I strive hard for financial independence (FI). This is probably typical of a lot of personal finance bloggers out there.

In order to reach FI, I need to have my passive income be at least as great as my household expenses.

That passive income needs to be net cash on an after-tax basis. The after-tax part has a huge impact given that income taxes are usually the number one expense for high income earners.

For those who follow this blog, you already know that I am a huge fan of real estate.

I believe real estate should be the cornerstone of everyone’s investment portfolios. There are many advantages to owning residential real estate such as the usage of leverage, buying below market price, and tax benefits.

It is no wonder I own greater than 20 rental units with most located in New York City. I am also actively looking to add to my rental real estate portfolio at the moment, despite the pandemic.

Real estate is also the main pillar of how I plan to achieve FI. I hope that one day my rental income will be greater than my household expenses.

Don’t Be Fooled – Real Estate Is Not All Sunshine

Real estate income isn’t truly 100% passive. There is the occasional work on managing rentals, especially if you own greater than 20 units.

I got calls from tenants during the worse times such as at vacations or at the movies.

I still think the payoff is well worth the work necessary to maintain those investment properties.

The cash flow stream from my rentals has been stress tested by recent events.

In April, the collectability of my rental income hovered around 60%. Then it went up to 80% in May. It was around 85% for the month of June.

From what I’ve read, I am pacing below what the average rent collection is for New York City. But this also gives me an opportunity to see how I can improve the stability of my rental cash flow the next time an economic crisis hits.

Nevertheless, the rent delinquency doesn’t taper my desire for more rental properties. Ironically, it almost strengthens my desire now that I have a better sense of the downside case for the stability of my rental income.

I have a few ideas also on how I can better position my rental portfolio in the future.

Cash On Cash Return Is The Reason Why I Am Still A Big Fan Of Real Estate

At the end of the day, I am still a big fan of real estate. The biggest reason is the cash on cash return profile I can obtain today.

According to Investopedia, a cash on cash return is defined as:

“A rate of return often used in real estate transactions that calculates the cash income earned on the cash invested in a property.”

The cash invested in a property is the cash out of your pocket. It does not take into consideration the cash the lender provides in the form of a mortgage.

As an example: You look to buy a rental property for $200,000. You plan to put down 20% and borrow the other 80%. Closing costs amount to 2% of the total purchase price.

Your out of pocket cash on the 20% is $40,000. The mortgage amounts to $160,000. The out of pocket cash (down payment) and the mortgage add up to the $200,000 purchase price.

The closing costs come out of your pocket and, in this example, amount to $4,000. The total cash out of pocket from you on this property is $44,000 (the 20% down payment plus 2% closing costs).

If the annual cash flow from the property is $4,400, then the cash on cash return is 10% ($4,400 annual cash flow over $44,000 out of pocket cash).

The annual cash flow from the property is the net cash you receive from renting out the property and is after all operating expenses.

Given the current low interest rate investment, I believe residential real estate presents great cash on cash return.

The last couple of real estate purchases I’ve made should yield at least a 10% cash on cash return.

I will shoot for a 10% cash on cash return on future purchases as well.

Is 10% Cash On Cash Return Even Good?

I think a 10% return for an investment is attractive in today’s low interest rate environment.

Fixed income products are financial instruments which provide a fixed rate of return to the investor. Investments in Treasury Bills, munis and bonds are fixed income investments.

Let’s examine what you can reasonably expect to receive when investing in those different types of fixed income instruments.

The US 10 Year Treasury is hovering around 70 basis points (7/10th of 1%). That is the yield you can expect to receive when you hold a US government issued bond for 10 years until maturity.

There is of course price fluctuation that can happen during this timeframe. But if you hold the Treasury for 10 years, you can expect to receive a return of 70 basis points a year for the next 10 years.

In my mind, US government issued debt is the closest thing to being risk free as possible. The low return is reflective of that.

There are bank accounts which pay a higher interest rate. Nerdwallet has a list of high yield online bank accounts. I see a number of online bank accounts paying a 1% interest. This doesn’t include any lock-up of the money like in the form of a CD.

Nerdwallet also has a list of high yielding CD rates. Some 3 year to 5 year CD rates are yielding a bit better than an online account at up to 1.5%.

As you move up the risk spectrum, the return increases. Single B bonds are yielding under 7% today.

The 10% cash on cash return is superior to those other alternatives as a periodic cash flow generating product.

An Investment Property Example For 10% Cash On Cash Return

Step #1: Start With A 6% Capitalization Rate Investment Property

The first step is to identify an investment property that produces a 6% capitalization rate (cap rate in real estate industry jargon).

The cap rate is the net operating income (NOI) of a property to the market value of the property.

Now there are situations where the market value is higher than the purchase price. In those instances, there is built in equity. But in this example, I assumed the market value is the same as the purchase price.

The net operating income is the rental income less all operating expenses of the property including vacancy, management fee, real estate tax, and insurance. It does not take into factor financing costs such as the interest expense on a mortgage.

The higher the cap rate, the higher the return on a property. Obviously, there is never something for nothing. A higher cap rate usually means the property is located in a less desirable location or the property needs work.

All things being equal, the higher the cap rate the better.

Step #2: Stick With A Residential Rental Property

I like residential properties above some of the other commercial properties. I am not a fan of retail space and office space.

It is not hard to imagine more firms are allowing remote work situations as technology continues to advance on video conferencing capacities and online group work applications.

The pandemic has given a lot of companies a test run on having people scattered across geographic locations. My belief is that a lot of those companies are discovering that a remote work setup is quite possible going forward.

Therefore, I believe there is less demand going forward for office space.

Amazon is destroying a lot of retail shops. With the pandemic, more people are buying items online. I can’t see them going back to shopping in person for a lot of the items they are purchasing online now even when things return back to normal.

Hence, I believe there is less demand for retail space going forward as well.

Multi-family residential rentals are what I favor over other real estate properties. I believe housing will always be needed.

The cap rate for multi-family properties is lower than other rental properties. The average cap rate comes out to 5.11% overall based on CBRE Semiannual U.S. Multifamily Cap Rate Survey for H2 2019.

But that doesn’t mean a 6% cap rate property is not possible. A little patience plus being selective can get you there.

I don’t buy a lot of rental properties in a year. It has been one or two per year. Therefore, I can wait for a property which meets my investment criteria.

6% cap rate isn’t out of the question, even for a property in New York City.

Step #3: Obtain An Interest-Only Mortgage With A Low Down Payment Requirement

Financing is really inexpensive today given the low interest rate environment.

I like to buy real estate because it provides for cheap leverage. After all, Warren Buffet got rich by having access to cheap capital for investment. Who better to learn and follow than the Oracle of Omaha himself?

The low rate of interest is a reason why I like the idea of obtaining as much financing as possible.

I spoke with a mortgage banker recently. A 30 year fixed rate mortgage for a rental property can be had for 3.4%. This is for a bank that is interested in keeping the mortgage for its own portfolio. Going through a Fannie program would cost a lot more.

The quote for an interest-only 10/1 ARM is 3.25%. This is with $75,000 deposited at the bank. The more assets I can bring over to them, the better the rate.

The bank is willing to reduce the interest rate by ⅛ of 1% if I transfer $250,000 in assets to them. One quarter of 1% off for $500,000 in assets and half a percent off for $1 million in assets.

I believe interest-only is very attractive in today’s environment. For an interest-only 10/1 ARM, only interest payments are required for the first 10 years. The payment of principal is optional during this period.

I like not paying principal on the mortgage when interest rates are so low.

The cash flow of the property increases when it is an interest-only mortgage.

The down payment required on this mortgage is 35%. The bank is willing to lend 65% of the total purchase price.

I can pay a quarter of 1% upfront to get the down payment down to 30%. The more I can borrow at such a low rate, the better for me.

Step #4: Calculate Closing Costs

The down payment isn’t the only cash outlay on a purchase. There is closing costs as well on a purchase. Potentially, there can also be renovation costs.

In New York City, we have a number of closing costs that make purchasing a property expensive to do.

There is the mansion tax for properties purchased at $1 million or above. Unfortunately, $1 million no longer gets a New Yorker a mansion.

But of course, the state never changed the $1 million threshold. In fact, they recently increased the mansion tax rate to make it more expensive to purchase a property in the millions.

There is also a mortgage recording tax, title insurance, and attorney fee.

I usually factor in 3% closing costs for a purchase at my price point. Obviously, different localities have different closing costs.

I added in a quarter percentage point to my closing costs number to get the down payment requirement down to 30%.

Do some research for what your closing costs is on a purchase.

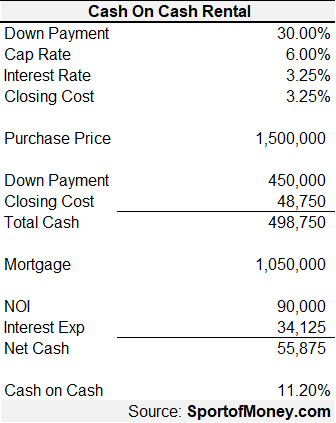

A 6% cap rate property with 30% down and 3.25% closing costs with an interest-only mortgage at 3.25% results in an 11.2% cash on cash return.

This is before any income tax payment.

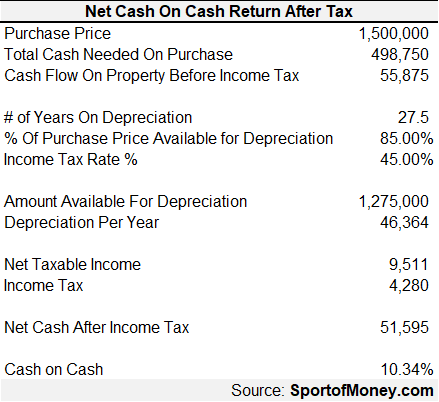

Step #5: Depreciation Is Key To Lowering Income Tax

This property is generating around $56,000 a year with a cash outlay of approximately $500,000.

Real estate has a lot of great tax advantages.

A key one I rely on to help reduce income tax on rental income is the ability to deduct depreciation.

Depreciation is a cashless tax expense. That means I can take a tax deduction for depreciation without having to actually pay anything in cash.

Depreciation is the key for me in generating a 6-figure cash flow across my rental portfolio and having zero income tax.

Being able to deduct the depreciation expense is also how we can lower the income tax impact on this property.

If you received $56,000 in income from your job, you will have to pay income tax on that full amount.

But due to depreciation, in our example, the $56,000 is reduced by $46,000 of depreciation expense. This results in only $10,000 of taxable income.

Assuming a 45% income tax rate, the total tax bill comes out to $4,500 on $56,000 of income. That is a rate less than 10% on the net rental income.

The cash on cash return on an after tax basis is over 10%.

The beauty of this cash flow is a few folds. There is some relative stability to rental income. Additionally, rental income has historically moved up along with inflation.

That means over time, the rental income will get higher. But the interest expense on the mortgage is fixed for 10 years on a 10/1 ARM. This will result in a higher cash flow in the later years.

Call that the cherry on top.

Step #6: The Total Return Is Even Greater!

But wait – there is more. I feel like an infomercial personnel selling you the latest pot set.

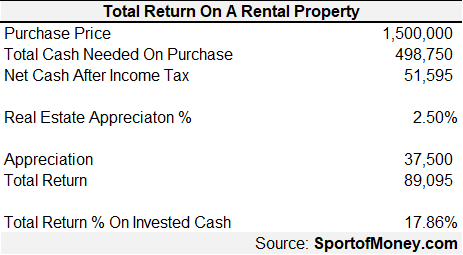

10% is only the cash on cash return. It does not represent the total return.

There is also appreciation on the rental property. Historically, rental properties have appreciated at the rate of inflation.

Certain neighborhoods have done significantly better than inflation in New York City over the past 20 years because of the increase in desirability of living in NYC and also gentrification.

Assuming an appreciation rate of 2.5% which is roughly the rate of inflation, it juices the total return to 18%.

While the property increases only 2.5%, the return on your cash is a lot higher due to leverage (aka the mortgage).

How awesome is a 17.8% return per year. Over a 10 year span, you can expect your cash investment to increase by 5 folds. In 25 years, your cash investment will increase by 60 times.

$100,000 at 17.8% return per year will be over $500,000 in 10 years and over $6,000,000 in 25 years.

Final Thoughts

Many people have gotten rich off real estate. I want to show what I do to obtain 10% cash on cash return and total return of close to 18% return.

While it isn’t always easy to find a 6% cap rate property, be patient and wait for the right deal. Definitely take advantage of the cheap financing out there.

I am still looking to add to my real estate portfolio even with over 20 rental units to my name.

To The Audience: Are you generating greater than a 10% return on your cash? If yes, how? What cap rate are you seeing on your rental properties? Have you recently looked into financing for a rental property? What mortgage terms are you seeing?

Related Posts – Real Estate Topics

5 Ways To Acquire Real Estate For Less Than Market Value

How To Maximize Rent And Other Considerations For A Vacant Rental Unit

Hidden Expenses To Owning Real Estate

How One Person Built A Real Estate Empire With Little Money To Start

The Risks Of Buying Rental Real Estate Properties In NYC During The Pandemic

Real Estate Should be Cornerstone of Your Investment Portfolio

$400,000 Income, No Taxes Paid

Many people work hard to better their physical and mental health. What about their financial health?

I started this blog back in 2019 to help people better their financial health as well.

My financial journey began with tens of thousands in student loan debt. Over the span of 20 years, I am close to achieving financial independence.

I truly believe anyone can get to strong financial health. Hopefully, this blog can help you on your financial journey to greater wealth and financial independence.

You can read more about me here.

Thank you for visiting. Come again soon!

Hey Rich,

Who do you talk to at your bank to negotiate interest rates when bringing assets over as you described?

Dom

I talk to the mortgage specialist at the bank. You can get to a mortgage specialist by talking to your relationship banker.

The mortgage specialist usually volunteers any special discounts happening at the bank. But it also doesn’t hurt to be proactive and ask if they offer any rate discounts when assets are brought over.

Assets typically have to be at the account during close. But after close, you can move the assets away if you so desire. Therefore, you can use the same assets and move them around to different banks to get lower rates on different mortgages.