Note: This post is part 2 of a 2 part post examining the household budget of a family of 4 making $1 million a year. Given the level of detail I want to provide on their household expenditures, I’ve decided to break the post into 2 parts.

This post contains discretionary and miscellaneous spending. Part 1 contains the pre-tax deductions, taxes, and non-discretionary expenses.

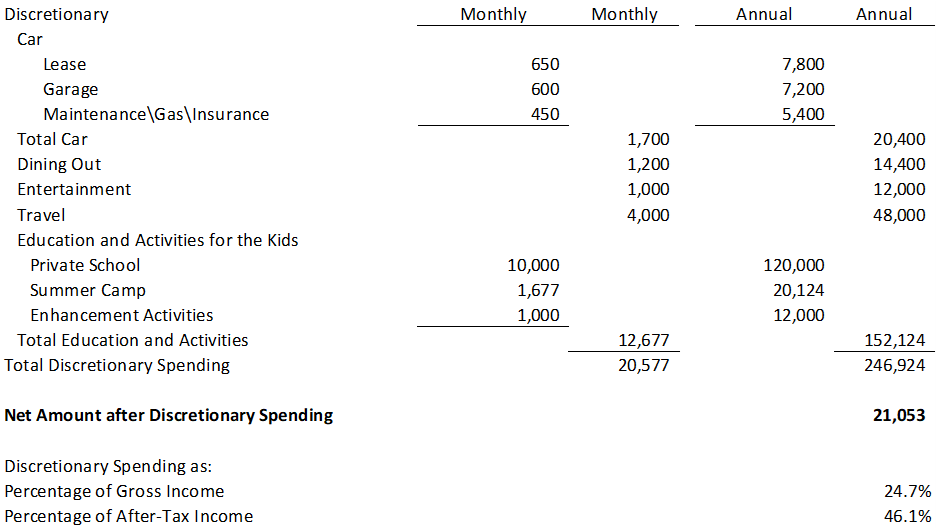

Discretionary Spending

Car

With the likes of Uber, Lyft, and other livery services, there are plenty of options to get around town by car.

However, with a family of 4, the Smiths know it is more convenient to have a car to tow the family around for weekend getaways, trips to the Hamptons, or visits to the grandparents in Westchester 60 miles away.

The Smiths lease a 2022 Buick Enclave Avenir for $650 per month in a 3-year lease. It has all the comfort, sophistication, and brand recognition you would expect from a $60,000 luxury SUV.

The seating for 7 is perfect for the family just in case they need to drive their kids’ friends or the grandparents around as well.

Of course, reliance on street parking is quite a pain living in Manhattan.

There is never a spot available for longer than a day without worrying about feeding the meter or dealing with alternative side parking rules.

A garage spot is an absolute must for the car.

With space at a premium in Manhattan, their parking garage 2 blocks away from their building costs $600 per month.

They also have to call 30 minutes in advance in order to pick up the car over the weekend and an entire day in advance if they want to use the car on a weekday.

Each time they pick up the car from the garage, they tip the garage attendant $5. They give each garage attendant a holiday tip at year-end as well.

Tips and maintenance such as oil change and registration renewal, gas, tolls, and insurance add another $450 per month.

Having this convenience costs $1,700 a month.

To top this all off, the Smiths do not even break 5,000 miles per year on their car.

Dining Out

New York City offers some of the best restaurants in the world.

In fact, out of all the cities in the world, New York City has the fifth most Michelin starred restaurants.

Unsurprisingly, NYC occupies the top spot of the most Michelin starred restaurants in the U.S.

It also has 5 restaurants with three Michelin stars, the highest star rating. That is 40% of the total three Michelin starred restaurants in the U.S.

Per Se is one of the 3 Michelin starred restaurants in New York City.

The chef’s tasting menu costs $355 per person and it doesn’t include alcohol or wine pairing.

A couple’s night out at Per Se with 2 tasting menu orders, a couple of starter cocktails, 1 wine pairing, and sales tax can easily cost $1,000.

If the Smiths enjoy two such nights a year, that is already $2,000 spent on dining out. But restaurants like Per Se are for special occasions.

On a more frequent basis, given that John and Jane work so hard during the week, they like to treat themselves by spending Fridays eating out by themselves at nice local restaurants.

The dinner bill for 2 runs on average $250 per meal.

Occasionally, they will bring their kids out to eat at a family restaurant as well.

All-in-all, the Smiths average $1,200 a month dining out.

Entertainment

Entertainment can include sporting events, Broadway shows, spa treatments, and family movie nights.

With a family of 4, even a movie night can cost $92 ($18 per ticket and $20 in snacks and drinks).

A Broadway show or catching a sporting event can cost anywhere from $200 to $400.

A spa treatment can cost $150 per hour.

$1,000 a month is spent by the Smiths on entertainment.

Travel

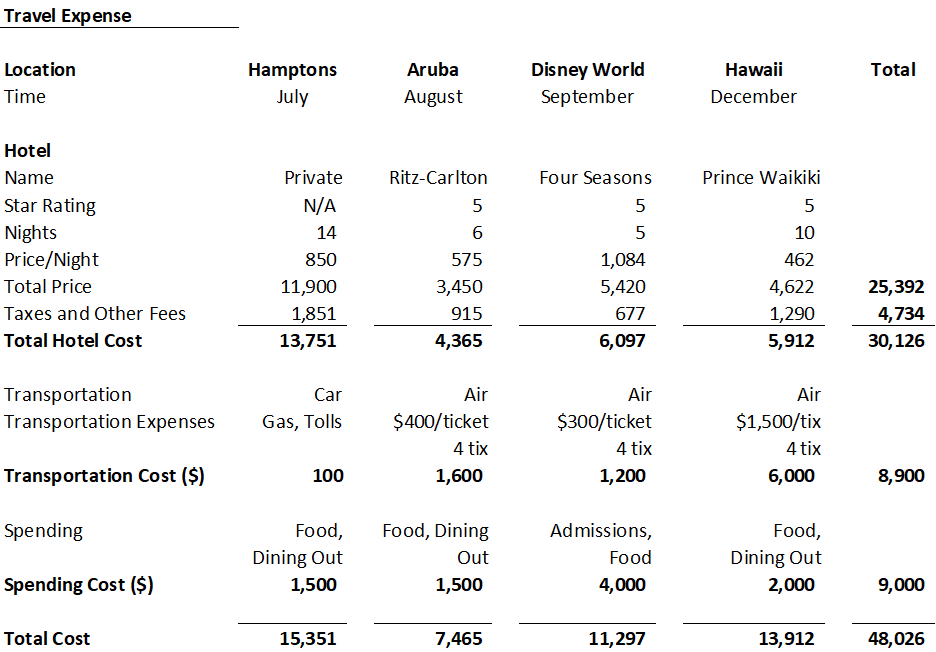

The Smiths take 5 weeks of vacation a year.

They especially enjoy vacations in warm places where they can get a lot of sun and beach.

Those vacations tend to be more relaxing for the adults.

This year’s vacation itinerary looks as such:

- over the month of July, a 2 week Hampton home vacation rental;

- in August, one week is spent in the Caribbean;

- before school starts for the children, the Smiths spend 5 days in Disney in the first week of September; and

- over the last week and a half of the year, a week and a half trip to Hawaii.

Travel has to work within the kids’ school schedules. The Smiths spend most of their time traveling over the summer and the year-end holiday break.

Because of the kids’ school calendars, they travel during peak vacation periods of the year and those vacation locations charge more money for lodging, flight, and entertainment.

Hamptons – 3 bedrooms, 4 bathrooms, and a swimming pool to enjoy the North East summer

Ritz-Carlton Aruba

Four Seasons Resort Orlando

Education And Activities for the Kids

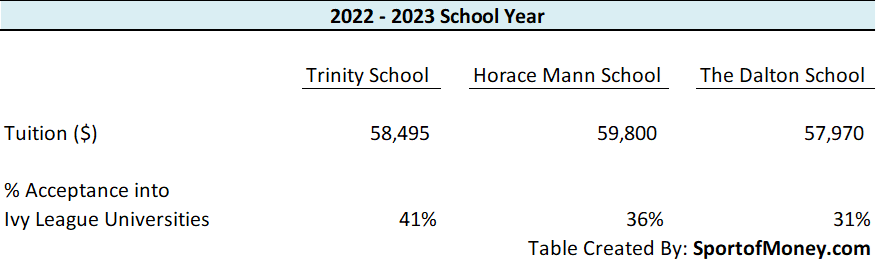

Private School

Generally speaking, the public school system in New York City isn’t great.

Although, in the neighborhood where the Smiths live, the local public school isn’t bad.

The Smiths thought long and hard about the benefits of attending public school versus private school.

In the end, they opted to send their two kids to private school.

The private school admissions process is a daunting one.

More and more families are choosing to raise their children in Manhattan.

This leads to a larger demand for better schooling.

The admissions process for some of the better private schools rivals those of the Ivy League universities.

They can start with an application and written essays, and then interviews with the parents and children, play dates, and references.

If you are lucky enough to survive the admissions process and get a coveted spot in an elite private school, the cost can set you back $60,000 a year.

Those expenses do not include transportation to the schools.

Select private schools are located in different areas of New York City. Transportation costs add another $2,000 per child, $4,000 in total.

These schools are also hungry for donations.

There are annual contribution campaigns to take part in, an annual auction night with proceeds benefiting the school, and a few volunteer events during the school year.

Without donations, the administration may be less enthusiastic in their support or recommendation for the Smith children to outside programs or during the college application process.

The Smiths choose to donate their time right now. At some point when their kids are closer to college application age, they plan to start donating money to the school in the amount of $10,000 per year ($5,000 per child).

Total private school costs amount to $120,000 a year for 2 children.

Summer Camp

The Dalton School is one of the top private schools in NYC. The 2022-2023 school year starts on September 8 and ends on June 15.

There are 12 weeks for the summer break in between the last day of school and the first day of the next school year.

The Smiths opted to use about 4 weeks to travel over the summer.

Out of the remaining 8 weeks, the Smiths signed the children up for a 6-week summer camp program.

The other 2 weeks are general free time for the kids. It is summer after all.

A 6-week program at Pierce Country Day Camp located in Long Island New York costs $10,450 for one child, and $9,925 for a second child (the camp offers a 5% discount for a second child).

Summer camp adds another $20,000 a year to the spending.

The summer camp offers an opportunity for the children to reconnect with summer camp friends, continue to build their social skills, spend time outdoors, and participate in organized activities.

Best of all, it provides the children with a regimented schedule as opposed to sleeping in all summer with countless hours of TV or internet surfing.

Enhancement Activities

To help with the school work during the school year, the kids have a private tutor who comes twice a week to spend 2 hours with them for $50 per hour.

That comes out to be $6,500 paid over the course of a school year.

Throw in private swim and golf lessons, piano lessons, acting classes, and Mandarin classes, the Smiths spend on average $1,000 per month on enhancement activities for the children, amounting to $12,000 a year.

The total cost of private school education and activities for the kids amounts to $152,000 per year.

This is the 3rd highest expense category for the family, after taxes and housing.

Of course, John and Jane feel that there is no better way to spend their hard-earned money than to spend it on the education and enrichment of their kids.

The total discretionary spending amounts to about a quarter of a million dollars per year, with the majority of that spent on their kids.

Discretionary spending makes up 46% of their after-tax income.

This leaves the remaining after-tax income balance at approximately $21,000.

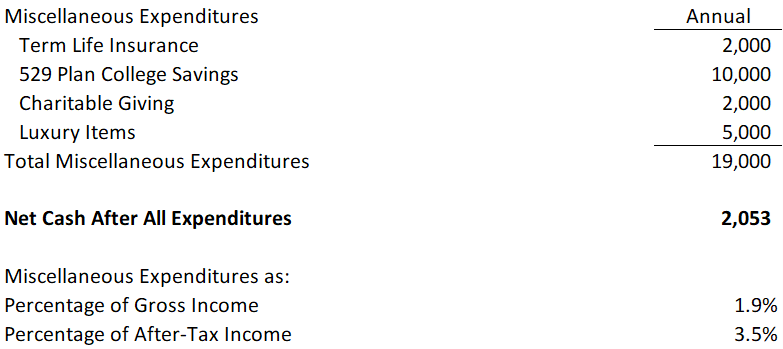

Miscellaneous Expenditures

Term Life Insurance

It makes a lot of financial sense for the Smiths to obtain a life insurance policy.

They do have a $2.7 million mortgage still outstanding on their primary home and 2 school-age kids to worry about.

They have each taken out a $2 million 20-year term life insurance policy when they were younger.

The term of the life insurance policy should cover them to when the younger child becomes an adult.

The premium is $1,100 per year for John and $900 per year for Jane.

They pay $2,000 in total annually for term life insurance coverage.

529 Plan College Savings

The Smiths know that obtaining a 4-year degree at a private university is getting more and more expensive.

Almost daily, the Smiths are reminded by finance articles they have read that there are students who graduate with crushing student loan balances.

They don’t want their kids to have this financial burden when starting their professional life out of the gate.

Therefore, they decided to contribute to a 529 college savings plan.

The money in the 529 plan can grow tax free if the money is ultimately used to pay for college-related expenses.

The contribution to the plan is also a tax deduction (capped at $10,000 per year) for the Smiths at the New York State level.

The tax savings is an incentive for them to contribute to a New York State 529 Plan.

They put in $10,000 a year to take full advantage of the New York State deduction.

Charitable Giving

The Smiths feel very fortunate for their high income and lifestyle.

They get asked by friends and family to donate to various causes throughout the year.

From all the donation requests, they contribute $2,000 a year to a variety of charitable organizations.

While this amount isn’t a large percentage of their total income, it is an amount they can afford right now.

They plan to donate more money to charity when their children are grown and self-sufficient.

Luxury Items

The Smiths don’t buy luxury items often.

They might go years without buying something luxurious.

But when they do, they spend money.

Their luxury items spend averages out to $5,000 a year.

John has been eyeing a blue face Audemars Piguet Royal Oak Self-winding watch ref. #15500ST.OO.1220ST.01.

The watch retails for $26,600 and goes for higher in the secondary market given the current strong demand for steel watches.

Fortunately, John is friendly with a salesperson at an authorized AP dealership and that salesperson came through on a new delivery of that watch.

John has been saving for a few years and has finally saved up enough money to pull the trigger on this watch as a gift to himself for his 45th birthday.

Jane has also been eyeing a black Tago leather with rose gold hardware 25cm Hermes Birkin Bag.

She has been saving money towards the $10,145 price for that in-demand bag. She is looking to also reward herself with that bag for her 40th birthday.

Net Cash After All Expenditures

The total expenditures amount to $19,000 a year.

That results in a very small amount left over after all the costs are accounted for.

Now, let’s look at how much the Smiths are able to save on their $1 million a year budget.

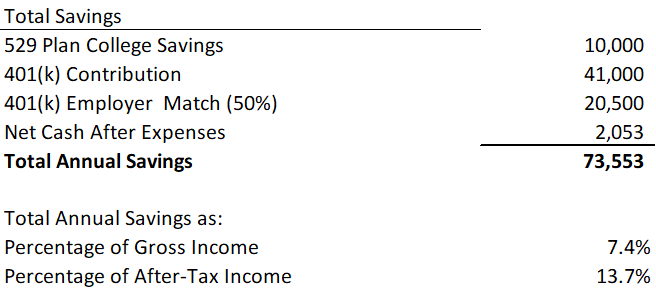

Total Annual Savings

The total savings come out to be approximately $73,000 a year.

That amounts to 7.4% of the gross income and 13.7% of the net income.

This savings amount includes a 401(k) employer match of 50% of their contribution into the 401(k) plan.

That is below the ideal budget which calls for a 20% savings rate in order to achieve financial freedom sooner.

Even for an extremely high-income earning family, savings do not come easy.

I hope you have enjoyed a detailed look at a family living in New York City and how that family spends a million dollar income in a given year.

To The Audience: Does this budget of a million dollar income family change your perspective of how much a million dollar income actually is? Are there any expenses I might have missed? Do you think that the amount saved is a high amount for this family?

Other Posts That Might Interest You

Here’s What You Need To Be Upper Middle Class And Upper Class In NYC – It’s A Lot!

It Takes A Lot To Be In The Top 1% In Net Worth In America Right Now

Average Income In New York City: What Salary Puts You In The Top 50%, Top 10%, And Top 1%?

How Rich Are Americans On A Global Scale? Very Rich!

Many people work hard to better their physical and mental health. What about their financial health?

I started this blog back in 2019 to help people better their financial health as well.

My financial journey began with tens of thousands in student loan debt. Over the span of 20 years, I am close to achieving financial independence.

I truly believe anyone can get to strong financial health. Hopefully, this blog can help you on your financial journey to greater wealth and financial independence.

You can read more about me here.

Thank you for visiting. Come again soon!

My only comment would be the savings rate is low. When you make that kind of income, you gotta find a way to save a much bigger percentage.

What’s the age of the parents. You mentioned dual income, too. If something were to happen to either one of them, their salary would plummet. You simply must save a lot more than that when times are good.

One of the parents is in his early forties and the other one is in late thirties. If one of them loses the job, they will need to downgrade for sure.

Agreed, they should save more when times are good. But taxes, housing and education already eat away a significant portion of their million dollar income.