California is the most populous state in the United States with over 39 million people.

That state makes up 12% of the national population.

Not only is California the most populous, it also has the largest economy of any state in the United States.

As a stand-alone economy, California ranks in the top 5 economies in the world.

The state is poised to overtake Germany as the World’s number 4 economy when all the current GDP figures are finalized for the year.

The strength of the California economy is derived from Californians who live throughout the state.

There are many wonderful and distinctive cities in California ranging from Los Angeles to San Francisco to San Diego to Palm Springs.

The state is home to industries centrally located in iconic areas such as Silicon Valley and Hollywood.

There are many benefits to living in California.

Want to tour wine country? Then visit Napa Valley.

The most scenic drive I’ve been on in the United States is driving the Big Sur on US 1.

You can hit Malibu for beach action or spend time with young kids at Disneyland.

What about hiking one of the most popular national parks? You can visit Yosemite in California for that as well.

Now, with all the benefits come a bit of the downside.

There are people from all over the world who go to California to visit, work, and live.

That means there is demand for everything California has to offer.

We all know the effect of strong demand. Prices move up to reflect such demand.

California is an expensive state; but does it make it a place that is unaffordable to the general population?

Let’s take a look at the average income in California.

Average Income In California

The average income in California can be measured in several ways.

Let’s take a look at the income information collected by the United States Census Bureau.

The United States Census Bureau collects California income information at the household level.

The household includes all the persons who occupy the same housing unit as their usual place of residence.

There is the median household income and the mean household income.

The median is the middle number in a set of data that is ordered from least to greatest.

Taking you back to 4th-grade math, the mean is the sum of all the data items divided by the number of data items.

According to the United States Census Bureau, the median household income in California is $84,907. This is based on 2021 income information which is the latest data published.

This means half the California households made more than $84,907 and half of them made less than $84,907 in 2021.

The mean household income comes in at $120,953. The mean is skewed higher up because of all the high earners in California.

For instance, if there are 2 households and one earns $0 and the other earns $100,000. The mean is $50,000.

But if there are 2 households and one earns $0 and the other earns $1,000,000, the mean comes out to be $500,000.

The higher income households can really skew the result for the mean income.

The United States median household income in 2021 is $70,784 and the mean is $102,316.

It is not surprising that the median income is higher in California than in the United States. Also, the mean income is higher for California as well.

After all, we know California to be an expensive state. A lot of people earn above the rest of the United States.

California Income Compared To United States Income

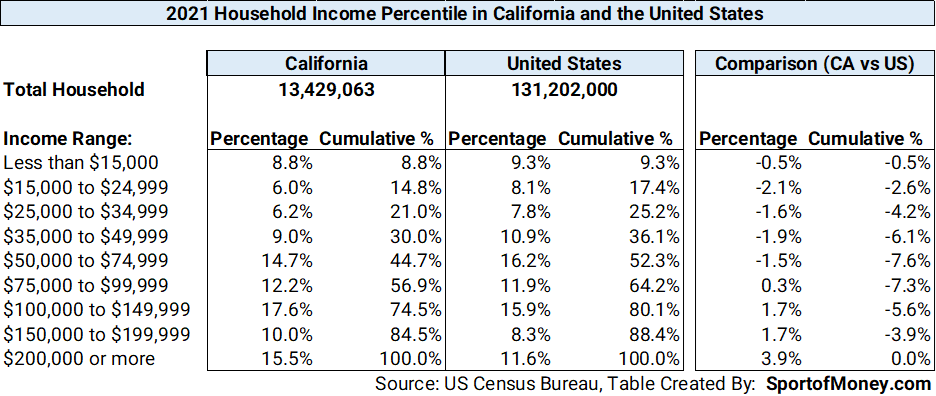

This table shows the household income in the various income ranges for California and the United States.

This further shows how the household income of Californians skews higher than the typical American income.

There are fewer people on the low end of the income scale (less than $75,000) when compared to the rest of the United States. This is likely due to the minimum wage in California.

And there are a lot more people in California making 6 figures ($100,000+).

This might not surprise you given California is the tech hub of the world. The state is also home to the most millionaires and billionaires in the United States.

Therefore, a lot of money can be found in Californians.

California Minimum Wage

The United States federal government has set the minimum wage at $7.25 per hour.

Many states have their own minimum wage laws.

30 states and Washington D.C. have minimum wages above the federal minimum wage.

California is one of those 30 states with minimum wages above the federal level.

In fact, California has the highest minimum wage amongst the 50 states.

Additionally, different cities within California have their own minimum wage calculated based on the cost of living.

Los Angeles for instance has $16.04 as the minimum wage.

San Francisco, another high cost of living city, has $16.99 as the minimum wage.

The minimum wage in California is double that of the federal level.

The high minimum wage pushes other wages higher as well.

According to Indeed, the #1 job site in the world, the average salary in the state of California ranges from $14.13 per hour to $50.48 per hour.

No wonder the medium income in California is 20% higher than for the country as a whole.

California Household Income Deciles

The table below shows the income that you have to clear to get into the top percent of all household income.

It reads as “how much do I need to earn to be considered top X% of household earners in California.”

Top 10%: $200,000+

Top 20%: $173,547

Top 30%: $136,000*

Top 40%: $105,995

Top 50%: $84,907 <-Median

Top 60%: $66,612

Top 70%: $50,000*

Top 80%: $33,049

Top 90%: $16,000*

*Extrapolated from the US Census Bureau Data. All other deciles come from the US Census Bureau Data.

Have you ever wondered if $80,000 is a good salary in California? Well, an $80,000 salary puts you slightly below half of all Californian households in income.

How about making the six-figure mark of $100,000? Is $100,000 a good salary in California? You make around the top 40% of all Californians.

Don’t forget, all the above is based on household income. A household is made up of more than 1 earner on average per household.

To get into the top 5%, an income of $291,277 is needed.

According to Smart Asset, cracking the top 1% income requires three quarters of a million ($745,314) .

Unsurprisingly, it takes a lot to get into the top 1% of earners in California. After all, California is home to the most millionaires and billionaires in the United States.

California Income Tax Rate

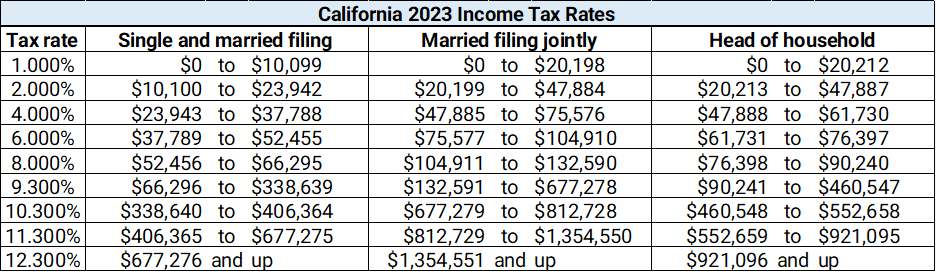

While most Californians earn a larger salary compared to the rest of the country, they also have the privilege of paying some of the highest income taxes in the whole nation.

The income tax rate at the state level ranges from 1% to 12.3%.

In addition, million dollar earners are subject to an additional 1% income tax on income over $ 1 million for those filing individually and on more than $1,354,550 for married filing jointly.

That brings the top marginal tax rate in the State of California to 13.3%.

San Francisco also has a 1.5% income tax on both residents and nonresidents who work in the city.

That means top earners living in California and San Francisco are subject to a total state and city marginal income tax rate of 13.3% and 14.8%, respectively.

A tax filer needs to earn over $1,000,000 to trigger the highest rate. Combined with the Federal income tax rate, these ultra-high earners keep less than half of their gross income.

But it doesn’t take much to start paying meaningful state taxes in California.

Even earning the median income subject the earner to a state marginal income tax rate of 6% to 9.3%, depending on filing status.

Come April 15th of each year, I am sure Californians envy people living in states without income taxes.

California’s Other Taxes

In addition to high income taxes, there are also property and sales taxes.

California is number 9 out of 50 states in 2022 when it comes to the highest state and local taxes paid as a percentage of income. This includes not only income taxes, but other state and local taxes such as sales tax and real estate tax.

Californians, on average, pay close to 10% of their income towards state and locate taxes.

State And Local Tax Effect On Medium Household Income

The average income of a Californian is where I thought relative to the rest of the U.S.

I know the average California has to make more than the average American.

And it didn’t surprise me that the top earners make good money. There is no doubt about that.

There are many people in Silicon Valley and Hollywood who make more than $1,000,000 a year.

Additionally, every income decile is higher than that of the nation.

But state and local tax adjustments do knock the higher income down a notch.

The average state and local taxes (including income, sales, and property taxes) in America is 8.6%.

Californians, on the other hand, pay 9.72% on average in total state and local taxes.

When the median household income is reduced by the state and local tax burden, the adjusted income amounts to $76,654 for a Californian and $64,676 for the average American.

The average Californian still takes home more pay after taxes but the dollar amount narrows a bit.

How About The High Cost Of Living?

California doesn’t just overperform on income compared to the rest of America.

Unfortunately, California is also good at outperforming the rest of the United States when it comes to the cost of living.

Once again, this shouldn’t come as a surprise to anyone who has visited California before.

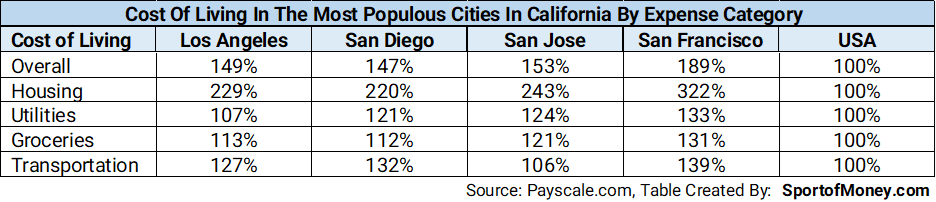

When you look at the top 4 most populated cities in California (Los Angeles, San Diego, San Jose, and San Francisco), the cost of living is significantly above the national average.

According to Payscale.com, Los Angeles, the most populous city in California, is about 50% (49% to be exact) more expensive to live in when compared to the national average.

It doesn’t get any better for the other 3 populous cities. San Diego is 47% more expensive, San Jose is 53% more expensive, and San Francisco comes in at a whopping 94% more expensive than the national average.

Housing cost is the biggest culprit here, far outpacing the national average. In the largest cities in California, housing cost is either over 2 times or 3 times the national average.

Here is a sampling of the costs of living in Los Angeles:

Median home price: $958,932

Median rent: $2,929/month

Energy bill: $187.85/month

Phone bill: $206.71/month

Loaf of bread: $3.86

A gallon of milk: $2.47

Carton of eggs: $1.75

Bunch of bananas: $3.74

Hamburger: $5.29

When adjusting for the high cost of living in California, in addition to the high state taxes, the median household income shrinks even more.

In terms of buying power, the family at the halfway mark of income in the state can buy about 20% less than what the average American family can buy.

Despite the higher income, the standard of living is lower for an average family in California.

Summary

California has a higher average income than the United States.

As a percentage of the population, there are more people in California making six figure ($100,000+) in this state than in the rest of the nation.

Also, there are fewer people percentage wise making $75,000 or less due to the state’s high minimum wage.

However, California does have high state taxes (#9 in ranking) and it is expensive to live in that state.

Even with high state taxes and a high cost of living, California is still the most populous state in the nation.

There must be something special with California when 10 million more people are calling that state home than the next closest state.

To The Audience: Did the high average income in California surprise you? What do you think about the high minimum wage in the state? If you live in California, do you agree that the state is an expensive place to live?

Other Posts That Might Interest You

Here’s What You Need To Be Upper Middle Class And Upper Class In NYC – It’s A Lot!

It Takes A Lot To Be In The Top 1% In Net Worth In America Right Now

Average Income In New York City: What Salary Puts You In The Top 50%, Top 10%, And Top 1%?

How Rich Are Americans On A Global Scale? Very Rich!

A Million Dollar Income – A Detailed Analysis Of The Household Budget

The Best Million Dollars A Year Jobs

Many people work hard to better their physical and mental health. What about their financial health?

I started this blog back in 2019 to help people better their financial health as well.

My financial journey began with tens of thousands in student loan debt. Over the span of 20 years, I am close to achieving financial independence.

I truly believe anyone can get to strong financial health. Hopefully, this blog can help you on your financial journey to greater wealth and financial independence.

You can read more about me here.

Thank you for visiting. Come again soon!