I know the temptation is there; the temptation to spend all of your first full time paycheck.

You’ve lived under your parents’ rules for 18 years. In that time, you might have made some side money but was highly dependent on your parents for financial support. They gave you as much as they want to give you or as much as they can afford to provide.

Then came college. At least 4 years of higher education. Potentially you worked while pursuing your college degree. Between paying for tuition, room and board, and other miscellaneous expenses, you barely had enough money to enjoy a nice meal. Those ramen noodles sure taste good when you can’t afford anything better.

Now you have finally done it. You’ve graduated into full adulthood. Along with the territory of being an adult means taking on a full time job.

You finally receive your first full time paycheck after a couple of weeks into the start of your career. Even after taking out taxes, the amount is the biggest you have ever received.

“I finally get to make my own financial decisions” you think to yourself. “I deserve to treat myself real nice and I now have the financial means to do so.”

The paycheck is calling out to you “spend me, spend me.” After depositing your paycheck into your bank account, you see the balance show up. You log in your online account app daily to check on it.

The temptation to spend it continues to grow.

Saving And Investing Your Earnings Lead To Great Wealth

I am here to tell you not to spend the money. Just don’t spend it. Try to save as much of the paycheck as possible and invest the savings.

As I’ve mentioned time and time again, saving and investing your earnings is the easiest way to accumulating great wealth. If you have been following this blog, I must sound like a broken record.

The reason why I keep repeating this point is that it works. Saving and investing early will go a long way to building your financial wealth.

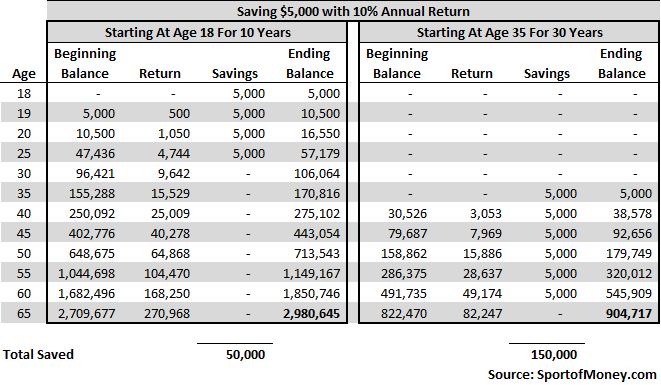

Check out the math in the table below.

You should pass the table below to someone in their early 20s. The left hand side shows a person who started saving $5,000 per year at the age of 18 for 10 years. The person stopped saving at the age of 28. The $5,000 is put into the S&P 500 each year. Assuming a 10% annual return, the $50,000 of total savings turns into about $3 million at the age of 65.

Now compare that to the person on the right. The person started saving at the age of 35 for 30 years. Assuming the same 10% annual return on the savings, the person ends up with less than a million dollars at age 65.

Think about that. The person on the left put in only $50,000 and ends up with $3 million. The person on the right put in $150,000 (3 times the amount) and ends up with 1/3 of the total. The only difference is that the person on the left started saving and investing 17 years earlier. That is the power of compound return!

That is the reason why I want to teach my kids as early as possible about financial literacy so that one day they can be financially wealthy as well.

Okay I’m Saving Early, Now What?

It would be so easy to save if living like a college kid forever. This is especially true if you continue to live like a college kid under the roof of your mom and dad while earning a full time paycheck.

Rent payment? Not necessary. Food? Breakfast and dinner all covered. Car? Can use dad’s 2015 Ford Explorer. Laundry? Free. Cleaning, what cleaning. Utilities, cable, tv? All covered.

The hardest trapping to overcome with making money is to stop the urge of not spending money.

Living like a college student your first few years really pay off. Of course, there is a shelf life to being able to do that.

There has to be an end goal to saving and investing your money. The point is to be able to do something with the financial nut accumulated.

Life changes and along with it comes changing financial responsibilities.

While eating ramen noodle by yourself in college might have been fine, it becomes destructive to your dating life in your 20s if you constantly try to convince your date to eat ramen noodles as well.

Of course, you have to use the savings. If it doesn’t bring about betterment to your life, what’s the point of wealth accumulation anyway?

People have to live their lives. Progressing and growing in life requires money. That personal growth comes from owning a home, a car, going on new adventures, expanding cultural horizons by taking trips, recharging on vacation, and enjoying nights out at new restaurants.

Another word, there is lifestyle inflation and, along with the lifestyle inflation, increasing expenses.

Lifestyle Inflation Is Not Why You Can’t Save; Lifestyle Inflation Is The Reason Why You Should Save In The First Place

Life progresses in different stages. We graduate from college, get a job, fall in love, get married, buy a home, have kids, etc. Each stage of life requires more financial resources.

Dating is expensive. There are a slew of expenses with getting married. You need the down payment for your first house. And there are many new expenses with having kids (diapers, formulas, college savings, etc.).

“How can I save in light of lifestyle inflation?” you might think to yourself. Maybe you were a good saver right out of college, but life progression makes it hard to save in the later stages of life.

Lifestyle inflation is real. In my mind, one of the best ways of paying for lifestyle inflation is by saving early on in your 20s. This sounds counterintuitive. You might think you need to spend more, not save more. But let me show you the numbers.

Spender Without Savings

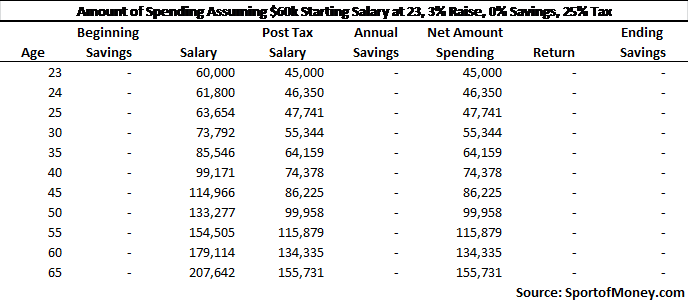

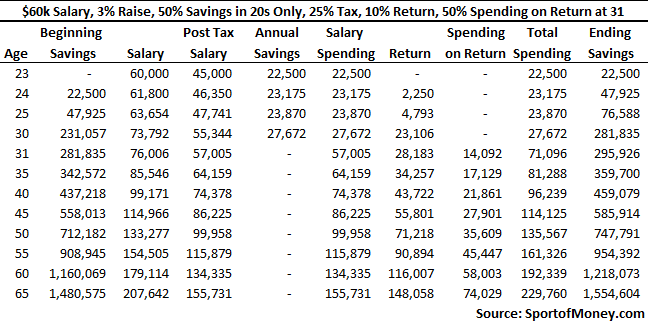

Let’s take a look at an example of a recent college graduate named Charles. He starts work at a bank making $60,000 his first year out of college at the age of 23. Let’s assume he receives a 3% annual raise from age 23 to age 65 and his income tax rate is at 25%.

With his live for the moment mantra and not one to think too much about the future, Charles enjoys spending his paycheck all at once. You can see his annual spending amount is equal to his take home pay.

After 40 plus years of work, Charles doesn’t have any savings.

Spending of A Saver

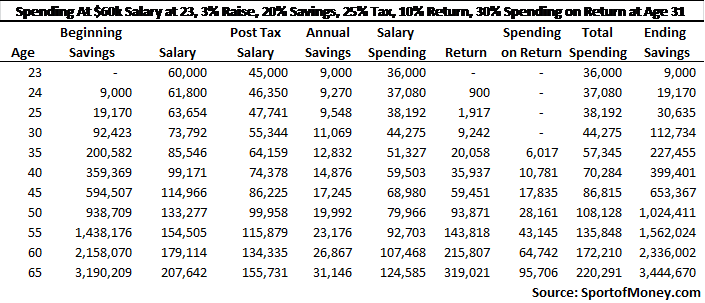

Let’s take another look at the spending of another recent college graduate named Michelle. She started full time employment at the same age as Charles (age 23) and has the same starting salary ($60,000 a year). Michelle can also expect an annual raise of 3% from age 23 to age 65 and a 25% income tax rate (all similar to Charles).

The difference is that Michelle is a saver. She enjoys saving 20% of her take home pay and spends only 80%. She invests that savings into the S&P 500. She decides to use 30% of the return generated on her savings at the age of 31 to support her lifestyle inflation.

Assuming the S&P 500 returns over the next 40 years the same as the past 90 years (averaging a 10% annual return), Michelle can expect to see $3.4 million in her savings account by the age of 65.

Let’s Compare the Spending of Charles and Michelle

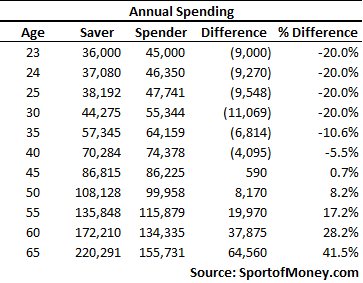

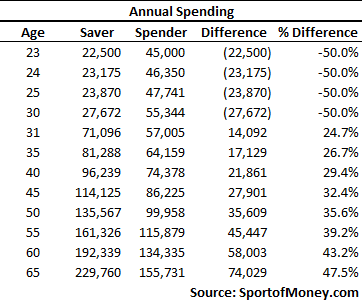

You can see the annual spending by both these people side by side. Michelle is the saver and Charles is the spender.

For the first 7 years out of college from age 23 to age 30, Charles spends all his income. This results in a greater financial lifestyle for Charles in his 20s when compared to Michelle.

At the age of 31, Michelle decides to also tap into some of her savings by using some of the positive returns generated from her savings to enhance her lifestyle. She is disciplined and uses only 30% of her return on savings.

You can see that the financial lifestyle gap between Charles and Michelle starts to come down at age 31, narrowing to a 6% gap by age 40. At age 45, Michelle has more money to spend. From that age on, Michelle’s spending budget increases at a faster rate than Charles.

By the age of 65, Michelle’s annual spending budget is 40% greater than Charles’s annual budget. That means Michelle can have a lot more fun in her 50s and 60s than Charles.

For the first 20 years out of college, Charles can spend more money but for the next 30 years, Michelle can. In addition, Michelle was able to accumulate $3.4 million in savings during this time.

When it comes to lifestyle inflation and being able to pay for it, Charles had a bigger spending budget early on but Michelle ends up with a bigger budget later on.

As we all know, spending picks up in our 30s with potentially a home purchase and kids. It is hard to wait until mid-40s to get to the “break even” point while spending less each year from age 23 until then.

So the above scenario for Michelle isn’t necessarily the best to be in given that it takes Michelle until mid-40s to catch up to Charles in her spending budget.

Let’s examine another scenario if Michelle changes her savings and spending habits.

Michelle2.0, The Spending of A Good Saver In Her 20s

What happens if we decide to live life a little bit longer as a college student when we start work full time? Living and spending as if we are still in college isn’t the end of the world if done during our 20s.

After all, the share of American young adults living with their parents are the highest in 75 years. 33% of 25-29 year olds lived with their parents or grandparents in 2016 according to Pew Research Center. Therefore, there should be little shame to living like a college student even into your late 20s.

But who wants to live like a college kid in our 30s? We know we need to spend more in our 30s given the prospect of homeowner, kids and just overall enjoyment of life. If nothing else, we should spend more just to feel progress (yes, I am not against spending more if your financial situation can afford it – in fact, I encourage it!).

I reworked Michelle’s budget to look like the table below. Michelle is aggressive in her savings in her 20s. Michelle saves 50% of her post tax salary from age 23 to age 30 (8 years in total). With lifestyle inflation in her 30s and on, she finds it hard to save any more of her salary.

In fact, with a couple of kids at home, she decides to tap into the return generated from her savings as well. She decides to spend 50% of the annual return generated from her savings. As an example, at age 31, her savings generate a return of $28,000. Michelle decides to keep half of that in her savings and to use half in her spending budget.

You can see her spending jumps from $28,000 at the age of 30 to $71,000 a year later. That is a nice increase in her annual budget for spending. It should give her a nice financial bump up in addressing the more taxiing financial demands of life in her 30s and beyond.

Even with the increased spending after her 20s, Michelle is still able to accumulate $1.5 million in savings by the age of 65.

Let’s Compare the Spending of Michelle2.0 Against Charles

Once again, the saver column is Michelle2.0. The spending of Charles is listed under spender. As you can see from the table above, while Charles is spending every cent he made in his 20s, Michelle decided to live a lower key financial lifestyle.

Michelle spends only half of the amount in her 20s. But let’s look at age 31 and beyond. That is when the need for spending ramps up. Michelle is able to spend 25% more than Charles at the age of 31.

That spending amount increases year after year. By age 40, Michelle is able to spend 30% more than Charles and by 60, a 40% plus excess. That is a nice increase at a time when she needs more money. This is unlike spending money in her 20s which would have gone to more frivolous purchases.

Even with the bigger financial budget in her 30s and on, Michelle is still able to retire a millionaire by age 65. Charles, on the other hand, has to rely on Uncle Sam for his livelihood in his old age having spent every cent from each of his paycheck.

This illustrates that, because of lifestyle inflation, savings is even more important in your 20s. By saving and investing more in your 20s, you can set yourself up for a greater financial lifestyle in your 30s and beyond.

To the audience: If you lived like a college kid in your 20s, how did you feel about it? At what age did you experience the greatest lifestyle inflation?

Many people work hard to better their physical and mental health. What about their financial health?

I started this blog back in 2019 to help people better their financial health as well.

My financial journey began with tens of thousands in student loan debt. Over the span of 20 years, I am close to achieving financial independence.

I truly believe anyone can get to strong financial health. Hopefully, this blog can help you on your financial journey to greater wealth and financial independence.

You can read more about me here.

Thank you for visiting. Come again soon!

I wish every late teen could read this and do the math. Compounding is king.

I tried to counsel some average middle class folks on what their teen should do about college. (They asked for my advice, because they know I’ve done “Ok”, but have no idea I blog or am a multi-millionaire). I recommended their daughter go to a community college for first two years. The parents had saved about 30K for college. Their plan was to let her choose. She wanted to go to an out-of-state college (more money) and get away from home. I “begged” them not to. I even separate spoke with her father that she didn’t even have to go to college. They could simply invest the money for her and it would go a LONG ways. She went – she blew the 30K within the first year living on campus – she quit college – she came back home, and now is going to beauty school. 30K down the drain, and she had to take out loans for beauty school. THESE types of decisions are what kill the middle class.

Very insightful and particularly relevant for me. I aggressively saved the bulk of my after-tax income during my first decade out of college. I am now in my early 30s with over $2M to my name as a result of simply saving and being the beneficiary of a very robust equity market. Now that I am in my early 30s, married with a family, my temptation to spend has dramatically increased.

Having the nest egg, will certainly make it more tolerable assuming my savings rate decreases.

Living in the NYC area, my challenge is just trying to figure out the appropriate balancing act. I have have continually emphasized saving aggressively, now that I want to indulge, just hard to know what that the perfect balance should be. Raising a family in the NYC makes it difficult to retire relatively early and have a very good life. Given that, one might say that we might as well just maximize living and not be so concerned with saving aggressively, knowing I already have the

decent savings base etc.

Thanks again for all the content and happy Father’s Day weekend.

,

Belated Happy Father’s Day to you too!

You are at a great spot having accumulated $2 million in your early 30s. I say increase your spending percent and give yourself the reward for all your hard work. But it is hard to strike the balance of wanting to continue to save aggressively and opening the floodgate to spend. Increase your spending while still leaving a good savings percentage you are happy with (some dry powder for when the market turns).

I’ve increased my spending drastically (probably doubled my spending) from my early 30s to my late 30s but I still save a very healthy percentage of my savings. I was able to do that because my income from work increased drastically during this period and my rental income provides additional “fun money” for me.

Once I reach FI (probably in a couple of years) and can maintain a minimum life style I am happy with, I plan to open up my spending floodgate (maybe increase my spending by another 50% or so) to reward myself for reaching FI.

Really powerful visuals in this one!

Something about investing ‘only’ $50,000 and getting $3 million seems impossible to me (as a 25 year old), but your math backs it up. Awesome post!

Time is on your side!

Hey Rich!

Just wanted to stop by and say we’ve featured you on Personal Finance Blogs. I can’t find an email or a Twitter handle, so this is how I’ll congratulate you 🙂

Hope you have a great rest of your Friday!

Great – thank you for much for the increased exposure.