70% number and I’m going to one up you. Who else might be next to come out with a tax proposal to continue to tax the millionaires and billionaires? Let the competition begin.

Look, in my own opinion, it isn’t fair to pick on this minority class. They are constantly vilified by the likes of Ocasio-Cortez, Warren, and Sanders. What those politicians are forgetting and the people who support such politicians – those down beaten millionaires and billionaires are people too. They have feelings just like everyone else and bleed when cut. Seeing how there is so much coverage for the politicians railing against this minority class, I feel compelled to defend them here and provide you with reasons why not only do millionaires and billionaires not deserve our scorn, but they are quite deserving of our sympathy (and dare I say admiration as well).

The Rich Are Playing Their Fair Share

The rich have to pay their fair share. I hear that over and over again when there is a proposal to increase taxes on the millionaires and billionaires. I don’t think anyone would disagree that the rich should pay their fair share. After all, isn’t fairness an ideal we can all get behind? Now, the hard part of this statement is to determine what a fair share is.

The biggest single source of revenue for the United States federal government is individual income tax payments. Individual income taxes bring in approximately $1.7 trillion, about half of the total federal revenue of $3.3 trillion. The 2016 tax year is the latest individual tax data released. Some interesting fact regarding the 2016 tax data:

- The top 1 percent paid 37.3% of the total taxes and their income accounts for about 20% of the total. The taxes the1% paid is about twice as much as their income earned. The average income tax rate paid by the 1 percent is 27%. In contrast, the bottom 90 percent made 53.5% of total income but paid a combined 30.5% of total taxes with an average tax rate of 8%. The top 1% earned less than half the bottom 90 percent but paid more in taxes than the bottom 90 percent.

- The bottom 50 percent of taxpayers paid 3% of total individual income taxes with an average tax rate of 3.7%. They made 11.6% of total income. A large number in the bottom 50 percent paid no income taxes or was a net receiver of money from federal government programs such as the earned income tax credit.

This shows that the rich, the top 1%, do pay a large percentage of the total income taxes. Based on the tax data, it seems they have paid more than their fair share. To me, fair would be if you make $100 and I make $100, we pay the same amount in taxes. Now, according to the 2016 tax data, if a member of the top 1% makes $100, the person pays $27 in taxes. If a member of the bottom 90% makes $100, the person pays $8 in taxes. The 1% person paid over 3 times the amount in taxes on the same dollar earned. Does that sound fair?

If you still believe, given the 2016 tax data, that the rich are not paying their fair share, then how would you define what a fair share is? Is doubling the tax rate of the rich fair? Is a 70% tax on income above $10 million fair? What about an 80% tax on income over $10 million? Who also made you the arbiter of what is considered fair in this case?

A High Rate Of Tax On Income Is No Different Than Stealing Someone’s Labor And Forcing The Person Into Indentured Servitude

I think at the most basic level income is just an exchange for someone’s labor. As an employee, I provide my labor, my employer provides me with money. I then use my money to go and exchange it for goods or services provided or created by someone else’s labor. I spend my time working for money. The free market has determined how much my time is worth. Why should there be an arbitrary adjustment on how much my time is worth in the form of a tax on my income.

You might think an investment banker making $1 million per year should have to pay a higher tax than the current tax rates. The banker might net $700,000 after federal taxes (assuming a 30% federal tax rate on the income). Maybe Ocasio-Cortez might come out tomorrow and advocate for a higher margin tax rate on the income earned by the banker. Instead of 30%, she might want the banker to pay a 50% tax rate. Now, instead of netting $700,000, the banker nets only $500,000. The result of this change is, over the course of 3 years, instead of making $2.1 million net, the banker would only get $1.5 million under this new tax regime. In essence, that means the banker worked 1 year for free and contributed 1 year of time to the benefit of others. Why should the banker work for free or receive significantly less than what his labor is worth? Isn’t this a form of indentured servitude and hasn’t this practice been outlawed decades ago?

A Tax On Assets And/Or Net Worth = Double Taxation

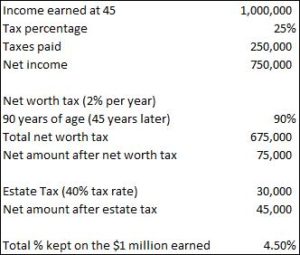

An estate tax is really a tax on the same dollar twice. There is the income tax that is paid on the income earned. The after tax dollar then becomes an asset to you. I pocket only $75,000 after earning $100,000 because of the income tax. Why should that $75,000 be taxed again if I decide to save it increasing both my assets and net worth. There is just double taxation on the same dollar. What is worse, if there is an annual net worth tax in addition to the estate tax as proposed by Warren, one dollar of income can result in only 5 cents in the earner’s pocket (see below for the calculation). Wow, imagine you only get to keep 5% of your income. That is a terribly low number and doesn’t serve as an incentive for people to bust their behind to work.

A Tax On Assets And/Or Net Worth Can Result in Liquidity Concerns

Some of the people scoped into the net worth tax might be small business owners. The bulk of their net worth might be from the small business they run and own. They do not have a lot of liquid assets sitting around and might find it really hard to pay a net worth tax without either taking a hit to their lifestyle or by slowing selling off their small business to raise the funds to pay this tax. Do we want to destroy business ownership?

Rich Took Risks Or Made Sacrifices

Chances are there were risks taken by the millionaires and billionaires to get to this point in their life. Maybe at an earlier stage they made a big wager which paid off. But if the wager didn’t pay off, they might have to start all over financially. There are many more people who took risks to try to get to that level but were not successful. Why should the person who survived the risk be punished for it. Why should surviving all that risk taking and becoming successful because of it result in a reduction in the payout. It doesn’t appropriately compensate for success.

The rich might have also made sacrifices. They might have worked 7 days a week or 15 hours per day to make the money they have. This potentially means missing birthday parties, not taking vacation, missing soccer matches and so on. The wealth or money is the trade-off for those missed memories. The non-rich might have used their time differently and were able to create wonderful memories. Why take the fruits of their sacrifices away from the rich. That might be the only thing the rich have.

Rich Focused on Making Money – There is No Need to Be Jealous

Sometimes, the rich are rich because they focused on making money or created value where people are willing to compensate them for that value creation. Their focus might be to make as much money as possible. Not a lot of people out there are solely focused on making money. The average person knows money is needed for survival, to pay for a roof over the head, food on the table, a car, a vacation, etc. But that person might not be focused on making money for the sake of making money. There is nothing wrong with that. For instance, it is probably very hard for a teacher to end up making a lot of money. Teachers, obviously, are vital to the success of the country. But on average, it is not a high paying profession. If one chooses to be a teacher, making a lot of money is probably not on top of that person’s priority list. This is fine. Conversely, an investment banker is a job which provides opportunities to make a lot of money. More likely than not, the mentality of someone who wants to be an investment banker is one in which that person wants to make a lot of money. Making money is a priority item for that person. Therefore, don’t be jealous of that person’s income or financial success. The investment banker simply placed making money on the top of the list.

A Net Worth Tax Or Estate Tax Does Not Encourage Savings – In Fact, It Forces Spending

A tax on net worth does not help with developing a saver mentality. The people who became rich might have saved and invested their way to their upper echelon financial position. Now, if that net worth is taxed, it serves as an incentive for them to go out and spend that money instead of saving it and paying taxes on the savings. Why not use the money instead of giving it to the federal government.

This has the reverse effect of what I think we need to do. We need to encourage people to save, not to encourage spending. This also might have the effect of turning off older workers who still want to produce but, now with this wealth tax, might find it not financially beneficial to continue to work. This results in lost productivity for the older generation of workers.

Don’t Allow The Masses To Pick On The Minority Class – You Might Be Next

At the end of the day, don’t allow the masses to pick on this minority class. The millionaires and billionaires are easy targets today. They have certainly spoken up about the absurdity of those tax proposals by the likes of Ocasio-Cortez, Warren and Sanders. But the majority probably find their comments to be out of touch and uncaring. But stop to think for a moment. You might one day be a millionaire or billionaire; do you want to be treated this way and have to pay through your nose in taxes? Or worse yet, the politicians might start to lower the bar on who they consider to be rich and you might be caught in this wider net. Maybe a net worth tax above $50 million is too high of a threshold, how about a net worth tax for any amount above $500,000. How about a 70% marginal tax rate above $150,000 of income? After all, shouldn’t you pay your fair share?

To the audience: Do you believe the rich should pay more or are they already paying too much? Do you think the majority will continue to attack the rich for not paying their fair share? At what point do you think the majority will be happy with the tax rate paid by the rich?

Many people work hard to better their physical and mental health. What about their financial health?

I started this blog back in 2019 to help people better their financial health as well.

My financial journey began with tens of thousands in student loan debt. Over the span of 20 years, I am close to achieving financial independence.

I truly believe anyone can get to strong financial health. Hopefully, this blog can help you on your financial journey to greater wealth and financial independence.

You can read more about me here.

Thank you for visiting. Come again soon!

The only people who think “the rich” needs to be taxed more are people who don’t have a clue what it’s like to pay that much in taxes, and the uber-uber wealthy (billionaires) where it simply doesn’t matter anymore (because they’ve accumulated so much wealth).

I don’t expect anyone to feel sorry for me, but anyone that’s ever paid taxes on 500K to 2M in income, the tax bill is simply absurd.

I also believe those with extreme wealth are for taxing people to help reduce “competition” of folks trying to also become billionaires. I know that’s a bit cynical, but I feel that way none-the-less.

Your point about billionaires wanting higher taxes on the wealthy to reduce competition of folks trying to also become billionaires makes sense to me. Billionaires in America made their money in private enterprises. They then should have a propensity to believe that private enterprises (or charitable organizations/foundations) can provide the greatest return on addressing societal issues as opposed to governmental programs. Isn’t that why Warren Buffet donated and plans to donate so much of his net worth to the Bill and Melinda Gates Foundation? He advocates for higher taxes but, at the end of the day, chooses to write a check to a foundation as opposed to cutting the check out to the US Treasury.

>>Your point about billionaires wanting higher taxes on the wealthy to reduce competition of folks trying to also become billionaires makes sense to me.

That was the first thing that hit me when I first started making serious money (500K+). I thought about all the work that went into making just to THIS POINT, and the uber rich being OK with being taxed more. I felt “I worked 10-20 years ridiculous hours just to make it to this point, and the guys with more money than me are trying to keep me down.” And the only reason I could think why they would want to keep other people trying to make it higher was to reduce competition. You even see it on shows like Shark Tank where Mark Cuban has more money than the other sharks COMBINED — if he wants to win a deal, he can, because even the other hundred-millionaire sharks can’t compete. I rarely see hundred-millionaires being OK with being taxed more — I actually can’t think of even one. But there are lots of Billionaires that are fine with it. I also believe making it to Billionaire status means you got a bit luckier than the hundred-millionaires, so you’re playing more with house money. Cuban worked hard to create a company that he sold for like 25M earlier in his life — His sale of Broadcast.Com for billions was LUCK. The WORST thing someone can tell me is that “I’m lucky” to be where I’m at — No, you have NO IDEA how hard I’ve worked and sacrificed to get here.

I imagine you’ve made quite a few sacrifices in your life, too.

I’ll stop ranting now… haha.

Hi – I don’t mind the rant, it’s nice to get another person’s point of view – especially a financially successful one. In my opinion, one of the best ways of learning is by listening.

>>”The WORST thing someone can tell me is that “I’m lucky” to be where I’m at — No, you have NO IDEA how hard I’ve worked and sacrificed to get here.”

I find it interesting that an outsider can make that statement without understanding all the blood, sweat, and tears invested into creating a financially successful life with little or nothing to start.

That’s why I find it ridiculous politicians say let’s tax the wealthy because they have a lot. How about taking into consideration how much has been sacrificed to get there.