By now you should know that I’m a big fan of real estate, especially residential rental properties. I believe firmly real estate should be the cornerstone of your investment portfolio.

There are many benefits to owning investment properties despite hidden expenses no one tells you about. Those benefits include the ability to use leverage, appreciation of the asset, monthly cash flows, and the illiquidity nature of the asset class.

The benefits are the reasons why I own 6 rental properties totaling to 18 units.

My properties are located predominantly in Brooklyn, New York.

Real estate prices in many Brooklyn neighborhoods have appreciated quite nicely over the past 10 years. I was very fortunate to be able to ride the wave up on a few of the properties I purchased back in the early 2010’s.

Even with the run up in real estate pricing, I am still searching for additional rental properties to buy in Brooklyn.

Throughout the course of purchasing real estate investment properties I was fortunate enough to buy properties for under market price.

I also know of someone who has purchased north of 30 properties and has built himself a mini-real estate empire. He hunts for underpriced properties all the time.

Is it easy to do – to buy a property for under market value? Of course not.

But under market value properties do exist for a variety of reasons.

Some of the reasons might be too much of an obstacle for a buyer to overlook but they might not be for you.

Reasons Why A Property Might Sell For Below Market Value

Trouble Rental With Tenant Issues

The rental property might already be occupied.

The tenant might not be accommodating in allowing showings on the unit. With limited or no access to the unit, the seller will have a hard time getting market value for it if no prospective buyers can view the property.

In some cases, they might even want to sabotage the showing by leaving their unit a mess or highlighting all the issues with the unit when the prospective buyers come through.

This can detract from the property value in the minds of prospective buyers. Hence, even if an offer is made, it could be below market price.

Also, high maintenance tenants who complain about little issues with the house expecting the landlord to fix them or the tenants are delinquent on rent payments can also result in the seller’s willingness to part with the property at a lower than market price in order to not have to deal with headaches caused by the tenants.

In An Upward Trending Market, Pricing Might Not Have Caught Up To The Market

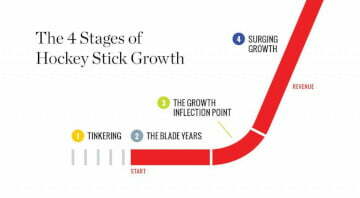

A hockey stick real estate market can result in underpriced listings.

The real estate market experiences a hockey stick situation when the real estate price declined or remained flat for a while and then all of a sudden it starts a nice run up.

In an up-ward trending market, it takes a while for sellers, and even listing agents, time to catch up to the movement of the market.

This can result in listing a property at a price which was considered market a quarter ago but is now lower than where the market is given the continued upward movement of the overall real estate market.

I saw this in some of the available properties in the market about a decade back in Brooklyn. The market was shooting up and, in some cases, the listed price and what the seller would accept is based on information a quarter or even a year ago.

Also, if the seller purchased it years before the run up of the market, at a fraction of the current market price, the seller might be happy to sell at 2 or 3 times the original cost and might leave some money on the table unknowingly. They are already happy with the price received and are more willing to sell the property to lock in the nice gain they have experienced.

The Seller Enlisted The Help Of A Listing Broker From Out Of Town Or The Seller Is Out Of Town

If you are a seller, I would never recommend engaging a listing broker from out of town.

Real estate market behavior is localized and, if you don’t have local knowledge, I cannot understand how you can extract maximum price.

A seller might use a non-local listing agent if the agent is a family member or family friend. A listing agent from out of town might compare the property to determine the listing price to properties that might appear similar but are not actually good comps.

For instance, if the listing agent is not a local, the agent might look at properties at Greenwood in Brooklyn which is an adjacent neighborhood to Park Slope to comp a property in Park Slope.

Park Slope, on average, trades for 10% higher on a price per square foot than Greenwood. This can lead to a below market price for the property.

Additionally, an out of town agent might also have an incentive to push the seller to accept the first offer or a lower offer. The seller’s agent wants to avoid the commute time required to continue to show the property given the agent is out of town and needs to commute to the property.

Conversely, even with a local broker, but the seller is out of town, it can also provide for an opportunity to pick up a property at a below market price.

Similar to employees when the boss is away, a broker without constant supervision from the seller can result in less open houses or less effort on the agent’s part. The listing might not be marketed to the greatest extent possible.

Initial Aggressive Pricing Can Result In A Stale Listing

The property might be initially listed at a price too high because either the seller thinks too highly of the property or the listing agent might want to promise a higher than reasonable price to land the listing.

This can result in very little turn out at an open house, and very little interest in general on the property.

Even if prospective buyers show up to the open house, given the unreasonably high price, no offers will be made. This can cause the property to stale on the market.

The longer the property is on the market, the more people assume there are issues with the property. Even with price cuts, buyers might still feel hesitant on making a move on the property. Surely, someone must know of something negative about the property for the property to sit on the market for so long.

This can result in a property transacting at a price below where it might if the property was listed at a fair market price to begin with.

There Are Violations To Clear

A property might sell for less than market if there are violations which would need to be cleared. This can result in less interest in the buyer pool. The seller might need to list it for a discount, more so than necessary, to accommodate for the work of clearing the violations.

The seller might also over-estimate the price effect the violations have on the property and, thus, offer the property at a price lower than what the property is truly worth.

There might be monetary fines tied to the violations. The buyer can come in and take over the fines for a discounted purchase price. Then the buyer can negotiate a reduced fine with the city and pocket the difference.

Techniques To Use To Take Advantage Of A Good Deal

Now that you know of some reasons why a property can sell for less than market price, how can you take advantage of a deal? I’ve been fortunate enough to have completed real estate transactions at prices below market (and so have some people I know) and here are a few techniques we used to take advantage of a good deal.

Be Educated And Understand The Real Estate Market

First and foremost, you have to invest time to understand a market. How can you identify a great deal if you don’t have a sense as to what the appropriate market price is and if the property is listed at a price that is less than market price.

You need to go out there and attend open houses to understand the market. You can do research online by visiting sites such as Zillow.com and Trulia.com in order to understand what are the properties available and properties which sold.

Without having a good understanding of the real estate market, it will be hard for you to have the confidence to take action.

Offering An All Cash Purchase

We have all heard “cash is king”.

It is also valuable in helping take advantage of a below market deal. Cash provides certainty to the seller which can be extremely valuable to the seller.

Think about some of the instances listed above when a property might sell below market:

- In an upward trending market – in such a situation, obtaining financing can be challenging given the appraiser engaged by the bank might also be slow in reflecting true market price as they rely on closed transactions from a quarter or two ago. Those closed transactions reflect an outdated price lower than the current market. Hence, an all-cash deal prevents a seller from having to stress about the appraisal coming in lower than the sell price which can jeopardize the transaction.

- Another instance of when a property can sell lower than market is if the property has violations. Violations present an obstacle to obtaining financing which makes an all-cash deal necessary.

–

Ability To Move Quickly

There might be value to the seller if you can move quickly on a transaction.

This can be achieved with an all-cash deal or by moving very quickly throughout the whole process such as marking an offer on the first showing or scheduling a private showing before the first open house.

Think about some of the reasons listed above as to why a property might sell below market:

- The property was overpriced initially which means the seller had to hold onto the property for longer than originally anticipated. This can result in the seller wanting to move as quickly as possible on selling the property.

- An out of town listing agent wants to off load the property as quickly as possible to not have to continue to spend the time commuting in for showings.

–

Offer To Use The Seller’s Agent As Your Agent As Well In A Dual Agent Capacity

At the end of the day, people are involved in real estate transactions. You can use that to your advantage.

The seller’s agent is the one who can convince the seller who to go with. If the property is priced under market, you might have competition.

How do you stand out from the crowd? You can try to entice the seller’s agent to fight harder for you by offering to use the seller’s agent services as your representative as well.

You can have the seller’s agent be a dual agent. This would result in the seller’s agent collecting a dual fee and can have the seller’s agent work harder to push your offer above the rest if all else is equal.

Use All Services Offered By The Seller’s Agent

Once again, real estate transactions are heavily people driven. If the seller’s agent has recommendations for whom to use for financing or for insurance, it might be to your advantage to also let the listing agent know that you will be using the services of the recommended providers.

The listing agent might have a good relationship with those other service providers and would be appreciative if you use the services of people who have a relationship with the listing agent.

For instance, the seller’s agent is the mother of the recommended mortgage broker. Not only does the seller’s agent receive the commission for selling the property, her son now also gets a commission for selling you a mortgage.

This might once again result in the seller’s agent pushing your offer above others when all else is equal.

Jump In

At the end of the day, you just need to jump in and take action.

No matter how good of a deal is available, it is meaningless if you don’t take action and close the deal.

Do not hesitate in submitting lowball offers on properties that have been sitting on the market for a while. Submitting 10+ low offers and getting 1 accepted can result in a below market value property.

You really need to just move forward and see the transaction to completion by closing – especially when there is equity to the property and the purchase price is below market.

To the audience: Have you ever gotten a property for below market price? If yes, how were you able to do it? Do you know why the property sold below market? What were some of the tricks or techniques you used to purchase a property for under market price?

Related Posts

$400,000 Income From Real Estate, No Income Taxes Paid

How To Maximize Rent And Other Considerations For A Vacant Rental Unit

Many people work hard to better their physical and mental health. What about their financial health?

I started this blog back in 2019 to help people better their financial health as well.

My financial journey began with tens of thousands in student loan debt. Over the span of 20 years, I am close to achieving financial independence.

I truly believe anyone can get to strong financial health. Hopefully, this blog can help you on your financial journey to greater wealth and financial independence.

You can read more about me here.

Thank you for visiting. Come again soon!