It shouldn’t surprise anyone that New York City is an expensive city.

After all, NYC is a global tier-one city.

In the 2021 A.T. Kearney Global Cities Index (latest one available), New York City ranks number 1.

Do you know who ranked number 1 in 2020? You got it, NYC.

NYC has been ranked number 1 since 2017. It’s nice to see that NYC is still able to retain the top spot through the pandemic.

As a native New Yorker, I happen to agree with the ranking. There is no bias at all here.

Think about all the great things New York City has to offer:

-World-class museums such as the Metropolitan Museum of Arts and American Museum of Natural History

-Iconic buildings such as the Empire State Building and Chrysler Building

-Centers of culture such as Lincoln Center and Broadway

-Michelin-starred restaurants such as Per Se and Eleven Madison

-World-famous shopping such as at Time Square and Fifth Avenue

-Unbelievable parks and outdoor spaces such as Central Park and The High Line

-Global landmarks such as The Statue of Liberty and Grand Central

The food, culture, and people are immensely diverse in New York City. Is there a wonder why the United Nations decided to place its headquarter in this great city?

Now, with all the benefits come a bit of the downside.

There are people from all over the world who come to New York City to visit, work, and live.

That means there is demand for everything New York City has to offer.

We all know the effect of strong demand. Prices move up to reflect such demand.

New York City is an expensive city; but does it make it a city that is unaffordable to the general population?

Let’s take a look at the average income in New York City.

Average Income In New York City

The average income in New York City can be measured in a number of ways.

Let’s take a look at the income information collected by the United States Census Bureau.

The United States Census Bureau collects information at the household level.

There is the median household income and the mean household income.

The median is the middle number in a set of data that is ordered from least to greatest.

Taking you back to 4th-grade math, the mean is the sum of all the data items divided by the number of data items.

According to the United States Census Bureau, the median household income in New York City is $67,997. This is based on 2021 income information which is the latest data published.

This means half the NYC households made more than $67,997 and half of them made less than $67,997 in 2021.

The mean household income comes in at $107,684The mean is skewed higher up because of all the high earners in New York City.

For instance, if there are 2 households and one earns $0 and the other earns $100,000. The mean is $50,000.

But if there are 2 households and one earns $0 and the other earns $1,000,000, the mean comes out to be $500,000.

The higher income households can really skew the result for the mean income.

The United States median household income in 2021 is $70,784 and the mean is $102,316.

Isn’t it surprising that the median income is higher in the United States than in New York City? Also, the mean income is very close between New York City and the United States.

For such an expensive city, a lot of the people earn comparable to the rest of the United States.

New York City Income Compared To United States Income

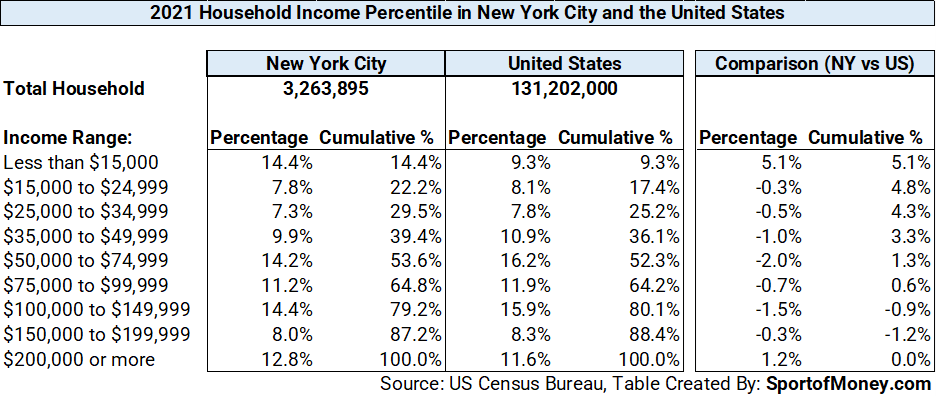

This table shows the household income in the various income ranges for New York City and the United States.

This further shows how the income distribution in NYC is very similar to the US except for the following two observations:

Observation 1: New York City has a higher percentage of households making less than $15,000 than the rest of the United States (14.4% versus 9.3%).

It’s probably not what you would expect to see with so many New Yorkers earning below $15,000 – significantly more so than across the nation.

Observation 2: New York City has a higher percentage of households making $200,000+ (12.8% versus 11.6%).

This might not surprise you given New York City is the financial capital of the world and home to the most millionaires in the United States.

New York City when compared to the rest of the United States is a tale of two stories.

New York Household Income Deciles

The table below shows the income that you have to clear in order to get into the top percent of all household income.

It reads as “how much do I need to earn to be considered top X% of household earners in New York City.”

Top 10%: $200,000+

Top 20%: $153,359

Top 30%: $115,000*

Top 40%: $87,767

Top 50%: $67,997 <-Median

Top 60%: $50,739

Top 70%: $36,000*

Top 80%: $21,852

Top 90%: $10,000*

*Extrapolated from the US Census Bureau Data. All other deciles come from the US Census Bureau Data.

Have you ever wondered if $70,000 is a good salary in New York City? Well, a $70,000 salary puts you above half of all New York households in income.

How about making the six-figure mark of $100,000? Is $100,000 a good salary in New York City? You make more than 60% of the New York population.

Don’t forget, all the above is based on household income. A household is made up of more than 1 earner on average per household.

To get into the top 5%, a household income over $250,000 is needed.

According to the New York City Independent Budget Office 2019 income tax data (the latest information I can find on NYC income), cracking the top 1% requires over $800,000 of income ($804,297). This is based on the number of tax returns filed and not based on the household.

Unsurprisingly, it takes a lot to get into the top 1% of earners in New York City. After all, New York City is home to the most millionaires – not just in the United States, but globally as well.

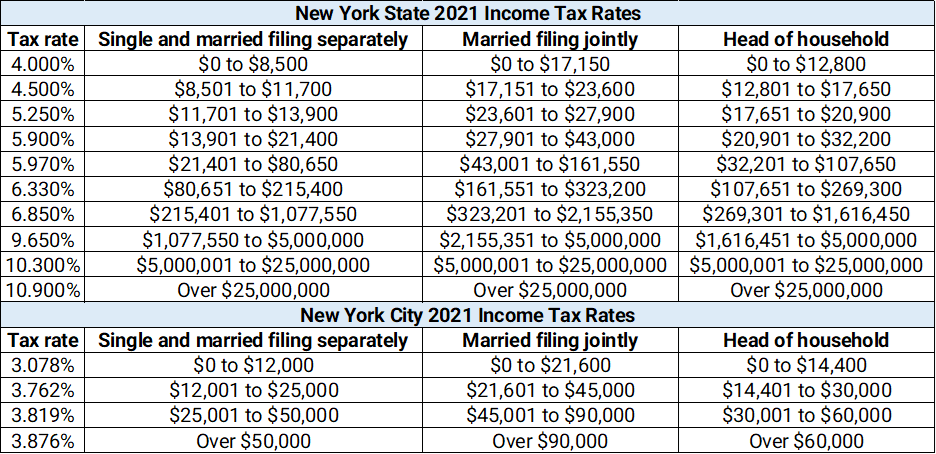

New York City Income Tax Rate

Not only are most New Yorkers not earning a large salary, but we also have the privilege of paying some of the highest income taxes in the whole nation.

There is both an income tax at the state level and an income tax at the city level.

Top earners are subject to a total state and city marginal tax rate of 14.776%. A tax filer needs to earn over $25,000,000 to trigger this highest rate. Combined with the Federal income tax rate, this ultra-high earner keeps less than half of gross income.

But it doesn’t take much to start paying state and city taxes. Even the lowest tax bracket subjects the earner to an income tax of 7.078%.

Come April 15th of each year, I always envy people living in states without income taxes.

Sometimes, I do think about escaping from New York City and moving to another state to avoid income taxes.

Nevertheless, I still find myself living here. There must be something in the water here!

There is one silver lining when it comes to income tax filing time: both the New York State and City tax information can be filed on one tax form. That’s a time saver.

New York City’s Other Taxes

In addition to high income taxes, there are also property and sales taxes.

New York City, as the #1 ranked global city in the world, isn’t the only place being top ranked here.

New York State also has the top ranking of all 50 states in 2022 when it comes to the highest state and local taxes paid as a percentage of income. This includes not only income taxes, but other state and local taxes such as sales tax and real estate tax.

For the non-New Yorkers, next time you feel like complaining about the crazy high taxes you pay, just rest assured that people in New York are paying a higher amount than you.

State And Local Tax Effect On Medium Household Income

The income of a New Yorker is certainly not as high as I thought before doing my research for this post.

I know the top earners make good money. There is no doubt about that.

There are many people in my New York based financial services firm who make more than $1,000,000 a year.

But I was quite surprised that the median household income in the US is actually higher than that of New York City. The bottom half of New York households are worse off in dollar income than the bottom half of the United States.

Even the top 80% of New Yorkers have a comparable income to the top 80% of Americans.

With state and local tax adjustments, the take-home pay looks even worse for a New Yorker compared to your average American.

The average state and local taxes (including income, sales, and property taxes) in America is 8.6%.

New Yorkers on the other hand pay 12.75% on average in total state and local taxes.

When the median household income is reduced by the state and local tax burden, the adjusted income amounts to $59,327 for a New Yorker and $64,676 for the average American.

Quite surprising now, isn’t it?

The average person in New York City ends up taking home almost 10% less post-tax income than an average person in America.

How About The High Cost Of Living?

There is underperformance in pay for the average New Yorker compared to the rest of America.

But unfortunately, New York City is good at outperforming the rest of the United States when it comes to the cost of living.

Once again, this shouldn’t come as a surprise to anyone who has visited New York City before.

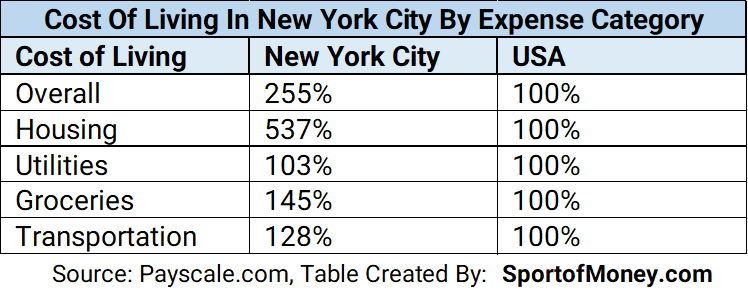

According to Payscale.com, New York City is over twice as expensive to live in when compared to the national average.

Housing cost is the biggest culprit here, far outpacing the national average.

Here is a sampling of the costs of living in New York City:

Median home price: $2,137,777

Median rent: $6,530/month

Energy bill: $174.89/month

Phone bill: $192.44/month

Loaf of bread: $5.03

A gallon of milk: $3.22

Carton of eggs: $2.27

Bunch of bananas: $4.87

Hamburger: $6.88

When adjusting for the high cost of living in New York City, the median household income shrinks even more.

In terms of buying power, the family at the halfway mark can buy about half of what the average American family can buy.

That is tight living.

In my mind, this really shows the grit and determination of most New Yorkers who battle to stay in the city.

Despite a median income lower than the rest of the nation, the highest state and local taxes of all 50 states, and the tremendously high cost of living, the average New Yorker finds a way to stay in this great city.

There really must be something special with the water here.

To The Audience: Were you as surprised as I was by the median household income of a New Yorker compared to the rest of the nation? Where do you live and do you think you can live a good life on a household income of $68,000, about the medium income for a New York household? Do you agree that New York City is the best city in the world?

Other Posts You Might Be Interested In

It Takes A Lot To Be In The Top 1% In Net Worth In America Right Now

How Rich Are Americans On A Global Scale – Very Rich!

Here’s What You Need To Be Upper Middle Class And Upper Class In NYC – It’s A Lot

Many people work hard to better their physical and mental health. What about their financial health?

I started this blog back in 2019 to help people better their financial health as well.

My financial journey began with tens of thousands in student loan debt. Over the span of 20 years, I am close to achieving financial independence.

I truly believe anyone can get to strong financial health. Hopefully, this blog can help you on your financial journey to greater wealth and financial independence.

You can read more about me here.

Thank you for visiting. Come again soon!

New York City is truly one of the best among the top tier cities. It’s a tough battle though as I love Berlin, London, Amsterdam and a few other major European cities.

Haven’t been to NY City in the past 6 years and now you made me miss it 🙁

$60,000 household income for living in a top tier major city is not enough in my opinion. Can you make it work? Sure but we are looking for a great life smack down where all the action is, right?

$100,000 would make for an extremely good life and $200,000 would put you in baller status in most places, even expensive ones.

I’ve been to some of the European cities you have listed. They are great cities for sure.

I think $200,000 is a good income to live a comfortable life, even for New York City standard. But I think it would be hard to be in baller status unless a young single.

I have a household income of a little over 200,000 and it is tough! We are a family of 4 and the kiddies get all the extras of an upper class household (ballet, piano class, summer camp, etc.), but don’t have extra for things like nice vacations, apartment renovations, and we live in Queens, not even Manhattan! We have a small mortgage but we put away for pensions and for our kids college tuition. After taxes and savings, we are left with just enough!

I think about this a lot. My partner and I (well we used to before Covid) make six figures and we live on the UWS. I feel that we live SOLIDLY middle class lives in NYC putting us in the top percentage of earners in the city yet no where NEAR the kind of lifestyle the billionaires have that inflate this data in the first place! I absolutely do think New York is the best city in the world, not only are there so many amazing things to do here for free but living among one of the most diverse places in the world and riding the subway with people from all walks of life opens your eyes to different people, cultures and experiences. When it comes to enrichment as a human being and the pride that comes with making it and having a middle class but fullfilling life I think it’s absolutely worth it.

Nice to hear from another person who enjoys living in New York City.

The income outliers on the top end really distort the perception of what most people have of New York. Surely, there are billionaires and people making multiple millions a year in New York City. But there are a lot more people making less than $100,000 per year here.

What would your net be on 100k? As a family what kind of lifestyle would you have on that income?

My image of NY has always been of 3 types. 1. The taxi drivers and other folks that eke out a living in the rough parts, 2. The median income workers that live in a small place but love the city, 3. The high income earners, but because it’s banking they work 100 hours a week and have no time.

Is it only group 3 that can build a nest egg and get to a better lifestyle? I feel group 1 and 2 are just living somewhere too expensive?

Group #3 definitely have the potential for a significantly higher financial nest egg. But there are also people who earn a lot but spend a lot as well.

I think Group #2 can still accumulate wealth but there needs to be a lot more sacrifices and work on their part.

Group #1 has it the toughest to build that nest egg. A lot of them might be in survival mode placing their hopes in the next generation. Multiple earners within the household should help with their financial situation.

Not surprised at all on the median income when you consider that NYC is filled with services for those in the upper echelon, which relies on many hourly workers not even salaried. I’d also love to see a breakdown of how housing availability also impacts the ability to earn/save in this city, despite having 50% of households earning less than 60k, there isn’t equitable housing for that to be possible. If you make above a certain point you cannot be in public housing but yet there isn’t enough affordable housing in the city for this low income population.

NYC have over million people living in project housing where they pay on sliding scale. Also, there are millions of people living in middle income affordable housing under Mitchell-Lama cooperative where they bought or rented the unit. It’s all funded by NYC taxes. But there is a catch: you have long waiting list for both project housing and Mitchell-Lama coop/rent.

Those low income folks who wasn’t fortunate to get into affordable housing either live far away in outer borough where you have to walk, bus and subway to get anywhere. To make the matters worst, there are usually high crime in the area. Or if you are single, have two or more roommates or rent a room or get into a single room occupancy unit where you share bathroom (if you can find SRO). In other words, either you pay an arm and a leg to have a roof over your head or you literally pay an arm and a leg in cheap high crime areas. Queens neighborhood like Corona and Brooklyn neighborhood like Sunset Park where they have a large Hispanic population live in either two or more families in one unit or illegally converted unit or just rent a bed and sleep among others like in hostels.

You can also get lucky and land a rent stabilized apartment like millions of people. But rent stabilized units have been in declined since Bloomberg administration where at certain rental rate, it goes into market rate apartment.

If you didn’t do all the research, how can we trust any of it. I doubt there is a place in the country where you can get a gallon of milk for $2.49

I cited the research I have done and the sources of the data. The great thing about the internet is that you can do your own research if you so desire.

I cited the research I have done and the sources of the data. The great thing about the internet is that you can do your own research if you so desire.

Wasted my time reading this. $5,000 rent is the stupidest thing I ever heard. Nyc has 5 boroughs and you would only pay that for an apartment in Manhattan.

The #s are what they are.

I came to see the income distribution to check how sustainable all that 1MM+ housing in Long Island, NY. Clearly with more than 10% of households making more than 200K+, 1MM houses are within their reach. And it’s almost more preferable living style compared to Manhattan when you consider all these high earn income individuals are mostly working from home.

Also, especially with the low mortgage rates (probably to the recent Fed hikes).