There are times when seemingly insignificant, small action can led to a big impact in your life.

One such action might be deciding to strike up a conversation with that stranger while waiting on line at Starbucks. 3 years later you might end up marrying that stranger. That small action of saying hi to a complete stranger has completely altered your life.

There are small actions which can also produce a huge financial impact. I can give you one small action which changed the path of my professional life.

After graduating college, I started work at my first corporate job. My focus was on the banking industry and I had a slate of banking clients. It wasn’t until a few years in that I had a seemingly insignificant conversation with my girlfriend at the time (now wife) about the industry she was covering.

She was covering the alternative asset management industry. I didn’t know much about that industry and she provided me with information about it. But what stuck in my mind was when she mentioned a few people at one of her clients and how much those people were making.

Based off of that conversation, I then decided to focus my time and energy in the alternative asset management space. I’ve been working in this industry for the past 15+ years and have built my career in that industry.

Obviously, entering the alternative asset management industry has a great impact to my financial life. That one seemingly short conversation (in particular how much certain industry professionals made) I had with my wife changed my career path. It was a small action but resulted in a big impact, especially financially.

This got me thinking – are there small actions I have taken which produced an outsized financial impact relative to the action?

Small Actions Taken

The answer to my own question is yes (isn’t it great I can ask my own question and be able to answer it at the same time?). I’ve taken small actions which resulted in a big financial impact.

Now the resulting financial impact from some of those actions is not fully within my control. I could have been better off or worse off depending on market condition and environment. But I do want to highlight them to you so that you can (1) take them into consideration and (2) take action when appropriate.

Small Consideration Of Where To Live But Giant Financial Impact

Choosing where to call home is both a mix of emotional endeavor and your budget. But one thing I don’t think people spend too much time thinking about is the future appreciation potential of the home. I think that becomes an afterthought and a small consideration.

However, the choice of location can greatly impact your financial life.

Prior to kids, my wife and I had numerous discussions about where to live and what neighborhoods are great for starting a family.

Should we stay in New York City or move out to the surrounding suburbs? This is a classic debate many families in New York City go through.

You probably already know how the debate goes. There are pros and cons for each.

The primary pros in moving out to suburbia on our list are as follows:

⇒Houses sell for a lower price per square foot. Therefore, at any given budget, you can get a bigger house in suburbia versus getting one in New York City.

⇒Suburbia has better public schools. A lot of New York City public schools are not performing to standard. Attending private school in New York City costs an arm and a leg.

⇒There is more yard space. My kids can run around in the back. We can set up a swing and slide set out back. Maybe we can even buy a house with a pool and a hot tub.

The primary cons in moving out to suburbia are as follows:

⇒The longer commute. My wife and I already work long hours and to add a longer commute (maybe 30 to 45 minutes more) would be very painful. Additionally, it would be harder to attend school events given the longer commute time. Obviously, with 3 kids, it is best to free up as much time to spend with them as possible.

⇒Lack of convenience. Instead of being about to run out and buy something we need at almost any hour of the day by hitting Duane Reade or CVS down the block, we would have to drive to get groceries or toiletries. Living in Manhattan, you are hardly ever more than a 5 minute walk away from food, grocery, toiletries and other everyday necessities.

⇒With a bigger house, front yard and back yard, maintenance becomes more time consuming. Keeping the house clean, leaves raked, gutters cleaned and other maintenance work can dominate the weekends. An apartment in New York City would greatly reduce this level of maintenance work.

Home Purchase Price Comparison And Financial Impact

Let’s examine 3 different locations I could have purchased when home shopping 10 years ago: Greenwich Village, Scarsdale, and Park Slope.

Greenwich Village is located in Downtown, Manhattan. There is a high degree of convenience living in Greenwich Village. There are shops and restaurants everywhere. A starter townhouse will set you back $6 million. Unless you have that much coin to spend, apartment it is.

Scarsdale is a town located in Westchester New York. It is a very nice suburban town located about 1 hour from Midtown Manhattan. A lot of well-to-do commuters to New York City live in Scarsdale. It has a great and highly ranked public school system.

Park Slope is located in Brooklyn New York. It is about a 40 minute commute to Midtown Manhattan by subway. As the name implies, there are a nice number of parks in Park Slope which is great for raising a family. There are restaurants and shops in Park Slope as well which makes it high on the convenience factor.

Choosing where to live is a very personal decision. One weighs the pros and cons of different areas and neighborhoods. Sometimes it is about the feel of a particular place and where you feel most comfortable.

The economics, outside of the budget for the home price purchase and real estate taxes, play little to the decision process. I know very little people who think about price appreciation potential as a factor for where they want to buy.

But choosing where to live can result in vastly different financial outcomes.

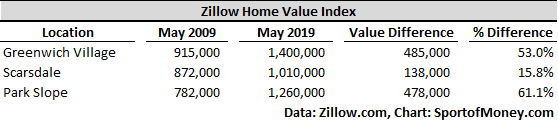

According to the Zillow Home Value Index, Greenwich Village appreciated 53% over the span of the past 10 years (from May 2009 to May 2019). Scarsdale went up 15.8% during that span. Park Slope did even better than Greenwich Village by appreciating over 60%.

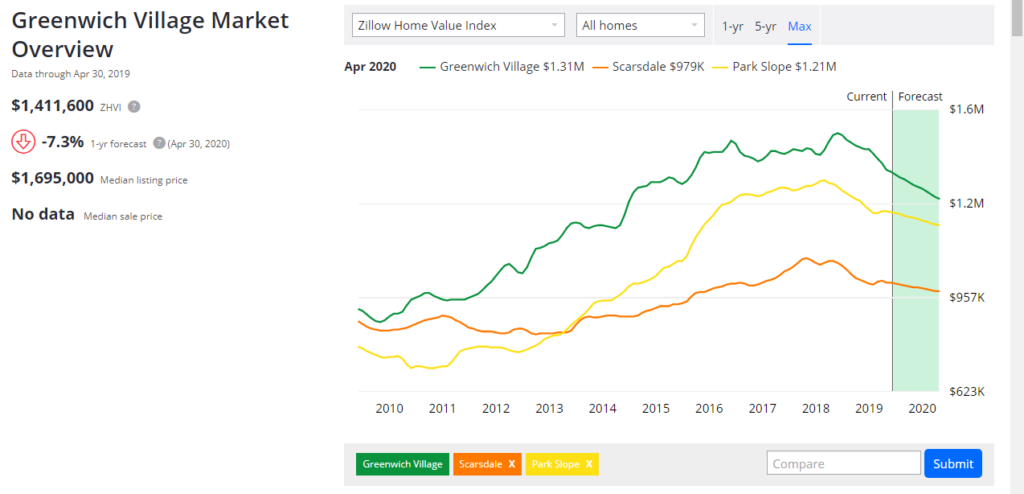

The chart below shows the comparison in how the home value trended over the past 10 years. Greenwich Village is in green, Scarsdale is in orange and Park Slope is in yellow. As you can see, Park Slope has the steepest increase, then Greenwich Village and, lastly, Scarsdale.

That is quite a difference in how the real estate market did.

If my budget was $1 million back in 2009 for a home purchase, the appreciation for a Greenwich Village home would have been $530,000, a Scarsdale home at $158,000 and a Park Slope home at $611,000.

The difference between choosing to live in Greenwich Village in Manhattan or Park Slope in Brooklyn versus moving to suburbia can result in a $370,000 to $450,000 increase to my net worth in the past 10 years.

What seemingly might be an afterthought – what is the appreciation potential of my house – can result in a significant net worth difference.

Therefore, during your next home purchase, do not forget to factor in the appreciation potential for the different neighborhoods you are exploring.

Moving Ahead With Mortgage Refinancing

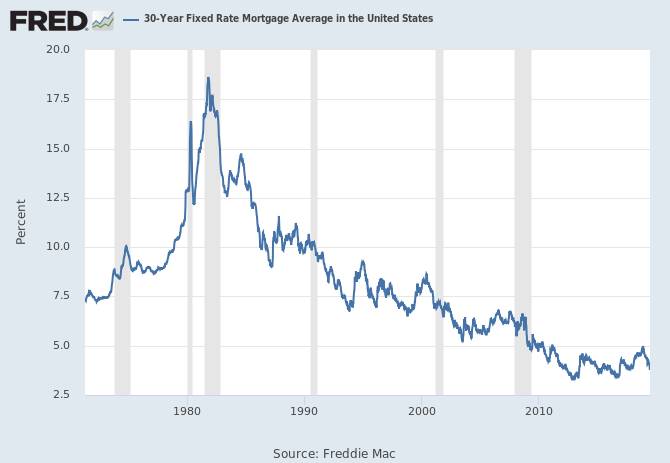

Mortgage rate has come down recently. The table below shows the 30-year fixed rate mortgage average in the United States going all the way back to April 1971.

You can see that the current 30-year fixed rate mortgage is approaching its historic lows. It has come a long way down from the peak in early 1980s.

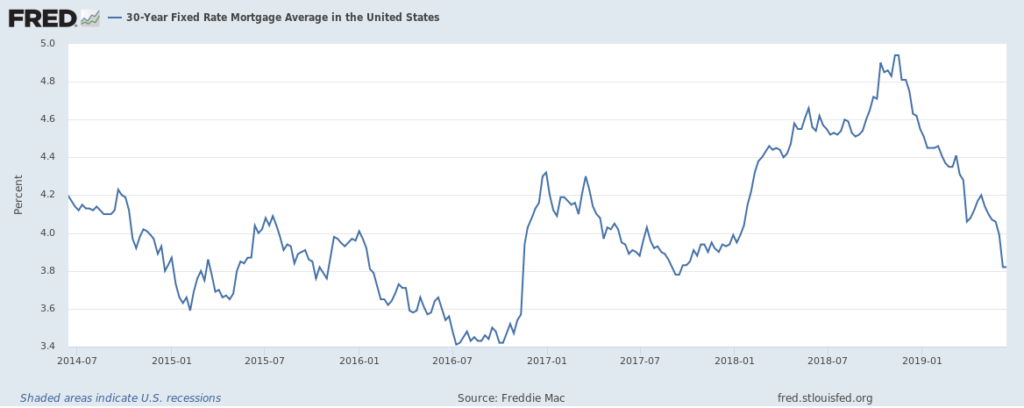

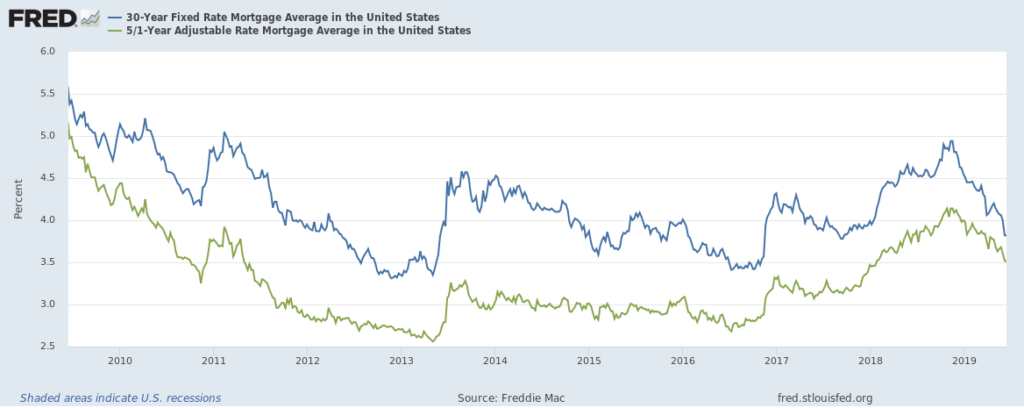

Here’s a closer look at the 30-year fixed rate mortgage average in the United States over the past 5 years. While it isn’t at the lowest point today, it has dropped from the highs in late 2018 by over 1%.

Given the low mortgage rate environment, I am refinancing my primary mortgage. My rate will drop by 0.75% and my bank will provide me with a credit at closing which should cover all my closing costs.

Basically, I have no cost to go through the refinancing except for time spend on the application and underwriting process. I should save over $1,000 on my monthly payment after the refinancing.

The small action of refinancing my mortgage can result in over $12,000 of cash in my pocket a year for the next 30 years. Now that is an action that is worth taking.

If you haven’t done so already, go and give a few banks a call to explore refinancing your mortgage rate to see how much lower your monthly payments can become. Ask them about the credit back at closing as well.

Then run the numbers to see if refinancing makes sense to you. If you got in during the highs in late 2018, it should be worthwhile for you to refinance at this point given the more than 1% decrease in rates.

Mortgage Financing – Choose Your Options Wisely

While on the subject of mortgage, choosing the right financing option can have a big impact on your financial position.

As you probably know by now, I’m a big fan of real estate investments. I believe real estate should be the cornerstone of your investment portfolio. It most certainly is for me.

That is why I started investing in rental properties a decade ago. I tend to be conservative in my investment approach. I don’t have a lot of leverage on my investment properties.

But for the ones in which I have taken out a mortgage, I went with the 30-year fixed rate mortgage. As you can see from the chart above dating back to the past 50 years, we were at a historically low mortgage rate environment during the 2010s.

As a conservative investor, I wanted to lock in my rates for the next 30 years. Therefore, I opted for 30-year fixed rate mortgages on my rental properties.

However, rates haven’t gone up in the past 10 years. In fact, they have come down. See the chart below.

Instead of selecting the 30-year fixed, I could have gone for the 5/1 Adjustable Rate Mortgage (ARM) on the investment properties.

The spread between the 30-year fixed mortgage and the 5/1 ARM reached about 1.5% in late 2013 to early 2014.

If I have selected the 5/1 ARM instead of 30-year fixed rate mortgages for my investment properties, I could have saved myself about $1,000 a month at a 1% spread. That is $12,000 down the drain because I decided to go with a 30-year fixed instead of a 5/1 ARM on a few of my mortgages.

Be knowledgeable and mindful of the mortgage rate option you choose. Choosing the incorrect one can be costly. This might seem like a small action but, depending on your mortgage size, can produce a big financial difference.

Increase Your 401(k) Contribution Percentage

In addition to being a big fan of real estate, I am also a big fan of investing early into your retirement account. After all, that is how I became a 401(k) millionaire in my late 30s.

Increasing your 401(k) savings, especially early on, will go a long way in helping to juice your retirement balance.

I maxed out my 401(k) contribution during my first year.

Increasing your retirement contribution by $3,000 a year or $250 a month can have a huge impact on your retirement balance. At a 10% annual return, the $3,000 annual contribution over a 35 year can grow to over $800,000.

An addition $3,000 per year works out to be a 5% increase to your contribution as a percentage of salary in your 401(k) based off of a $60,000 annual salary.

While increasing your 401(k) contribution amount seems like a small action, the resulting financial impact can be sizable. Go and increase your 401(k) contribution percentage today.

Set To Automatically Invest Your 401(k) Contributions Into Investments

I’ve had stock exposure in my 401(k) account since the beginning. I believe strongly in the performance of US listed equities. I automated my account in such a way that when a dollar gets contributed into my 401(k) account, that dollar goes into an S&P 500 index fund.

I’m glad that I set the auto investment. To leave my money just sitting in cash after contributing it to the 401(k) plan defeats the purpose of saving the retirement money in the first place. If the money is not invested and put to work, it will most likely just lose its buying power.

For each year you don’t invest the money, you will be able to buy less and less material goods or services. Conversely, investing it can result in a large return difference.

It is important to put your money to work. Money earning a 10% return (approximately the average annualized total return on the S&P 500 over the past 90 years) versus sitting in cash, over an extended period of time, can produce a sizable difference.

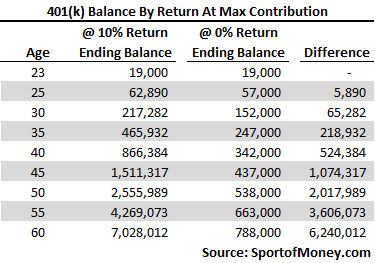

The above table shows someone contributing the maximum amount into the 401(k) account since the age of 23 and continued all the way to age 60. The first column shows what the balances will be at different ages given a 10% annual return. The second column shows what the balances will be at different ages given a zero percent annual return (i.e. money sitting in cash).

As you can tell by the difference column, the differences can be staggering if you are able to obtain a 10% annual return versus not putting the money to work and holding it in cash. By the age of 60, investing in the S&P 500 can produce over $6,000,000 of total value.

Do not just leave your contribution amounts sitting in your 401(k) in cash or money market, put the money to work. It might seem like a small action to set up the automatic investment allocation, but it can have a multi-million dollar impact.

To the audience: Were there any small actions you have taken which resulted in a big financial impact? Can you think of any more small actions our readers can take which can propel them far along on their financial path? Have you done any of the small actions above and how have they impacted you?

Many people work hard to better their physical and mental health. What about their financial health?

I started this blog back in 2019 to help people better their financial health as well.

My financial journey began with tens of thousands in student loan debt. Over the span of 20 years, I am close to achieving financial independence.

I truly believe anyone can get to strong financial health. Hopefully, this blog can help you on your financial journey to greater wealth and financial independence.

You can read more about me here.

Thank you for visiting. Come again soon!

Thanks for another great post. As I commented in your last post, I am in my early 30’s and just started a family. I am absolutely agonizing (perhaps like no other decision in my life) where I should ultimately raise a family. Ironically, I am considering a townhome in BK, apt style living in Manhattan, or a single family home in the Greenwhich/WestChester area. We are currently renting now.

The potential appreciation is certainly a large variable in our decision making process as well as many of the other factors you laid out. I honestly don’t know what makes the most sense. The ability to utilize public schools is an enormous pro as well as not being subject to city income taxes assuming we are out of the city.

However, it’s hard to justify buying in those areas especially after the SALT cap. I can’t imagine much appreciation, if at all, over the next 10 years as folks continue to find refuge in lower COlA/tax friendlier states. The city may hold up better price wise, but being subject to city/local income taxes (likely only going to go higher) and the potential astronomical private school tuition gives me pause. Not sure we could/want to pay for multiple kids in PS.

It seems to me my best options would be Greenwhich if I go the burb route given property taxes are so much lower than WC county similar properties. However, the schools, from what I understand, aren’t as robust as WC. Assuming I stay in the city, renting seems like the best value or going

the multi family/duplex route in BK/Queens and occupying one of the units.

I am so torn and have no idea what’s best. I would sincerely appreciate any feedback/advice you would have if you were in my shoes. As stated in previous comments, I have saved multiple millions (all saved in first decade working through income savings/investing) and could comfortably afford a $10Kish monthly housing nut.

Thanks again!

J

J – I think you are in an enviable position to be able to have choices given your financial position. Ironically, sometimes it gets harder the more choices we have.

At the end of the day, when my wife and I were deciding on where to live, I thought about what is most important for me and my family. My wife went through the same analysis. And fortunately for us, we were on the same page as to what is most important to us. When my wife and I thought through it all, what we really value is time with family. We want to maximize family time and being there for our kids as much as possible above all else. Hence, we decided to stay in Manhattan to shorten the commute to work and to free up as much time for family activities during the weekdays. We were willing to take the cons in exchange for the pros. Everything became clearer when we prioritized that as the most important factor on deciding where to live.

You (and your spouse) can ask yourself what is the single most important thing you want out of your home. Then go from there as opposed to trying to balance numerous items all at once.

I have thoughts about each of those locations. Since they might be unique to your situation, just let me know if I can email you my specific questions or thoughts.

Good luck with your decision. But given how much thought you have already put in the decision making process, I’m sure you will make the right choice!

Another great read, Rich.

>>Were there any small actions you have taken which resulted in a big financial impact?

I like the compounding that CONTINUOUS small actions make. I try to get at least one positive movement made per day. A movement being something that grows my wealth or makes my life better. I haven’t taken a day off from that since I don’t know when. It all accumulates to thousands of positive steps forward. You’re either moving forward or backward in life.

As for a small, seeming insignificant action that had a tremendous impact on my life…

Back in early 2000/2001, I was doing training and consulting nationally on a niche software product. A competitor’s previous employee (who had recently been laid off) contacted me for a job. As we were chatting, she mentioned to me that my competitor had recently created a software utility related to this niche software we both consulted and trained on… and that he had recently sold a site license for the utility for $2000. I though wow, I could build one of those utilities, and an extra $1000 or $2000 a month would be great. That one idea led to other software utilities for this niche software product, and I now make $700,000/year in SAAS/subscription revenue. When I began it would have been a dream just to make $24,000/year in software revenue; now it’s 30x that just in recurring revenue (and I was able to stop travelling and doing consulting and training sometime around 2008 or so).

It’s really interesting what a big impact can come from seemingly random conversations. I wonder if the person who mentioned that her previous employer made some money selling a site license for the utility knows that she led you down this path of a career and great financial freedom.

Sometimes, we don’t also fully understand or see the full extend of our impact on others. We might have significantly altered other people’s lives through small acts and don’t even know about the degree of the impact.

Rich,

Thanks for the detailed response, much appreciated. I have a tendency to obsess over large decisions at times, but can’t remember a more agonizing and daunting choice. Your suggestion is very helpful and an interesting way to frame the decision making process.

I would be sincerely grateful to continue the discussion via email. You can always email me privately with any specific questions/thoughts. Thanks again for your willingness to help.

J