By now, it’s no secret I believe real estate should be the cornerstone of your investment portfolio. There are many benefits to owning rental properties. Those benefits include the ability to use leverage to enhance your return, a steady stream of cash flows in the form of rental payments, the ability to acquire real estate under market value, and the various tax benefits. With all those benefits, there are very little reasons why you shouldn’t explore putting money in real estate.

Real estate investments also provide me an opportunity to pocket $200,000 a year without paying a cent in income tax. If that isn’t music to your ears, then you must be deaf.

Getting Started – Take The First Step!

The key with building anything is to take the first step. For many, this is the hardest part and the reason why they will never be able to buy even one property let alone accumulate a real estate empire. If you want to build a real estate empire, you need to have the mindset of going ahead with it. It is very important to take that first step!

How One Person Built and Grew a Real Estate Empire to 30+ Properties in 10 Years with Little Money to Start

This post is about someone I am familiar with who grew his real estate portfolio to over 30 properties. He started with little money 10 years ago. Through the process described in the steps below, he was able to create a real estate empire over the span of 10 years. Of course, he wouldn’t deny that timing worked out great for him as well given that real estate prices appreciated nicely during the past 10 years. As he wants to keep his identity anonymous, let’s call him REED (Real Estate Empire Developer).

He describes his journey as a rocket ship blasting off from the Kennedy Space Center in Cape Canaveral. A lot of force and energy is needed to push the rocket ship away from the Earth’s gravitational pull during takeoff. But once the rocket ship is firmly in the sky, less energy is needed to continue the rocket ship’s trajectory up. Once the rocket ship hits outer space, a little force can push it a long way.

It was hard for him to execute on his first purchase. But he kept at it. Eventually, with each purchased property, it became easier and easier. The deals were also getting better and better. The hardest part was the initial takeoff. There is a lot to learn when you first approach buying your first real estate property.

Step 1: Get Educated

Reed came across an infomercial one night featuring a real estate guru by the name of Dean Graziosi. Dean talked about all the opportunities and potential for income from real estate investing. This peaked Reed’s interest in real estate. It was at that moment he decided to pursue real estate investment as a pathway for wealth building.

He knew that in order to be successful, especially with no prior real estate experience, he needed to get educated about real estate. He subscribed to one of Dean Graziosi’s real estate programs called Success Academy. It provided him with the basics about a number of real estate investment topics: how to source real estate investments; how to negotiate; what is involved in a purchase; the different financing options available; and the different ways investors buy real estate. Without the educational foundation, it would be hard for him to feel a level of comfort to pull the trigger.

Feeling comfortable is important. Think about being in a new neighborhood for the first time, such as while on vacation. You would be more wary of the environment and your surroundings given that it is new to you. Compare that feeling to being around the neighborhood you grew up in or have been living in for the past 5 years. You have a better sense of safety and comfort given your familiarity with the neighborhood.

Education in real estate provides you with a higher level of comfort. A higher level of comfort should result in the ability to make a decisive decision which should, hopefully, lead to action.

Step 2: Buying the First Property

Source the Property

Armed with education, the next step for him was to search for a property to buy. Given his limited funds 10 years ago, Reed needed to look for a location which was at the right price range. He researched different localities to see which would make the most sense for him. He finally decided on a few neighborhoods in the Philadelphia suburbs. Those neighborhoods were hit hard during the Great Recession and a lot of the homes were in disrepair and vacated because the owners no longer can afford the mortgage payments.

Additionally, it was important for the property to be local and within driving distance from his home base in New York City. The Philadelphia suburban neighborhoods are about a 2 hour drive one way. He can attend open houses or set appointments for viewing of a property over the weekend or at night. Once purchased, he can also physically check on the property and can manage the property without a property manager in place.

Properties, which once sold for $100,000 prior to the Great Recession, were now going for $20,000 after the financial meltdown in 2008. They were going for a fraction of peak prices. He saw that as an opportunity to put his limited capital to work.

Purchase the Property

He put in all-cash offers on a number of properties – at amounts lower than the listing prices. Now remember, the listing price for a property at this point in time in 2009 was already a lot lower than the peak price. But of course, when starting out with limited funds, you have to try to preserve as much of your capital as possible.

His hope was to play the numbers game. He made a few all-cash low ball offers and received a couple of counter offers. He then began the negotiation process on those. This resulted in him buying the best priced property out there. Once he agreed with the listing agent on the final purchase price and the terms, Reed then worked quickly to close on the property. His first property purchase is a single family house. He inspected the property and went back to the table to negotiate after receiving back an inspection report with issues. He was able to get a slight concession from the seller on price.

With an all-cash deal, he was able to close quickly. The purchase price for this first house: $20,000.

Step 3: Renovate

The house he first purchased was in need of repair. It was abandoned by the previous owners given they purchased it for a significantly higher amount and their mortgage was under water (the mortgage balance was greater than the value of the house). The previous owners didn’t think it would make sense to continue to make the mortgage payments on a property that is significantly underwater.

Reed contacted a few contractors and obtained bids on the project. He selected a contractor who he felt would be able to produce quality work in a timely fashion at a reasonable price. He spent $5,000 on the renovation.

Step 4: Rent Out the Property

Once the renovation was completed, he contacted local rental agents to put his house on the market as a rental. He wanted to rent out the property as soon as possible to get some cash flow in. Otherwise, he would need to cover the on-going costs of property ownership such as real estate tax payments, insurance cost and paying the utility bills.

He was successful in getting a renter. Since the house was renovated, he was able to get a renter in who can afford the rent payments. His rental income exceeded the amount for all the operating expenses for the property. He was cash flow positive on this property. This is not a surprise given he paid all-cash for it.

Step 5: Cash Out Refinancing

He knew he wasn’t going to be able to get rich off of one rental property. Additionally, he was all in on building a real estate empire. As previously mentioned, he had limited funds and, therefore, wasn’t able to buy another property without obtaining more capital. Reed needed a way to get more capital for his next real estate investment.

Find a Local Bank to Provide Investor Friendly Financing

He knew cash out re-financing of the property he just purchased is the answer. He needed to find a local bank with investor friendly financing options which would allow a high loan-to-value (LTV) of 75 to 80%, no seasoning requirements, and a low to moderate debt service coverage ratio preferably less than or equal to 1.25x.

Loan-to-Value Ratio

The LTV is the mortgage amount the bank is willing to provide as a percentage of the total market value of the property. 80% LTV means the bank is willing to lend $80,000 for a property valued at $100,000. On an all-cash property with no underlying mortgage, if a bank is willing to provide an 80% LTV mortgage, the owner can walk out of the closing room with an $80,000 check on a $100,000 property.

Now, the property was purchased for $20,000. Factoring in the $5,000 renovation cost, Reed spent $25,000 in total on the property. 80% of $25,000 is $20,000. A nice amount to have back for sure, but now he has even less of an amount to invest than when he first started (Reed had $25,000 in his pocket when he first started).

Seasoning Period

The property can appraise for a lot more given the renovation and he purchased a distressed property with all-cash. But because Reed just recently closed on the property, most banks look at this recent transaction and use that as proxy for the market value. The key here is to find a bank willing to re-finance a property without a seasoning period. This means the bank provides financing based off of the market value on an appraisal report and not from a recent transaction. Reed was able to identify such a bank. This local Philadelphia bank provided financing based on the appraised value of the property and didn’t take the recent purchase price of the property into its consideration of the market value.

The renovated property ended up appraising for $100,000. He was able to cash out $80,000 from the bank. The mortgage payment on the $80,000 was covered by the cash flow from the rental income. He was able to turn $25,000 of initial cash into $80,000 of cash and ownership of 1 property. He was able to accomplish all this within the 6 months.

Step 6: Repeat Steps 1 to 6

With a cash amount of $80,000, he then used that money and put it to work. He repeated the steps above. Instead of buying one property at $20,000 with $5,000 set aside for renovation cost, he went ahead and purchased 3 properties at once. With those properties, he was able to pull out $80,000 per property which created $240,000 of cash for him.

You can see how quickly that can build up. The number of properties goes up exponentially greater and greater, also faster and faster.

Step 7: Buy Bigger Properties

You can continue to repeat the steps above. But at some point after a few years of real estate investing under his belt, Reed chose to buy higher priced properties once he was able to accumulate enough of a cash amount. He repeated the same process above but with those properties. A higher price property provides for better tenants, a higher re-finance amount, and better neighborhood options. This continues to accelerate the amount of cash he can pull out through cash out re-financing.

Reed continued to add to his real estate portfolio through the years. This snowballed year after year and before he knew it, he built a real estate empire with over 30 properties.

There are Benefits and Cons with the Strategy Above

A few benefits of the above strategy are:

Leveraged Appreciation

Leveraged appreciation can result with many properties. If the total real estate portfolio value ends up being $20,000,000 of value, a 3% increase can produce $600,000 of increased value. That is a nice increase in net worth and asset value by having built the real estate portfolio into such a sizable one. All this can come from an initial investment of $25,000, time, and effort.

Principal Pay-down

There is also the added benefit of the rental payments coming in to pay down a portion of the mortgages. Over time, those payments will pay more and more off of the principal balance. This can also help produce a large net worth amount the longer the properties are held given how the monthly payments are applied to principal pay down versus for interest payment.

Cash flow

Over time, as rental income increases with raising rent, the cash flow stream coming in from a large number of rental properties can be quite substantial.

A few negatives of the above strategy are:

Property Management Fee

With the volume of properties, it is impossible for you to be hands on in the management of those properties. Therefore, a property manager needs to be hired. The property manager takes 8 to 10% of the rental income; in some cases more given they are predominantly single family houses. The management fee will eat into your overall return.

Small Property, More Headaches

Starting out, with limited capital, the properties being acquired are small properties with plenty of headaches. Without the headaches, those properties wouldn’t be selling for cheap. Solving the problems which caused the headaches can result in higher property value but involves work.

Additionally, with so many properties, there are bound to be issues which need your attention despite having a property manager in place. This will eat into your personal time.

Neighborhood Won’t Be That Great

Once again, with limited funds, you might need to explore sub-par neighborhoods in the hunt for good bargains and houses in disrepair. This will inevitably lead you to neighborhoods which aren’t great and you would probably not normally visit.

Conclusion

Reed didn’t have any formal real estate investment training when he decided to go down the path of building his real estate empire. He went in with a desire to do it, took action, followed a strategy that worked, put in the energy, effort and time to be successful. Along the way, he also got lucky in catching the real estate market at the right time and started investing right after the Great Recession in 2009. If he can start with every little and get to over 30 properties in 10 years, you should be able to as well.

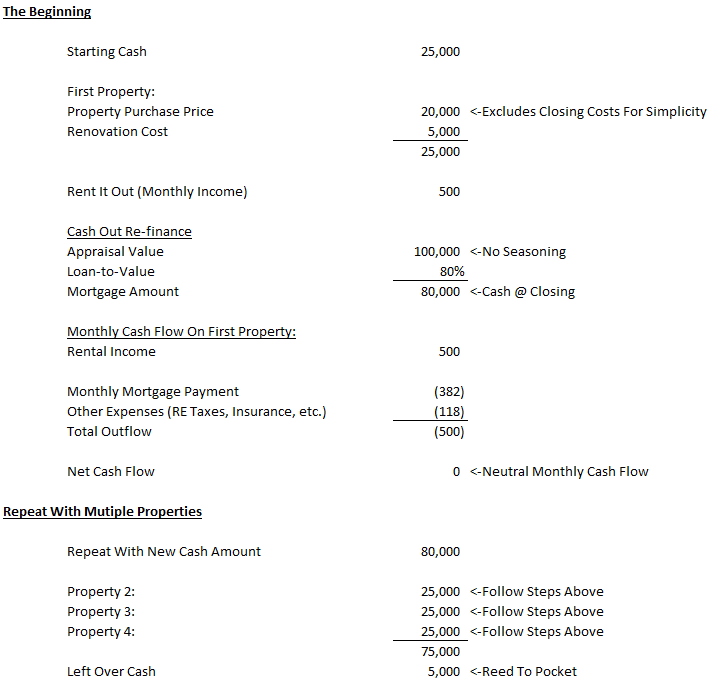

For readers who enjoy numbers:

To the Audience: Have you tried the above strategy? Did it work for you? What other real estate investment strategy have you successfully deployed?

Many people work hard to better their physical and mental health. What about their financial health?

I started this blog back in 2019 to help people better their financial health as well.

My financial journey began with tens of thousands in student loan debt. Over the span of 20 years, I am close to achieving financial independence.

I truly believe anyone can get to strong financial health. Hopefully, this blog can help you on your financial journey to greater wealth and financial independence.

You can read more about me here.

Thank you for visiting. Come again soon!

That’s a good overview. Seems like being able to enter the market during the recession is key to Reed’s success. I wonder if we’ll see a large dip in the housing market like in the last one – we probably won’t. I’m still in Step 1. So difficult to find reasonably priced properties where I live within 2-hour driving distance!

Yes, the real estate market has run up since when Reed first invested in real estate. He was highly leveraged and rode the wave up. Good timing on his part. Because of this good timing, his properties also appraised higher which allowed him to cash out re-fi more. The timing of when he got in certainly helped in his success.

Keep on at it in your search. Get educated, do your research and then jump right in if you really want to start your own real estate empire.

Good luck on your search.

Rich, I’ve only gotten into to real estate investing the past 5 years or so. I guess I can be a little dense sometimes, because it took me reading real estate articles MANY times before it sank in what investors were doing with cash-out refinancing. Especially the inexpensive rehabs where you could take out a lot more than you put in/down. At first it seemed too good to be true, but it all makes sense now. I haven’t done it personally yet, because I’m only in real estate to diversify a bit. I don’t need to get too fancy with it. I’ve enjoyed educating myself on real estate over the past few years, and I understand now how some have found extreme success doing the steps you outlined above over only a 10 year period.

Yes, there are a number of strategies which can be used on real estate investments to generate a great return. When starting out with a small capital pool, a cash out re-fi strategy could be a good option to build up a real estate portfolio.

I am skeptical at situations which might seem too good to be true too. The different ways Reed made money with real estate, the voracity and the amount of money made, I wouldn’t have believed too if I didn’t witness it myself personally.

>>what investors were doing with cash-out refinancing

And I should probably clarify what I didn’t understand, because maybe it will help someone else…

How I THOUGHT it worked was say putting down 20% (20K) on 100K house, repairing house, and taking your 20K back. That didn’t make sense to me, because I didn’t understand how it was safe to not have SOMETHING still down on your house (to have some base equity — not be upside-down). Again, I know that sounds really ignorant now, but just being honest of how I read it for so long.

And of course what is really going on is you might put 20% (20K) down on a 100K house (80K balance), rehab it, the house now is valued at 150K. You can refinance at 80% (120K and 30K down which is like a virtual 20% down). And because you currently only owe 80K, you get back the difference between the new value and what you owe (40K – your original 20K and an EXTRA 20K). Now you have 40K to put down on two properties to rinse-and-repeat. And of course this all works even better with 100% cash down, rehab, get money back, because you avoid mortgage (or hard money loans) process prior to rehab.

I’m not sure a lot of real estate blogs fully explain this “real estate math” setup. They seem to assume readers understand what’s really going on. (and if I’m wrong with MY math, let me know — haha).

Your math looks right to me.

Thanks for your feedback. I plan to put together an example to illustrate how this works and include it in this post in the near future.

Thanks so much for the math problem. Im a numbers person, so it’s easier to grasp when i can see how they play out. I’m new to investing and I’m a lil confused on the math. Please help me understand.

So if you initially put $20k down on $100k loan.. total balance $80k.

After renovations, value is $150k. You refinance the $150k, put down $30k, which leaves you now with a total balance of $120k.

How is it that you can just take $40k out of this to get to your original balance of $80k without paying down the loan? This is where i got lost.

What am i missing here?

In your example, the remaining balance is $80k on the initial mortgage. If you do a cash out refinance, you can take out 80% of the value of your property. If your property is worth $150k, then you can take out $120k.

$80k of the $120k will need to be used to pay off the initial mortgage. The balance of $40k is cash back in your pocket. That amount can be used to be a down payment for another property.

What are your thoughts on borrowing against a rental property’s equity to get cash to use as a down payment on another rental property? My current mortgage is already 80% of the property’s value. Or is pulling out a second loan not ideal for this case? (Part of this is me just not being educated in real estate)

I appreciate any response. Thanks!

I have yet to find a bank that allows a cash out on a rental property with higher than 80% loan to value (LTV).