I believe in a very simple equation for wealth creation and accumulation:

Earn ASAP + Save ASAP + Invest ASAP = Great Wealth

It’s pretty much self-explanatory – but just in case you need a quick refresher:

Earn is to make money.

Save is to not spend the money earned.

Invest is to put the saved money to work.

ASAP is as soon as possible. The earlier you can do all three, the greater the wealth you can generate.

Like I said – pretty simple stuff.

I personally followed this simple formula over the past 20 years to help guide my financial path.

Wanting to accumulate wealth is a choice we have to make individually.

I made the choice to follow the formula at a very young age because, even in my teens, I knew I wanted to be wealthy.

Maybe it was because I grew up financially poor in America and saw all the difficulties my parents faced being poor that drove me to want a better life for myself.

My father had to work two jobs earning low wages just to make ends meet. My mother, in addition to having to care for my siblings and me during the day, worked a job at night to bring in extra income.

There were constant worries about making rent payments and putting food on the table.

Back then, my socks got all soaked when walking home from school during a rainy day because of the worn out soles of my shoes and riddled with holes. My parents didn’t have the money to buy me a new pair of shoes until I outgrew my current pair.

Growing up financially poor provided me with benefits which helped me do financially well later in life. The irony isn’t lost on me.

Earn: Start Off In A High Paying Profession

I knew that in order to set myself up for financial success later in life, I needed to enter into a high profession which pays well. Pretty intuitive stuff right?

Being a native New Yorker and wanting to stay in New York after college, I decided to enter into the world of finance.

Finance, after all, is the top industry in New York City. This industry contributes the greatest to the economic activity in New York City. There is a reason why Wall Street is the most famous street in the world.

Within the finance industry, the securities sector is the biggest component. According to the Office of the New York State Comptroller’s report on the Securities Industry in New York City dated October 2019, the securities sector contributed 17 percent of all economic activity in New York City in 2018.

According to the report, in 2018 the average salary in the securities sector in New York City is $398,600.

The average salary in the securities sector is 5 times as great as the average salary of all other private sector jobs ($79,800).

Just by choosing to join the securities industry has given me a leg up in potential income earned.

It is a high paying industry and New York City is the capital for that industry.

If you live in New York City, being in the financial services industry is a good way to go.

Therefore, if you want to make it easier to accumulate wealth, look for a high paying industry.

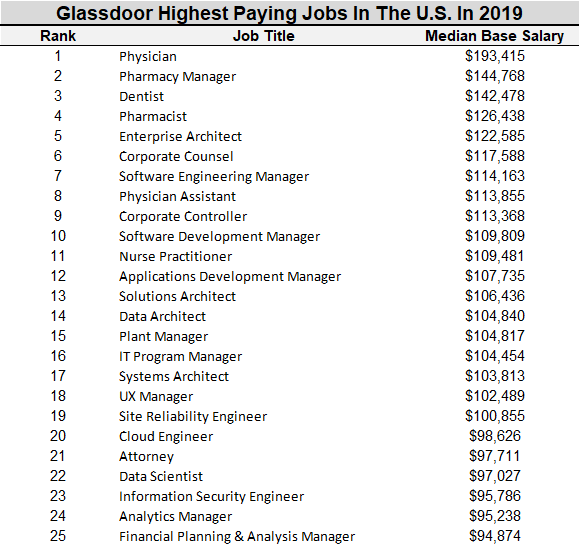

According to Glassdoor.com, here is a list of some of the highest paying jobs in the U.S. in 2019:

Conversely, it literally doesn’t pay to start off with a low paying job or enter into a low paying industry.

A low paying job makes it more difficult to generate income which is one of the three components in accumulating wealth.

Maximize your earnings by entering into a high paying profession.

Earn: Maximize Earnings By Not Staying With One Company

Not only is entering into the right industry and profession key to maximizing earnings, working for the right company helps as well.

In the old days, people can expect to work for one company their entire life. In return, the company offers to take care of its employees in the form of a pension.

The employees were loyal to their employers. And, equally as important, the employers were loyal to their employees.

Things have changed drastically from then.

Companies are exceedingly doing away with their pension plans. In fact, most corporate companies don’t even offer pension. Less than 20% of private sector workers have access to a pension plan.

The loyalty between employers and employees are now severed.

There is little upside to staying with one company if there are better paying positions elsewhere.

I moved around a few times myself during my 2 decades of work in order to maximize my own salary and position.

You should look to do the same. Constantly keep your ears on the ground to see what opportunities are out there for you to continue to increase your pay.

It literally pays to understand which companies within your industry pay the best and then try to land a job there.

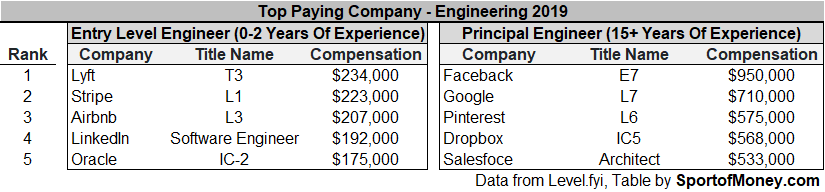

Level.fyi compiled information about top paying companies for engineers in 2019.

You can see that as you progress through your career as an engineer, the pay discrepancy between even the top company and the 5th highest is a huge gap.

But more importantly, the companies which pay well for entry level engineers don’t show up in the principal engineer top 5 for someone with 15+ years of experience.

Does it make sense for an entry level engineer to stay at Lyft when that person can make a lot more in Facebook down the line?

At some point, a switch in company is warranted for higher pay.

Save: Don’t Spend Money On An Expensive Vehicle

Americans sure love their cars. By some account, there are over 285 million registered vehicles in the U.S.

The average price for a new car is close to $40,000 today.

Americans are abandoning small, more affordable cars for big trucks and SUVs. Trucks and SUVs are not only more expensive, but they cost more to maintain.

The average American owner of a new car is now spending $9,300 a year according to an AAA study on the cost of car ownership.

That’s a really big annual expense considering the medium household income in the U.S. is $63,000. That’s approximately 15% of the pre-tax income.

To me, that is an incredible amount and percentage of income to spend on a depreciating asset.

According to Carfax, a brand new $40,000 car loses more than 10% of its value during the first month after you drive it off the lot.

The total loss of value for 12 months of ownership is 20% (or $8,000 on a $40,000 vehicle). Then, for the next 4 years, you can expect the car to lose roughly 10 percent of its value annually.

That means within 5 years, the car can lose 60% of its value or $24,000.

It just doesn’t make sense to me to go and buy a new expensive car.

In fact, the first time I owned a car was when my household income was in the mid-6 figures.

Even then, my first car wasn’t a new car. It was a second-hand car with a Kelly Blue Book Value of less than $10,000.

Now, I did have the advantage of living in New York City where there were plenty of public transportation options.

Even for many people, there might be more cost effective, environmentally friendly options.

There are shareride services such as Uber and Lyft. How about walking or riding a bike? Not only are those two options cost effective and environmentally friendly, they are healthier options.

Save: Don’t Spend Money On An Expensive Home

Owning a home is part of the American Dream.

I believe home ownership is a key component for the average American to build wealth in this country.

Any follower of this blog knows that I am a big fan of real estate. In fact, I believe real estate should be a cornerstone of any investment portfolio.

But I also believe that a house can turn into an expense trap. The key is to understand when your home moves from a positive contributor to your long term wealth to a negative detractor to your wealth.

The key here is not to buy too big of a house.

On average, Americans have large houses compared to the rest of the world.

According to PropertyShark, the average house size in the 1910s was a little over 1,400 square feet. Now, the average new home in America is over 2,400 square feet.

That is an increase of over 1,000 square feet and is larger by 74%.

When looking at personal living space, the number is even wider compared to 100 years ago. There are fewer people in a household now, 2.58 compared to 4.54 in 1910.

That means the average person now has over a 211% increase in personal space in the house (over 900 square feet today compared to 300 square feet in 1910).

Instead of purchasing 900 square feet of personal space per person in the household, try to shoot for 600 square feet of personal space. That is still twice as much personal space your grandparents had growing up.

That means for a couple, a 1,200 square foot home should do.

This can help you save tremendously on housing costs. Not only are you paying less for the house, but there is less real estate tax, lower insurance premium, less heating and electricity usage and less maintenance.

It all adds up to savings in your pocket.

My first house was an owner-occupied rental duplex. I encourage you to look into buying a duplex as your starter home.

It provides for a smaller home and at the same time, you can earn some rental income. There are many benefits why an owner-occupied rental duplex is the way to go for your first home.

Invest: Take Advantage Of Tax Advantage Accounts

Something I did early on was to not only save as much as possible of my earnings, but to also invest that savings in a 401(k) account.

I set up automatic contribution for each time I received my paycheck. I also set up the contribution to go directly into an S&P 500 Index Fund.

It didn’t matter to me what price the S&P 500 Index was at. I set up the account to make it as hands off as possible.

Given how well the equity market has done over the past two decades, I have a nice financial nest egg saved up for retirement.

You can see other things I did to turbocharge my 401 (k) into the 7-figure balance in my 30’s.

I believe it is important to take advantage of all the benefits of tax advantage accounts.

If your employer provides an employer match, it is a financial no-brainer to contribute up to the amount that would allow you to maximize the employer contribution piece.

Automate as much of the process as possible by setting up automatic deductions from paychecks and by setting up the investment allocation.

Setting up the investment allocation is important because you don’t want to contribute the cash into the account and then just have it sit there.

Invest: Don’t Look For Get Rich Quick Schemes For Wealth Generation; Do Rely On The Power Of Compounding

It took me years and years to accumulate a decent financial nut. It wasn’t done overnight.

I don’t believe in get rich quick schemes. I’ve gotten burned so many times on high flying stocks or investments.

I do believe in the power of compounding.

Compounding is the greatest financial force in the known universe.

$1,000 over a span of 50 years at a 10% return (which is the historical return of the S&P 500) can result in over $100,000.

Imagine just saving $5,000 per year from ages 18 to 22 into a retirement account and leaving it in the S&P 500. If the S&P 500 generates the same return in the next 50 years as the past 50 years, you are looking at $1.8 million of savings by the age of 67.

Basically, you can fund your retirement within the first 4 years of reaching adulthood if you invest your money for 50 years and let compounding work its magic for you.

The same goes for building a real estate portfolio. I’ve built my 20 plus unit portfolio over a decade.

It was buying one unit, then using my savings and rental income to buy another one. Then after a few years, I was able to buy another one.

As I continued to grow my real estate portfolio, it became easier and quicker for me to buy the next one. The savings from my high income job coupled with a nice rental income amount shortened the amount of time needed to accumulate the down payment for the next rental property.

Multiple Your Effort By Finding A Partner That Can Make You Better

You can have a multiplier effect on your wealth if you find the right partner. This cannot be understated.

My household was able to accumulate the net worth we have due to the contribution of my wife who also works a high income earning job and is financially minded as I am.

We were able to combine our financial savings to make better investments. Those investments have done well for us.

That is why I believe it is important to get on the same page as your significant other. I believe all couples should have discussions around their own personal finance.

I know it can be hard to talk about income, savings, and financial goals. But there are many benefits to sharing that information with your spouse, partner and significant other.

Find the wrong partner, and you can see a very negative effect on your wealth. But finding the right one can help multiple it many times over.

In Summary

In summary, maximize earnings by going into a high paying profession. Don’t be afraid to make moves to join the best paying companies in your industry.

Maximize savings by not spending on an expensive car or a big house.

Maximize investing by taking advantage of tax advantage accounts and rely on the power of compounding.

And if you want to increase your wealth by magnitudes, find the right partner.

To the audience: What were some steps you have taken for wealth creation and accumulation? The math is so compelling with the effect of compounding. Why do you think not more people save earlier to allow the power of compounding to work its magic?

Related Posts

Anyone Can Be Wealthy In America – Are You?

How Rich Are Americans On A Global Scale? Very Rich!

Path To Wealth And FIRE In 20 Years On An Average Salary

Many people work hard to better their physical and mental health. What about their financial health?

I started this blog back in 2019 to help people better their financial health as well.

My financial journey began with tens of thousands in student loan debt. Over the span of 20 years, I am close to achieving financial independence.

I truly believe anyone can get to strong financial health. Hopefully, this blog can help you on your financial journey to greater wealth and financial independence.

You can read more about me here.

Thank you for visiting. Come again soon!

My strategy was straightforward. I chose a relatively high paying profession and worked at it for a decade (still am). Although not nearly as rewarding as the financial sector in NY City, it’s still high pay compared to most people.

Combine that with barely any lifestyle inflation and it’s pretty much inevitable not to accumulate some kind of wealth.

Regarding why most people don’t save earlier. Most don’t save or invest because they haven’t the slightest clue what to do. Investing, compound interest and other “trivial” jargon are not part of their life. These things are only for “rich” people.

It’s a shame not more people save earlier because they just weren’t educated on financial literacy. It would be great if financial literary is a mandatory class period in senior year of high school – maybe replace one of the art or music electives.

Nice! Have a plan and execute it. That’s what I did, deciding on my high paying career early in my teens and never wavering allowed me to get a very inexpensive education and a very high paying career in a very low cost of living area. That’s a powerful combination especially if you are naturally frugal and marry a frugal spouse. Success is pretty much a lock, although not an overnight one. Great post, nice to see someone prove that you can start with nothing and still live the American dream.

The American Dream is still alive and well. In my mind, this is the best time to achieve the American Dream (and significant out-performance) than any other time in history. But it does require more individual initiative than before.

You’ve hit upon another formula for financial success. Inexpensive Education (decrease financial burden to start) + High Paying Career + Low Cost Of Living Area. Follow through for decades and you are all set.

Hey Rich! Just finding your content – this is good stuff!

I think the root of the ‘problem’ is that personal finance is not taught anywhere other than the home. And in the home, most families do not understand wealth accumulation at its fundamental level like you laid out. So they either do not discuss it or they pass on advice like you need a new car, new iphone and airpods, and buy a house as soon as you can so you don’t waste money on rent. We are left to figure it out on our own and boy does it sound nice to have the newest gadgets for only $x per month. Who cares about the liability because I can afford it monthly.

So maybe it’s a challenge to people like you and me to spread financial literacy. To help people understand how transactions affect their wealth. Great post!

America is a consumption society. That is why financial literacy is even more important because some of the concepts to accumulate wealth go against the grain of this country.